Initial asset value is the value of an asset at the start of the analysis period. What this represents, exactly, depends on the approach being used to make the calculation. In some cases, the initial value is the value of an asset when first constructed or acquired, while in others, it may be the value at a particular point in time.

This guide describes four basic approaches to calculating initial value. These are as follows:

- Current Replacement Cost – the cost of replacing the asset with its modern equivalent in today’s dollars. This is also referred to as the “gross replacement cost. When this approach is used, the initial value is the cost of constructing or acquiring a new asset. The cost is then adjusted for depreciation to obtain a “depreciated replacement cost” a described further in subsequent chapters. This approach is consistent with the cost perspective described in Section 2.

- Historic Cost – the actual cost paid to first construct or acquire the asset, expressed in year of expenditure dollars. When this approach is used, the initial value is the historic cost constructing or acquiring the asset. This approach is consistent with the cost perspective described in Section 2.

- Market Value – the price of an asset if offered for sale in a competitive market. This value can be established only if such a market exists. In this approach, the initial value is the price of an asset at a specific point in time. Further adjustment to this price may be required to account for recent appreciation or depreciation. This approach is consistent with the market perspective described in Section 2.

- Economic Value – the present value of the benefits of an asset to the asset’s owner, and asset users. When this approach is used, the initial value is the sum of future benefits of the asset at a specific point in time. Costs and benefits over time are discounted to a present value when they are combined. This approach is consistent with the economic perspective described in Section 2.

Table 4-1 summarizes the strengths and weaknesses of each approach.

Table 4-1. Approaches for Establishing Initial Value

| Approach | Description | Strengths | Weaknesses |

|---|---|---|---|

| Current Replacement Cost | Cost of replacing or reconstructing the asset in today’s dollars |

|

|

| Historic Cost | Cost originally paid to construct or purchase the asset |

|

|

| Market Value | Price of the asset in a competitive market |

|

|

| Economic Value | Present worth of future benefits to asset users (or a comparable proxy value) |

|

|

Replacement Cost

The replacement cost of an asset in today’s dollars represents the value of an asset from the perspective of the asset manager charged with deciding which assets to repair, rehabilitate, or replace using today’s dollars. Not surprisingly, many U.S. agencies base their estimate of asset value on asset replacement cost in their initial TAMP, and much of the U.S. and international guidance on calculating asset value to support TAM describes this approach.

Historic Cost

This approach differs from the replacement cost approach in its treatment of inflation. When using historic cost, one obtains the actual cost incurred to purchase or construct the asset in the year-of-expenditure dollars. This value is almost always less than the current replacement cost, or the cost of replacing the asset in today’s dollars, because the current replacement cost reflects the inflation that has occurred since the asset’s construction.

The historic cost is consistent with the U.S. GAAP and U.S. agencies’ calculations of asset value for financial reporting. However, historic costs have limited use for supporting decisions about how to spend today’s dollars. Further, it is frequently difficult to obtain historic cost data for individual assets or asset components, especially for older assets.

Market Value

Where a market exists for an asset, using the market value can simplify the process of calculating both initial value and depreciation, because both aspects are reflected in the market price. A market price also encapsulates the cost of the asset from the owner’s perspective and the economic benefits of the asset from the user’s perspective, helping to integrate the different perspectives concerning what asset value represents. Using the market price to establish fair value is consistent with the international accounting standard IFRS 13.

Economic Value

The economic value can be calculated explicitly as the net present value (NPV) of future benefits or approximated via a utility function that represents these benefits. Calculating the economic value of an asset is consistent with the concepts of benefit-cost analysis and offers the best support for certain types of decisions, like determining which assets to prioritize for resilience investment, retention, or new construction. However, this is the most time-consuming and data-intensive approach of the four listed here. For supporting day-to-day decisions regarding how to maintain existing assets, the additional information the economic value yields may be of limited use.

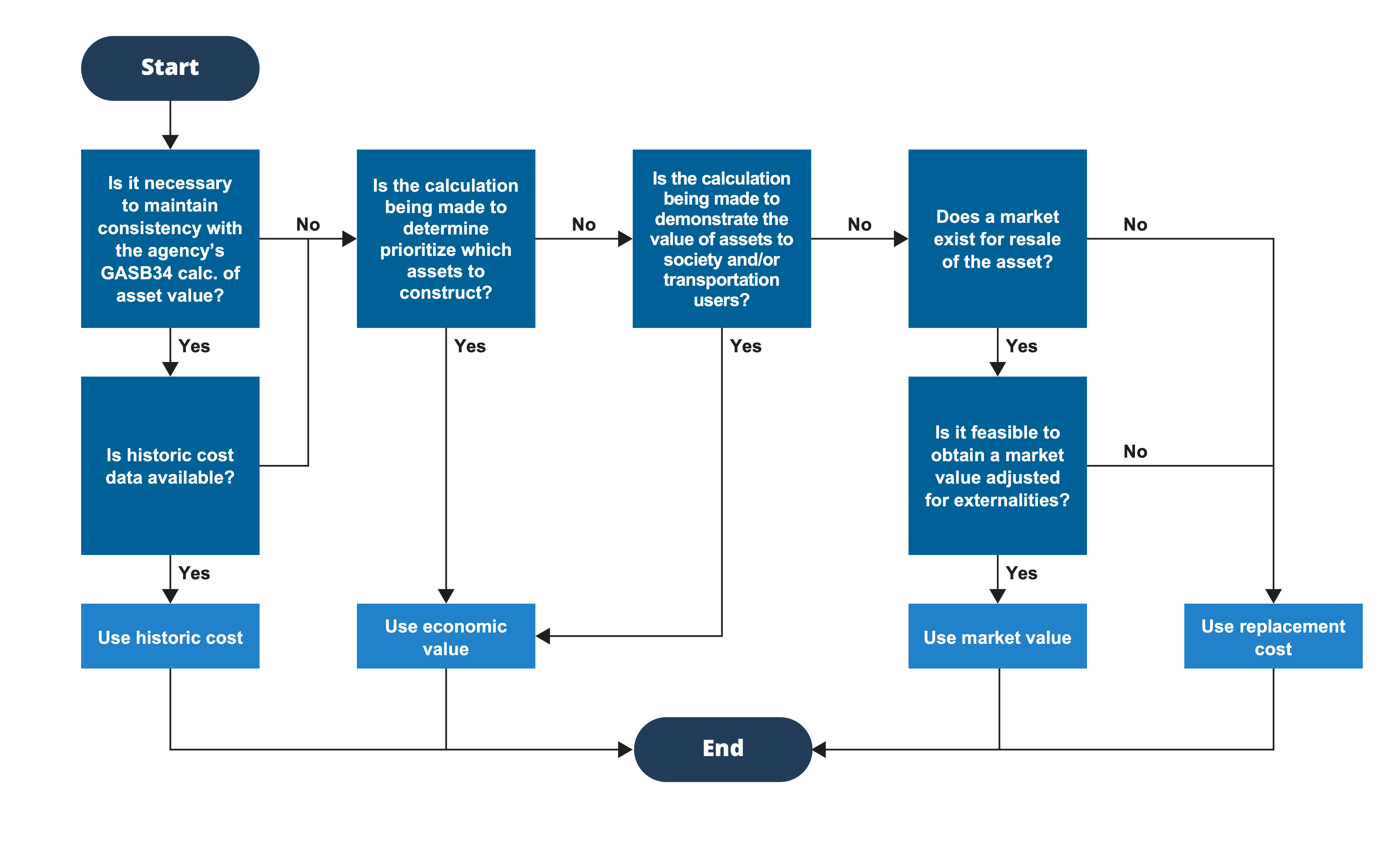

Figure 4-1 is a flowchart to assist in the selection of an approach for calculating initial asset value. The chart recommends current replacement cost as the default approach for establishing initial asset value, while presenting the cases where one of the other approaches may be preferred. The basic factors and assumptions reflected in the flowchart are as follows:

- Historic cost is not recommended for establishing initial value but should be used in cases where an agency seeks to maintain consistency with its calculation of asset value performed for financial reporting using GASB 34.

- Economic value is recommended for certain, specific applications, such as when the asset manager seeks to calculate the overall value of the asset to society in order to establish if an asset is worth constructing or decommissioning. For these cases, simply knowing the cost of an asset is insufficient for determining whether it is worthy of investment.

- In the situations where the market value of the asset is available, it should be used over the current replacement cost. When market value is not available, current replacement cost should be used.