Knowing what a physical asset is worth – its value – can be very useful both for financial reporting and for supporting asset management. Even if the notion of asset value is somewhat abstract, an asset owner generally prefers that the value of their assets increases or at least remain constant over time. Fundamentally, tracking and reporting asset value helps a transportation agency monitor the state of its assets and provides a sense of whether the inventory is improving or in a state of decline. Transportation agencies use data on asset value in a variety of ways to support asset management. Major applications of asset value aiding an overall asset management program are described below.

Asset value is used to communicate what assets an agency owns, their extent, and the agency’s responsibility for maintaining the asset inventory. Each asset has its own unit of measure: pavements may be summarized in terms of lane miles, bridges in terms of deck area, and other assets in terms of a count. However, it can be hard to relate these different units and to summarize their asset portfolio as a whole. For instance, how does one lane mile compare to 1,000 square feet of bridge deck or 100 culverts?

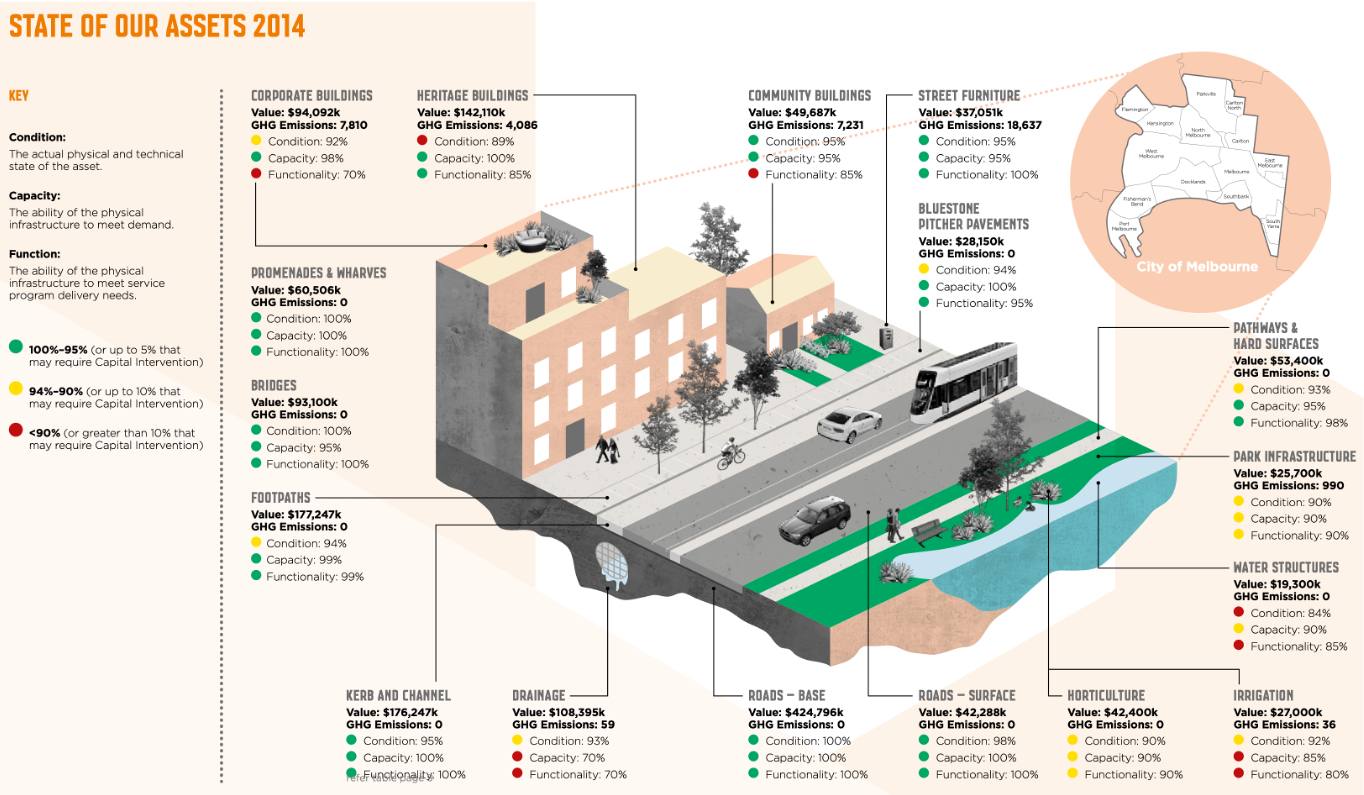

Figure 2-1, reproduced from the Melbourne Asset Management Plan (7), depicts the assets owned by the agency, including the roadway surface, roadway base, bridges, footpaths, drainage, buildings, and various other assets. Each type of asset is illustrated and labeled with its value and annual greenhouse gas (GHG) emissions. The City of Melbourne uses these two numbers to communicate the state of their assets to the public and other stakeholders.

Figure 2-2 shows an example from the TAMP prepared by Carver County, Minnesota (8). Here asset quantities and conditions are summarized for 13 transportation asset classes. Asset replacement value and current asset value are shown for the ten asset classes for which Carver County Public Works is responsible. The two asset values help communicate the state of the county’s assets to the public as well as providing a financial account of the publicly-owned assets.

Various measures have been formulated that use asset value and changes in value to demonstrate that an agency is managing its assets responsibly. The basic premise is that as assets deteriorate or depreciate in value, an agency should invest to maintain their value. Public agencies in Australia and New Zealand have used asset value in this manner for over a decade. The Australian Infrastructure Financial Management Manual (AIFMM) details recommended measures and practices for monitoring and applying asset value (9). A key measure in Australia is the Asset Sustainability Ratio (ASR), or ratio of spending on asset renewal and replacement to annual depreciation.

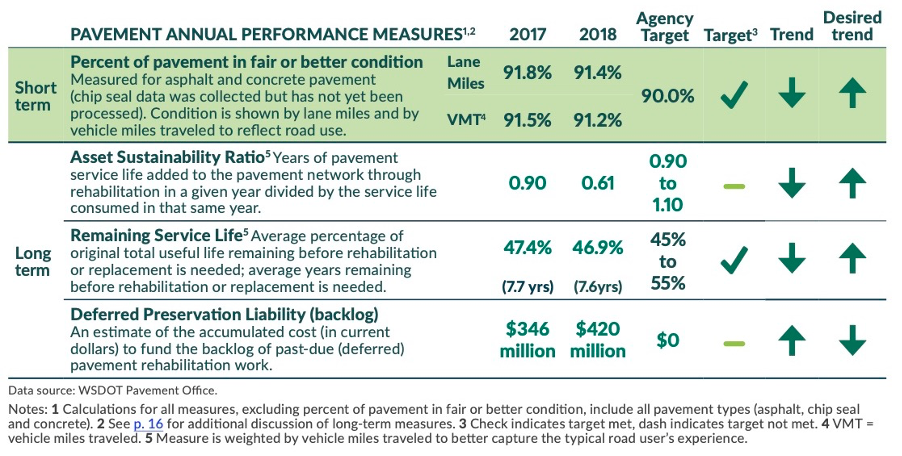

In the U.S., several agencies have calculated similar measures. Figure 2-3, reproduced from the Washington State Department of Transportation (WSDOT) Gray Book (10) includes several long-term measures for pavement assets related to asset value. The Gray Book is a quarterly performance report which covers a variety of aspects related to WSDOT’s transportation system and assets. The Gray Book from the fourth quarter of 2019 includes the following long-term measures for pavement: ASR, Remaining Service Life (RSL), and Deferred Preservation Liability (backlog). In this case, ASR is calculated as the years of pavement life added through different treatments divided by life consumed.

Asset value can be used to help illustrate the difference between alternative investment strategies, such as when comparing a strategy of performing recommend preservation treatments on an asset over its life to an alternative strategy in which preservation treatments are deferred, resulting in worse relative condition and potentially a shorter asset life.

One way to compare different investment strategies for a given asset is to perform a life cycle cost analysis (LCA). In such an analysis, the costs for an asset are computed over time for a given scenario relative to a base case. A results of a given investment strategy can be summarized by calculated the net present value for the strategy, where NPV is the sum of the discounted benefits of the asset less the sum of discounted costs.

Asset value is potentially relevant to such an analysis in two ways. If one adopts an economic interpretation of asset value, as discussed further in the next section, NPV can serve as the definition of asset value. However, even when asset value is computed differently from NPV, it can be used to represent the residual value of the asset at the end of the analysis periods. This provides a way to compare investment scenarios that result in different condition and/or remaining

asset life.

Another potential application of asset value for supporting TAM is helping compare and understand asset investment options. While asset value alone is insufficient for prioritizing investments, when used in conjunction with life cycle cost analyses it can provide a complete view of the asset’s worth. In particular, asset value can help prioritize decisions such as:

- Resilience investments;

- Reconstruction; or

- Decommissioning

Asset value provides insights for assets identified for decommission or reconstruction by pitting their intrinsic value (including the replacement cost and socio-economic importance) against the costs necessary to maintain or replace the asset. Asset value also supports investment decisions for resilience investments by placing an emphasis on the importance of asset renewal to mitigate future risks and by directly accounting for the potential costs associated with a risk.

In these applications, asset value is defined broadly, considering the cost of constructing the asset and its value to road users and society. For example, in determining which bridges to focus on for a set of resilience investments, one might consider the cost of replacing or improving each bridge, the risk to the bridge as a result of flooding or other events, the level of service the bridge provides, and the impacts to mobility in the event the bridge is closed. The inclusion of asset value in the investment decision could lead to the renewal of the asset to withstand the risks, or it could suggest an asset should be allowed to fall into obsolescence. Either way, it provides context to the investment decision.