In the context of this document, componentization is defined as the process of delineating parts of an asset – components – for which the asset value calculation is performed separately. Defining asset components may be necessary to obtain an accurate calculation of asset value, depending on the nature of the assets being valued and the intended application of the asset value calculation. The following subsections discuss the reasons for defining asset components when calculating asset value, specific criteria for when to componentize, and asset classes where componentization may be considered.

The basic reason one may wish to break an asset into components is that it may be a complex asset with different elements that have different asset lives. If the only treatment one performs on an asset is to replace it then this detail is immaterial. In this case the remaining life of an asset is dictated by the minimum remaining life of the different components of the asset. However, if it is feasible to treat individual components of an asset, extending their life while leaving the life of other portions of the asset unchanged, then the situation is more complex. In this case, considering the different asset components yields a different and arguably more accurate calculation of value than performing the calculation only for the asset as a whole.

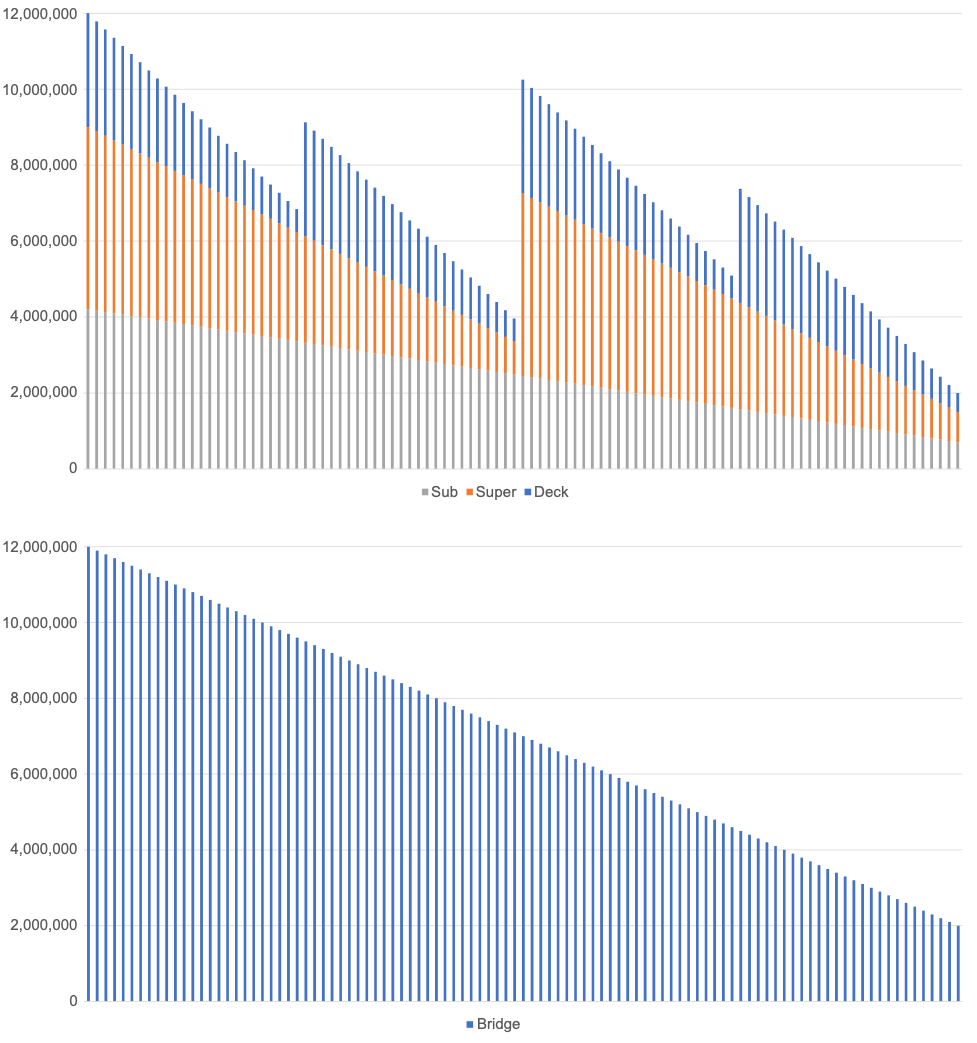

An asset that is commonly decomposed into components is a bridge, as discussed further below. Figure 3-2 shows how a bridge may be valued over time with and without calculations at the component level. The upper panel shows the asset value of the bridge by year, subdivided by components (deck, superstructure and substructure). The components have different asset lives and thus depreciate at different rates. At three points in time the value is increased as a result of a treatment performed on a component (the deck and/or superstructure).

The lower panel shows the value if calculated at the bridge level. In this case the value declines more gradually over time, and the treatments applied at a component level do not impact the overall value. Asset value at the beginning and end of the analysis is the same in both cases. However, the component-level representation more accurately reflects the effects of different treatments.

Note that in this case, various complicating factors have been omitted. Most notably, in this case, depreciation is based on component age. In reality for asset management applications, it is common to base depreciation on condition where condition are available.

Based on the above discussion, the following criteria are recommended for establishing when to perform the asset value calculation at the component level. Specifically, componentization is recommended in cases where:

- The asset represents a significant portion of the value being calculated;

- The asset is complex, with different identifiable components aging at different rates;

- Multiple treatments are performed to the asset over its life extending the life of different components;

- Data are available on the inventory of asset components and on either their condition or age to support calculation of depreciation; and

- The driver for calculating asset value is to evaluate different treatment options, or there is significant interest in doing so.

Agencies may establish additional criteria for when to value assets at a component level. The example below describes guidance for valuing assets at a component level. For example, Austroads describes that an asset over $5 million should be componentized when the asset structure can be separately identified, the different parts can each be measured, and the components have different service lives (24). The example below illustrates the componentization approach recommended by CIPFA for local agencies in the U.K.

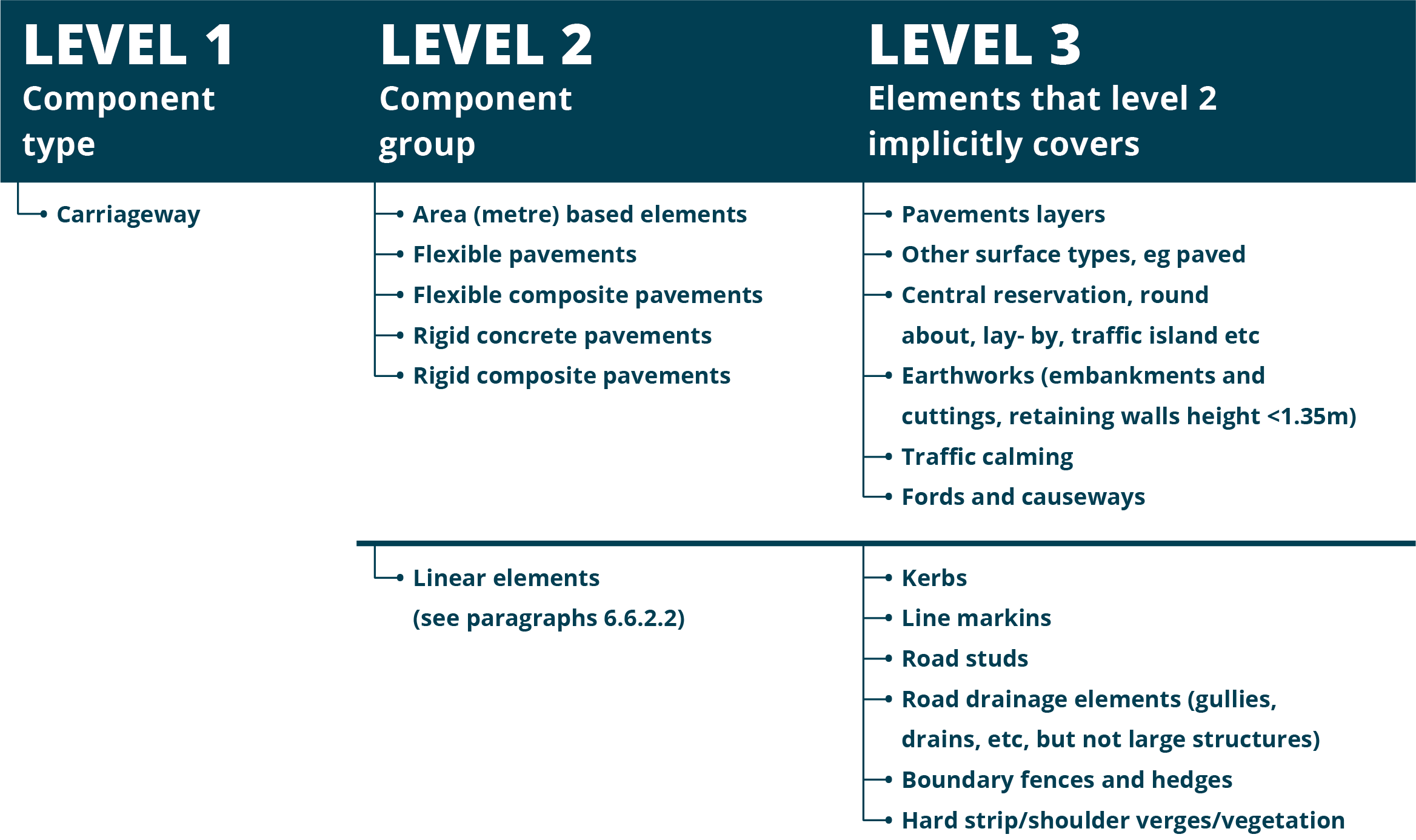

The Chartered Institute of Public Finance and Accountancy (CIPFA) has established an asset hierarchy and componentization approach for the purpose of calculating asset value to be used by local agencies in the U.K. (16). In its guidance CIPFA defines three levels in the hierarchy:

- Level 1: Component Type – broad categories based on the general function of the components. They divide the Highways Network Asset into categories of components and provide an appropriate basis for high-level management information.

- Level 2: Component groups – used to distinguish between component types that have a similar function and form.

- Level 3: Elements – distinguishes between components that, at least when systems become well developed, may require individual depreciation and impairment models, such as different service lives and/or rates of deterioration.

The table depicts how these levels are defined for pavement (carriageways).

Source: CIPFA (16)

The transportation asset classes that are most commonly divided into components are pavement and structures. Other asset classes that may be componentized are facilities and fixed guideway. Below are specific considerations regarding these asset classes.

Pavement

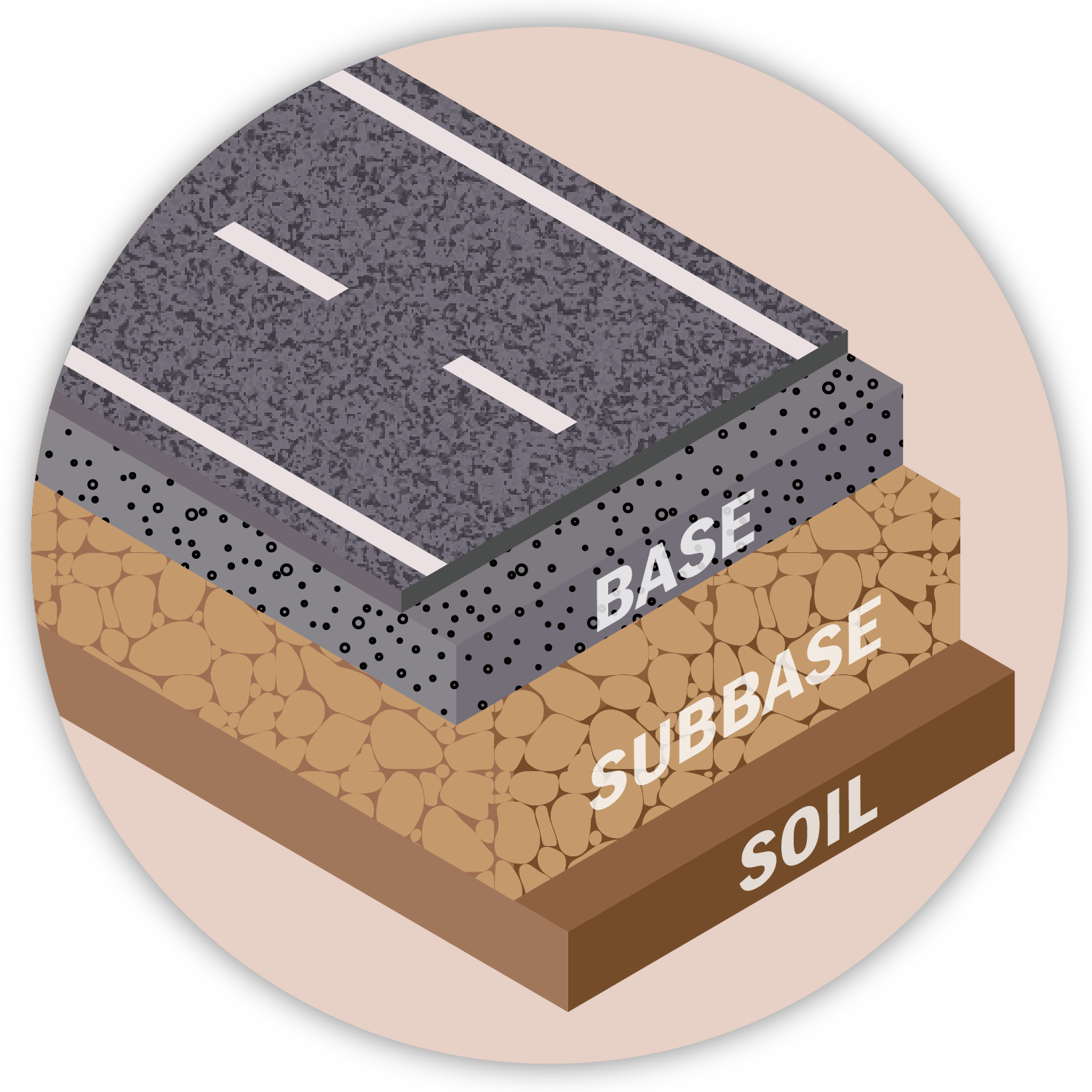

Pavement may be split into components, but doing so is the exception rather than the rule in U.S. practice. Where pavement is componentized, typical components include the pavement surface, base, subbase, and subsurface, as illustrated in Figure 3-3. This approach is used by agencies such as New Hampshire DOT TAMP (25), and recommended in by Austroads (26).

The challenge in valuing individual pavement components is that most condition data collected for pavement, such as roughness, rutting, cracking and faulting, are measures of surface distresses. Limited data are available regarding the underlying condition of the pavement structure and base, though increased surface distress may result from deterioration of the pavement structure. A further consideration is that while it is possible to treat the pavement surface without treating the pavement structure, the converse is not true: any treatment that impacts the structure or base of the pavement also effect the surface.

The basic approach that one can use to address the complexity of pavement without breaking it into components is to calculate an effective age for a pavement section that adjusts the actual age of the pavement (which captures the age of the base and structure) using condition data (which best represents the surface of the pavement). Also, agencies typically introduce business rules in developing their lifecycle strategies to limit the number of times that an overlay or other surface treatment can be performed without more extensive rehabilitation of the pavement structure.

Structures

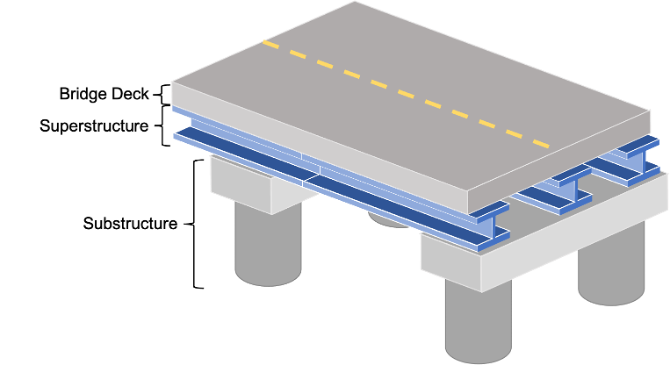

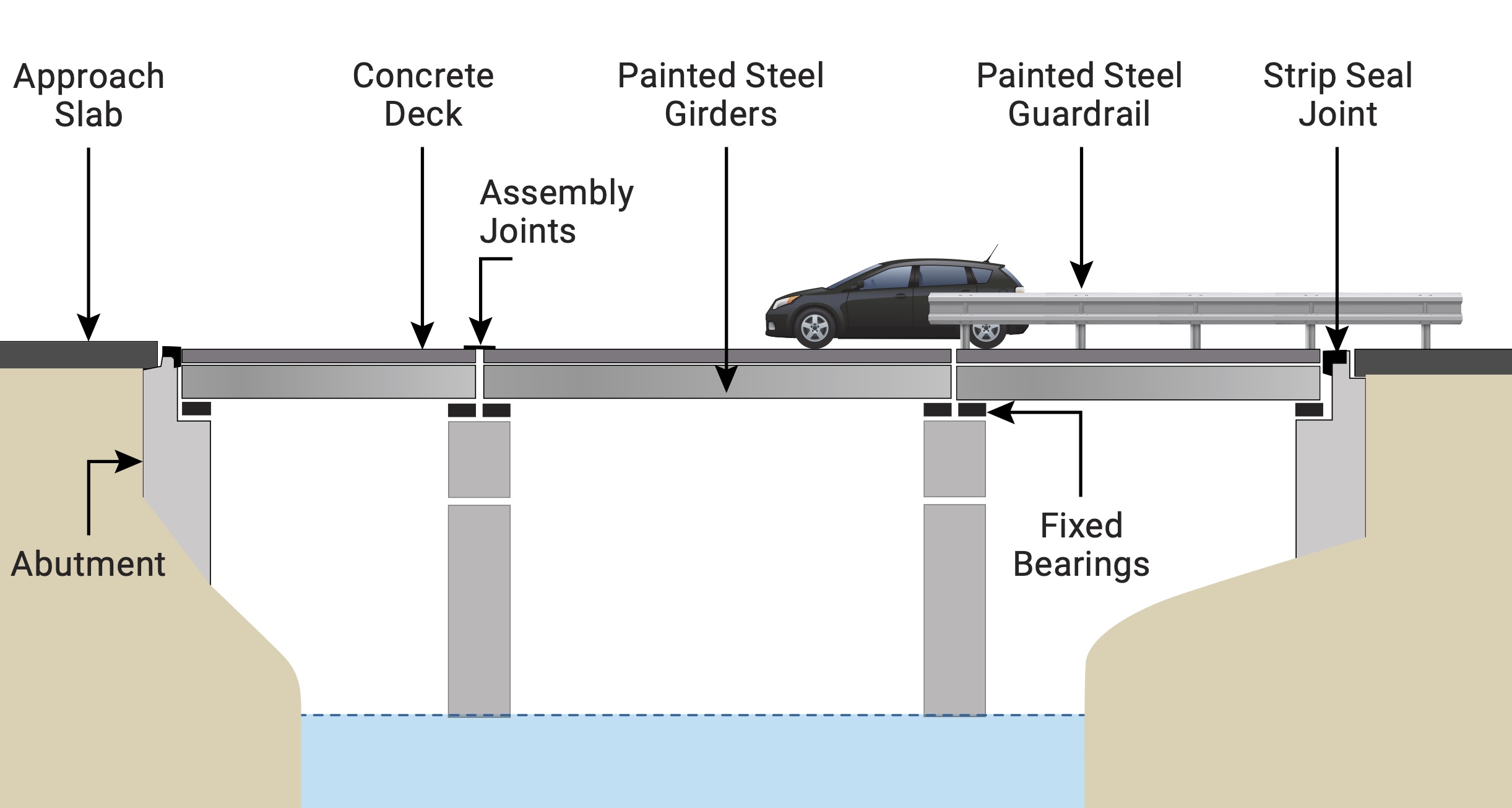

Structures – particularly bridges and tunnels – are complex assets that typically meet the criteria provided above for componentization. Where bridges are componentized, the typical components are the bridge deck, superstructure and substructure as depicted in Figure 3-4. The NBI includes visual ratings of these components, simplifying the task of componentizing for U.S. highway bridges. To support a componentized approach, one must determine what portion of the asset value is comprised by each component, and then value each component separately. Chapter 8 provides an example of a component-level calculation of asset value for structures.

For all NHS bridges and many other state-owned bridges, state DOTs also collect more detailed condition data for structural elements based on AASHTO specifications. This data provides the basis for componentizing at an even greater level of detail if desired. Figure 3-5 shows an example of the structural elements of a bridge.

Tunnels are extremely complicated structures and should be valued using a componentized approach where feasible. Components of highway tunnels are defined by FHWA in the Specifications for the National Tunnel Inventory (27). These include: structural elements (similar to bridges); civil elements (e.g., barriers and railings), mechanical systems (e.g., ventilation and drainage); electrical and lighting systems; and fire and life safety systems.

Other Assets

Facilities and fixed guideways are examples of asset classes that may be componentized, depending on data availability and the specific application of the asset value calculation. There are no widely accepted standards for assessing or componentizing highway facilities in the U.S. Regarding transit facilities, FTA has developed guidance for inspection of facility systems, subsystems, and components such as the substructure, shell, interiors, plumbing and electrical systems (28). Transit agencies assess conditions of their facilities and report their overall condition to the NTD. Fixed guideway is a complex asset and ideally should be componentized (e.g., into track, communication, and electrification subclasses). However, there are no specific standards in the U.S. for how to componentize and assess different guideway assets.