Information on asset value and how it is changing may support a number of different applications related to both TAM and financial reporting. When establishing the approach to calculating asset value, it is important to consider which applications the calculation is intended to support. This will then guide subsequent decisions concerning how specifically to calculate asset value.

Section 2.1 discusses a range of different applications of asset value for supporting TAM, and provides examples of approaches for using and communicating asset value. Many of the applications of asset value described in this section are complementary to one another. However, some of the applications require a greater level of detail in the calculation, while others may lead to selecting specific options regarding the nuances of the calculation. For the purpose of this step the different applications can be grouped into the following for the purpose of establishing the primary motivation or driver for calculating asset value:

- Maintaining consistency with financial reporting. In this case, an agency wishes to obtain a calculation of current asset value that is consistent with the agency’s calculation of asset value prepared for its financial reports based on GASB 34 and using historic costs.

- Reporting asset value for TAM. Here the primary motivation for calculating asset value is to report value in a TAMP and/or other documents to be read by the agency’s citizens and oversight groups. In addition to calculating current value, one also typically calculates required maintenance costs, and may calculate other measures. In this case, it is not necessary to maintain consistency with the asset value reported in agency financial reports prepared based on GASB 34, though some agencies may choose to do so.

- Evaluating treatment decisions. In this case the asset value calculation is intended to help evaluate what treatments to perform for an asset, such as when defining an agency’s life cycle policies. For this application, it may be necessary to perform the asset value calculations at a greater level of detail, but once performed the calculations can be used in a TAMP or in support of other applications.

- Determining the benefits to transportation users and society. For certain applications it is necessary to determine the benefits of an asset to users and/or society as a whole – e.g., if determining what assets should have highest priority for resilience investments, or whether an asset merits public investment.

Table 3-1 summarizes these drivers and the implications of each for subsequent decisions regarding how to calculate asset value. For each asset value driver the table lists the value perspective that best supports it. Also, it summarizes the implication of selecting the driver for calculation of asset value, calculation of depreciation and treatment selection.

Table 3-1. Implications of Different Asset Value Drivers on the Calculation Process

| Asset Value Driver | Initial Asset Value (Chapter 4) | Treatment Effects (Chapter 5) | Depreciation (Chapter 6) | Measure Calculation (Chapter 7) |

|---|---|---|---|---|

| Maintaining Financial Reporting Consistency | Calculate value based on historic cost. | Establish cost, useful life and treatment history for construction, reconstruction and replacement. | Depreciate value linearly based on asset age. | Asset Value Asset Consumption Ratio |

| Reporting Asset Value for TAM | Calculate value based on replacement cost or market value. | Establish cost and useful life for construction, reconstruction and replacement. Avoid analysis of historic treatments by using condition data where available. | Depreciate value based on effective age determined using condition data. Use linear depreciation unless a non-linear depreciation pattern has been established. | Asset Value Cost to Maintain Value Asset Consumption Ratio Asset Sustainability Ratio Asset Funding Ratio |

| Evaluating Treatment Decisions | Calculate value based on replacement cost | Establish cost, useful life and treatment effects for all treatments being compared. Avoid analysis of historic treatments by using condition data where available. | Depreciate value based on effective age determined using condition data. Evaluate the benefit consumption pattern in determining how to depreciate. | Asset Value Cost to Maintain Value Net Present Value Asset Consumption Ratio |

| Determining Benefits to Users and Society | Calculate value using an economic perspective. | Establish cost and useful life for construction, reconstruction and replacement. | Calculate costs and benefits expected over the life of the asset in lieu of depreciation. | Net Present Value Benefit/Cost Ratio |

As detailed in the table, it is important to maintain consistency with financial reporting then it is important to adopt a cost perspective and base asset value calculations on historic costs. On the other hand, if one seeks to quantify the benefits of an asset to transportation users and society, then one should adopt the economic perspective.

With the other drivers listed in the table one may adopt a cost or market perspective, and may use different approaches for different asset classes. These two drivers differ from each other in the level of detail they imply. More detail is needed to support making treatment decisions than to calculate an overall value without comparing specific treatment decisions. Thus, in cases where treatment decisions are being evaluated a greater level of detail may be required, specifically with regard to calculating depreciation and treatment effects.

Calculating asset value requires data on the asset inventory, on asset age or condition, and on asset treatments. The availability of asset data, or lack of it, may impact what approach an agency uses for calculating asset value. Also, it may impact what assets are included in the calculation and the level of detail at which calculations are performed.

Collecting and maintaining quality asset data can be a significant investment in and of itself. If needed data are unavailable, an agency may be able to expend additional resources to collect additional data and/or improve data quality. Thus, questions about data availability can become questions about resources: are the resources available to collect the desired data? This section discusses what data are needed for calculating asset value and approaches for assessing asset data.

Table 3-2 summarizes data needs for calculating asset value. This information may be available from a range of agency management systems and data repositories. As indicated in the table, certain types of data are required regardless of the approach one uses. Other data may be needed depending on the specific approach. This point at this step is to determine what data are actually available to help support decisions about the scope of the calculation. Key considerations include:

- Inventory data are critical for the calculation, but the level of detail required in the asset inventory depends upon the specific application. Having a comprehensive inventory of all assets is ideal, but often neither achievable nor necessary for the purpose of calculating asset value. Often it is feasible to use summary data on an asset inventory to calculate asset value – e.g., the distribution of assets by age or condition for a given asset class or subclass. Also, assets are frequently included implicitly as part of another asset rather than being inventoried explicitly.

- Some form of data is needed regarding the current condition of the asset inventory using either asset age, condition, or a mix of the two. This is used to depreciate asset value. Chapter 6 discusses issues regarding calculation of depreciation. Often the availability of this data is a limiting factor in calculating value.

- The availability of treatment data is critical for establishing what treatments are considered in the calculation. This topic is discussed further in Chapter 5. For any treatment that is included it is imperative to have a unit cost. If historic costs are used as the basis for the calculation, then ideally one would have historic costs as well, but historic costs can be approximated given unit treatment costs and information on asset age.

- Various other parameters may be required for the asset value calculation, particularly if calculating market or economic value. These approaches are discussed further in Chapter 4.

Table 3-2. Data Needs for Asset Value Calculation

| Inventory Data | |

| Always Needed Asset quantity by:

| May Be Needed

|

Challenges

|

|

| Condition Data | |

Always Needed

| May Be Needed

|

| Treatment Data | |

Always Needed

| May Be Needed Historic data on treatments performed by:

|

Challenges

|

|

| Other Data and Parameters | |

Always Needed

| May Be Neeeded

|

Challenges

|

|

In assessing what data are available, one should also consider the quality and completeness of the data, noting any significant concerns. Common issues in this regard include, but are not limited to:

- Data may be available for a given subset of the inventory (e.g., for a given asset class and/or district), but may not be available consistently across the agency. For many asset classes data on a statistical sample of the assets are acceptable.

- Inventory and/or condition data may be available for a given point in time, but may not be consistently maintained.

- There may be limited data on what treatments have been performed on a given asset since it was first constructed. This can be an issue if one is relying on asset age rather than condition to establish depreciation, particularly if one also seeks to include other treatments besides asset construction/reconstruction in the approach.

- There may be other changes over time that changes in data over time that may difficult to track and that further complicate use of historic data. This may include changes in the network (e.g., which highways are included in the NHS), changes in asset ownership, and/or changes in data collection approaches.

- Information on current and predicted future asset use needed for calculating economic value may be unavailable or difficult to obtain.

The process of assessing the data available for calculating asset value may be performed as part of a broader assessment of an agency’s asset data resources and needs. NCHRP Report 956: Guidebook for Data and Information Systems for Transportation Asset Management presents an approach for assessing an organization’s current data and information management practices in support of TAM, as well as strategies for improving these practices (17). An agency can apply the guidebook comprehensively to all of the organization’s TAM activities or use it to focus on particular components, such as components related to calculating asset value.

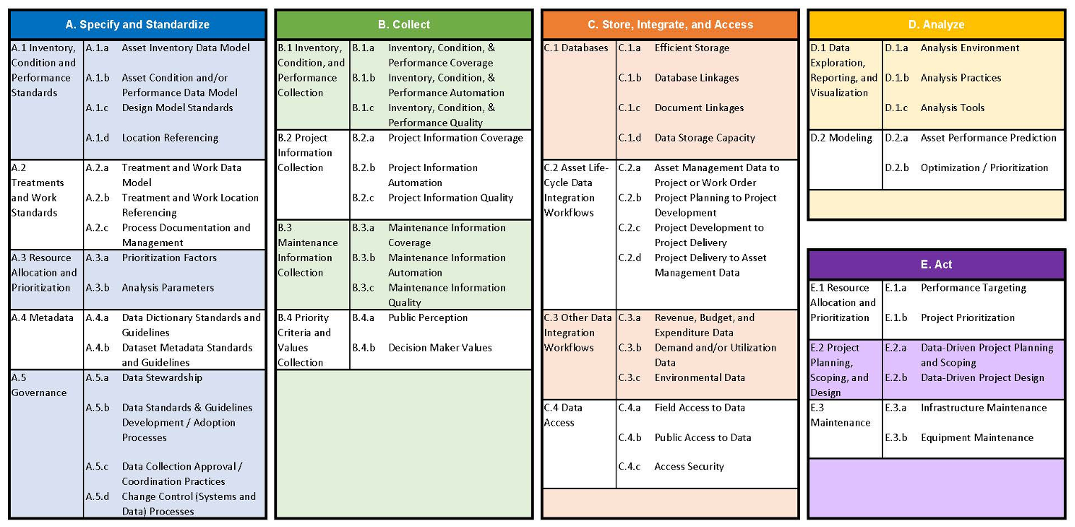

Figure 3-1 reproduces the “Data Life-Cycle Framework” from NCHRP Report 956. This shows the different elements of an organization’s asset data included as part of an assessment. The framework organizes the assessment items into five categories. Of these, two are most relevant for assessment of data for asset valuation: A. Specify and Standardize; and B. Collect.

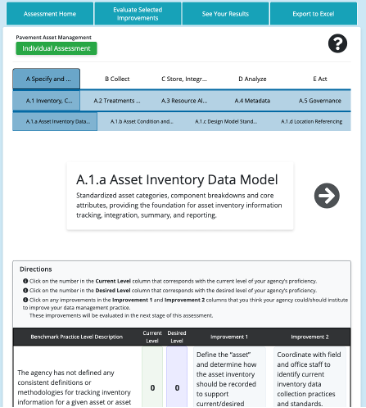

NCHRP Report 956 is accompanied by a web tool, the TAM Data Assistant, to support the assessment of TAM data needs. Together the guidebook and the tool offer an organized process for evaluating and improving an agency’s data systems. This web tool is hosted by AASHTO and available for public agency use.

The screenshots below show the primary two steps in the tool’s process. First, users assess their data system using benchmarks provided for each of the five areas outlined in Figure 3-1. Then, in the screen on the right, they evaluate their selected improvements to prepare an implementation plan.

In addition to guidance for the TAM Data Assistant, the report provides case studies demonstrating the importance and impact of data improvements across state DOTs and resources for those facilitating the assessment. For more information about the tool and the NCHRP Report, visit www.tamdataguide.com.

Source: NCHRP Report 956 (17)

After establishing the motivation for calculating asset value and reviewing available data, the next step is to identify which assets will be included in the valuation calculation through establishing an asset hierarchy. An asset hierarchy is a framework for organizing a set of assets. It specifies asset classes and sub-classes, as well as any parent-child relationships between different types of assets.

Note that an organization may already have established an asset hierarchy that can be used to support this step. Alternatively, one may establish a hierarchy specifically for the purpose of calculating asset value. In any case, it is important to note that the set of assets included in the asset value calculation may be different from that defined for other purposes. Thus, if one is referencing an existing hierarchy, it will be necessary to further note which assets are included explicitly in the asset value calculation, which are included implicitly as part of some other asset, and which are excluded.

Assets exist within a network, and they rely upon the collective maintenance of the network to function properly. If some assets in these networks are not explicitly valued, their impact should be accounted for implicitly within the valuation. Also, at this point practitioners should establish whether the asset value calculation is focused on specific systems or subsets of assets. Asset subsets comprise its inclusion within a system (e.g., on the NHS or Interstate), ownership of the asset (federal, state, or local), and the asset’s geography.

A final consideration for the asset hierarchy is ensuring that assets excluded from the analysis are not neglected in maintenance or other investments. By analyzing assets within a network or along a corridor, one can weigh all aspects of maintenance for all levels of assets, from geotechnical structures to the pavement markings.

The following subsections describes common classes of transportation assets and considerations in calculating asset value for each.

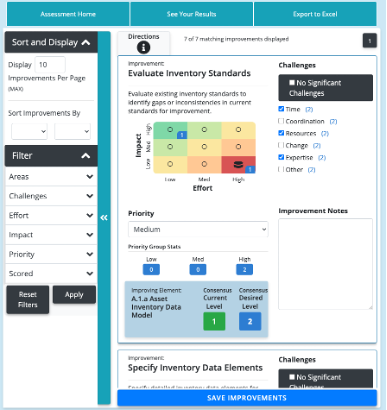

Minnesota DOT (MnDOT) includes calculates value for pavement and bridge assets in its 2019 TAMP, as well as for culverts, tunnels, signs, light towers, noise walls, signals & lighting, pedestrian infrastructure, buildings and ITS. The table displays MnDOT’s full asset hierarchy.

Source: Minnesota DOT (29)

This asset includes the wearing surface of roads, runways, sidewalks and other paved surfaces, as well as the other layers supporting the wearing surface. For highway agencies pavement is typically the asset with the greatest overall value; it is the asset a highway department has the most of. State DOTs are required to estimate the value of their NHS pavement in their TAMPs.

State DOTs are required to maintain an inventory of their roadway pavement through the Highway Performance Monitoring System (HPMS), and to collect condition data for different pavement distresses for pavement on the NHS. A challenge in managing pavement data is that pavement is a linear asset, and can be sectioned in different ways. For instance, condition data may be collected and reported for 1/10-mile sections, while longer management sections are used for predicting future conditions and developing projects.

Frequently, asset value calculations include a number of additional assets as part of the valuation of pavement, to the extent these additional assets may be replaced or reconstructed as part of a project to replace or rehabilitate the pavement. This may include shoulders, curbs, pavement markers/markings, signs, and drainage assets. Also, sidewalks and bike paths, though paved, are often treated as separate assets from roadway pavement.

Pavement life varies by material type (e.g., asphalt, concrete, hybrid, etc.), operating environment, how the pavement is maintained, how the end-of-life is defined, and what specific assets are included as part of the pavement asset. Typically, the wearing surface of a road is assumed to last approximately 20 years, while the “full-depth life” which includes multiple rehabilitation treatments of the wearing surface, is assumed to be approximately 50 years (18).

This asset class includes constructed works that allow a road to span a physical obstacle, such as a river or other road. For a highway agency structures are typically the asset class with the second greatest value following pavements.

Here this asset class is defined to include bridges and tunnels, and culverts. In practice the terms “structures” and “bridges” are often used interchangeably. In the U.S. bridges, tunnels and larger culverts are all included in the National Bridge Inventory (NBI) and State DOTs are required to estimate the value of their NHS structures in their TAMPs.

State DOTs are required to maintain an inventory of all bridges on public roads in their state. Also, State DOTs are to report condition data for the bridges in the state, collected through periodic visual inspections.

Structures are long-lived assets. As a practical matter, a structure can remain functional for 100 years or more if it is appropriately maintained. However, structures are often replaced when replacement is the most cost-effective alternative for addressing deterioration, or if the structure has functional issues that render it obsolete (e.g., designed for smaller loads or traffic levels than current standards). Based on review of the 2019 State DOT TAMPs, DOTs typically assume a design life of 75 years for their structures for the purpose of calculating asset value.

This class includes a number of different assets that either enhance mobility and/or improve safety. This includes, but is not limited to:

- Signs and their supporting structures

- Traffic signals

- Lighting

- Guardrail, median barriers, cable barriers and other impact attenuators

- Pavement markings and markers

- Intelligent Transportation Systems (ITS) devices such as cameras, other sensors and detectors, and variable message signs

- Tolling systems

- Grade crossings

Practices regarding management of traffic and safety assets vary widely between specific asset types and agencies. NCHRP Synthesis 371 provides a summary of current practices and typical asset lives for several common types of assets (19). Service lives for traffic and safety assets range from one to two years for certain types of pavement markings to 20 years or more for guardrails and median barriers.

Generally, agencies lack data on asset condition for many traffic and safety assets, as collecting condition data can be impractical and condition is often a poor predictor of when the asset needs to be replaced. Furthermore, many agencies have limited or incomplete inventory data on these assets, which is the starting block for collecting condition data. In many cases, traffic and safety assets are replaced due to functional obsolescence rather than as a result of their physical deterioration. As noted above, these assets are frequently replaced as part of a larger effort to rehabilitate a section of pavement or a corridor, and thus, they are often valued as part of the pavement asset class.

Vehicle assets include revenue and maintenance vehicles, such as buses, paratransit vehicles, ferries, train cars, tow trucks, plows, and various other types of service vehicles. For State DOTs vehicles are often a small portion of an agency’s inventory. On the other hand, for transit agencies revenue vehicles typically represent the largest single asset class an agency owns based on asset value.

The Federal Transit Administration (FTA) has published assumed useful lives, termed “useful life benchmarks,” for a range of vehicle types (20). Default values are 8 years for four-tired vehicles such as automobiles and vans, 14 years for buses, 31 years for light and heavy rail vehicles, and 39 years for commuter rail coaches and locomotives.

Agencies track inventory data on their vehicles, but approaches vary regarding tracking condition data. Often age or vehicle mileage is used as a proxy for asset condition. Transit agencies report data by vehicle subfleet for revenue and service vehicles to the National Transit Database (NTD).

A notable feature of vehicles is that relative to fixed assets they are more easily transferred from one owner to another. Thus, it is often feasible to establish a market value for vehicles using information on the sale or auction of used vehicles.

For transit systems that operate light rail, heavy rail or commuter rail, fixed guideway is a significant asset class. This includes track, communications and signals, and electrification systems. For the purpose of reporting to the NTD, transit agencies group other fixed assets besides facilities into the category of “Infrastructure.” In the NTD this category also includes structures and guideway for bus rapid transit systems that are addressed above in structures and pavement.

It is difficult to generalize management approaches and asset lives as these vary significantly between different asset subclasses and agencies. Generally fixed guideway assets tend to be long-lived. Track requires periodic rehabilitation but can be maintained indefinitely. Communications, signals, and electrification assets have varying lives which are often dictated by consideration of functional obsolescence rather than physical condition. Transit agencies report data on their inventory and its age to the NTD. FTA describes different guideway assets and management approaches in its Transit Asset Management Guide (21).

Transportation agencies own and operate a number of facilities. Typical facilities for highway agencies are discussed in (22) and include:

- Administrative facilities

- Maintenance depots;

- Rest areas;

- Toll plazas;

- Weight stations; and

- Communications facilities.

Transit facilities are classified in the NTD as either: administrative/maintenance facilities such as office buildings, bus garages or rail yards; or passenger facilities such as stations and parking garages. Airport facilities include many of these same types, as well as aircraft hangars, terminals, fueling facilities and baggage handling facilities. Many facilities include major pieces of equipment (e.g., vehicle lifts) that may be inventoried separately or considered as part of the facility.

Like structures, facilities are typically complex, with many different components, and have a seemingly indefinite lifespan. Overall facilities lives are estimated as 50 to 100 years in models such as FTA’s Transit Economic Requirements Model (TERM) Lite (23). Similar to vehicles, in some cases facilities may be transferable to other owners, simplifying the calculation of a market value for a facility.

Transportation agencies manage various other assets not addressed in the classes discussed above, including:

- Drainage: this encompasses pipes, gutters, drains, retention/detention ponds, and others. Management of drainage assets is complicated by the fact that many are underground and difficult to inventory. Also, in many cases it may be difficult to establish maintenance responsibility for drainage assets.

- Geotechnical: NCHRP identifies four basic subclasses of constructed geotechnical assets (24). These are slopes, embankments, subgrade, and retaining walls. Agencies may also identify geohazard locations (e.g., potential rockfall locations) in an asset inventory. As in the case of drainage assets, it can be a challenge to establish an inventory of geotechnical assets. Typically, these assets are long-lived, with asset lives similar to structures.

- Bicycle and Pedestrian Assets: bike lanes, sidewalks, curb ramps, and other related features. These assets promote multimodal accessibility, and in some cases (e.g., curb ramps) may be needed to comply with the legal requirements such as the Americans with Disabilities Act (ADA). Typically these assets have lives similar to traffic and safety assets described above.

- Land: this includes right-of-way, land used for facilities, and other land owned by a transportation agency. Land is different from other transportation assets regarding calculation of asset value in that it is not assumed to depreciate. Also, methods established for calculating the market value of real estate are directly applicable for valuing land, with the additional complication that in many cases there is additional value associated with maintaining a corridor (e.g., for construction of a future transportation link or fiber optic cable). Transportation agencies typically do not calculate a value for their land for TAM applications given it does not vary as a function of TAM-related decisions. However, land value can be highly relevant for decisions where the privatization of assets is evaluated, or where the overall benefit of an asset to society is considered.

In the context of this document, componentization is defined as the process of delineating parts of an asset – components – for which the asset value calculation is performed separately. Defining asset components may be necessary to obtain an accurate calculation of asset value, depending on the nature of the assets being valued and the intended application of the asset value calculation. The following subsections discuss the reasons for defining asset components when calculating asset value, specific criteria for when to componentize, and asset classes where componentization may be considered.

The basic reason one may wish to break an asset into components is that it may be a complex asset with different elements that have different asset lives. If the only treatment one performs on an asset is to replace it then this detail is immaterial. In this case the remaining life of an asset is dictated by the minimum remaining life of the different components of the asset. However, if it is feasible to treat individual components of an asset, extending their life while leaving the life of other portions of the asset unchanged, then the situation is more complex. In this case, considering the different asset components yields a different and arguably more accurate calculation of value than performing the calculation only for the asset as a whole.

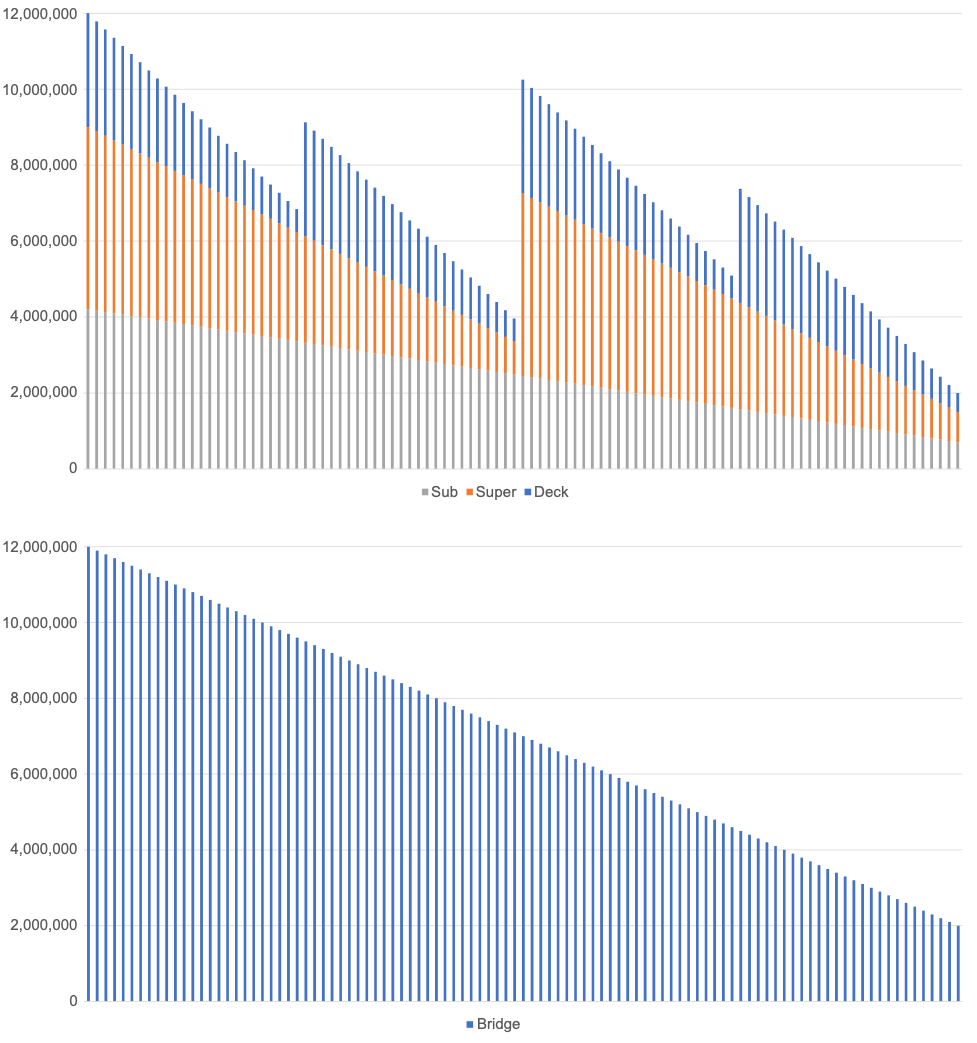

An asset that is commonly decomposed into components is a bridge, as discussed further below. Figure 3-2 shows how a bridge may be valued over time with and without calculations at the component level. The upper panel shows the asset value of the bridge by year, subdivided by components (deck, superstructure and substructure). The components have different asset lives and thus depreciate at different rates. At three points in time the value is increased as a result of a treatment performed on a component (the deck and/or superstructure).

The lower panel shows the value if calculated at the bridge level. In this case the value declines more gradually over time, and the treatments applied at a component level do not impact the overall value. Asset value at the beginning and end of the analysis is the same in both cases. However, the component-level representation more accurately reflects the effects of different treatments.

Note that in this case, various complicating factors have been omitted. Most notably, in this case, depreciation is based on component age. In reality for asset management applications, it is common to base depreciation on condition where condition are available.

Based on the above discussion, the following criteria are recommended for establishing when to perform the asset value calculation at the component level. Specifically, componentization is recommended in cases where:

- The asset represents a significant portion of the value being calculated;

- The asset is complex, with different identifiable components aging at different rates;

- Multiple treatments are performed to the asset over its life extending the life of different components;

- Data are available on the inventory of asset components and on either their condition or age to support calculation of depreciation; and

- The driver for calculating asset value is to evaluate different treatment options, or there is significant interest in doing so.

Agencies may establish additional criteria for when to value assets at a component level. The example below describes guidance for valuing assets at a component level. For example, Austroads describes that an asset over $5 million should be componentized when the asset structure can be separately identified, the different parts can each be measured, and the components have different service lives (24). The example below illustrates the componentization approach recommended by CIPFA for local agencies in the U.K.

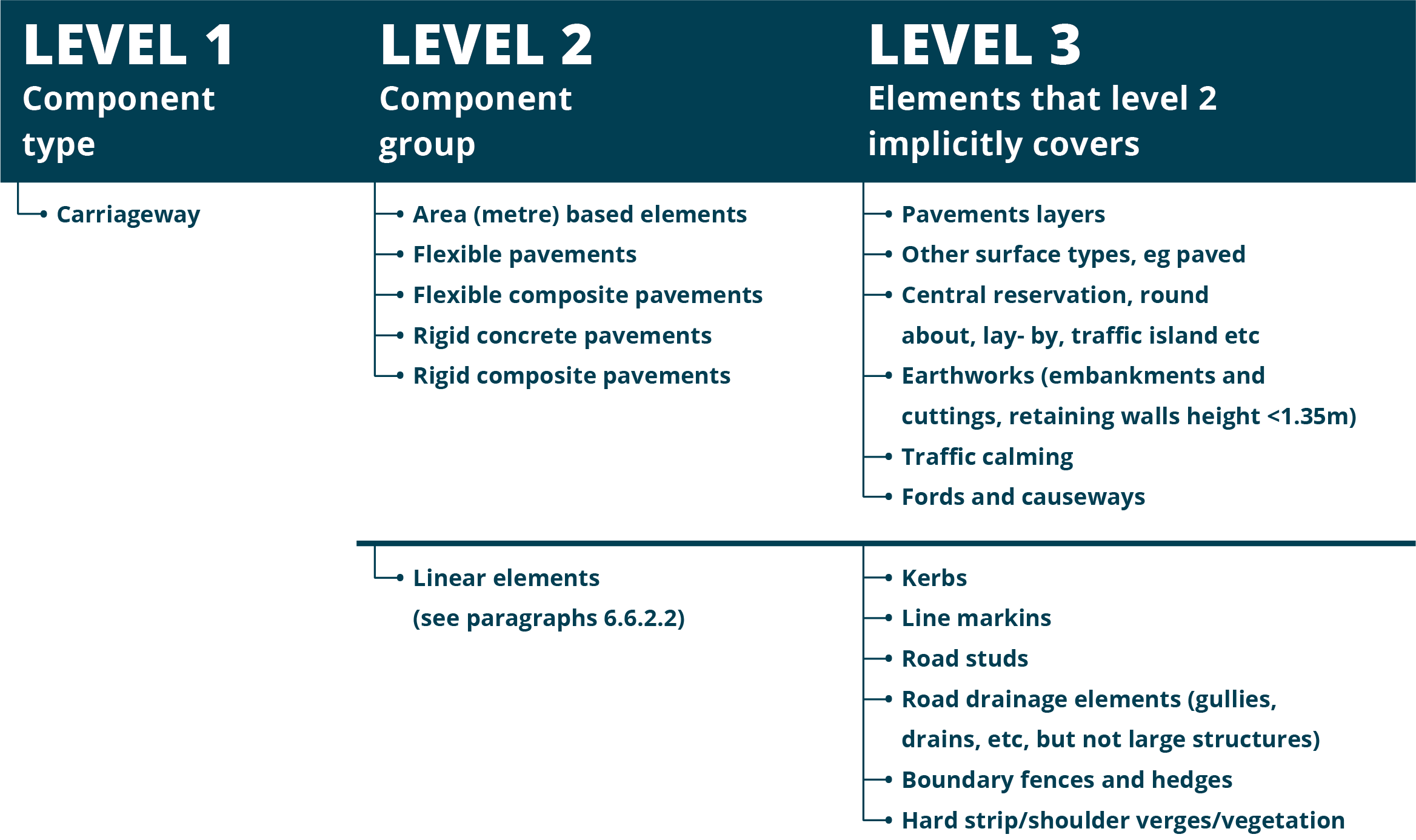

The Chartered Institute of Public Finance and Accountancy (CIPFA) has established an asset hierarchy and componentization approach for the purpose of calculating asset value to be used by local agencies in the U.K. (16). In its guidance CIPFA defines three levels in the hierarchy:

- Level 1: Component Type – broad categories based on the general function of the components. They divide the Highways Network Asset into categories of components and provide an appropriate basis for high-level management information.

- Level 2: Component groups – used to distinguish between component types that have a similar function and form.

- Level 3: Elements – distinguishes between components that, at least when systems become well developed, may require individual depreciation and impairment models, such as different service lives and/or rates of deterioration.

The table depicts how these levels are defined for pavement (carriageways).

Source: CIPFA (16)

The transportation asset classes that are most commonly divided into components are pavement and structures. Other asset classes that may be componentized are facilities and fixed guideway. Below are specific considerations regarding these asset classes.

Pavement

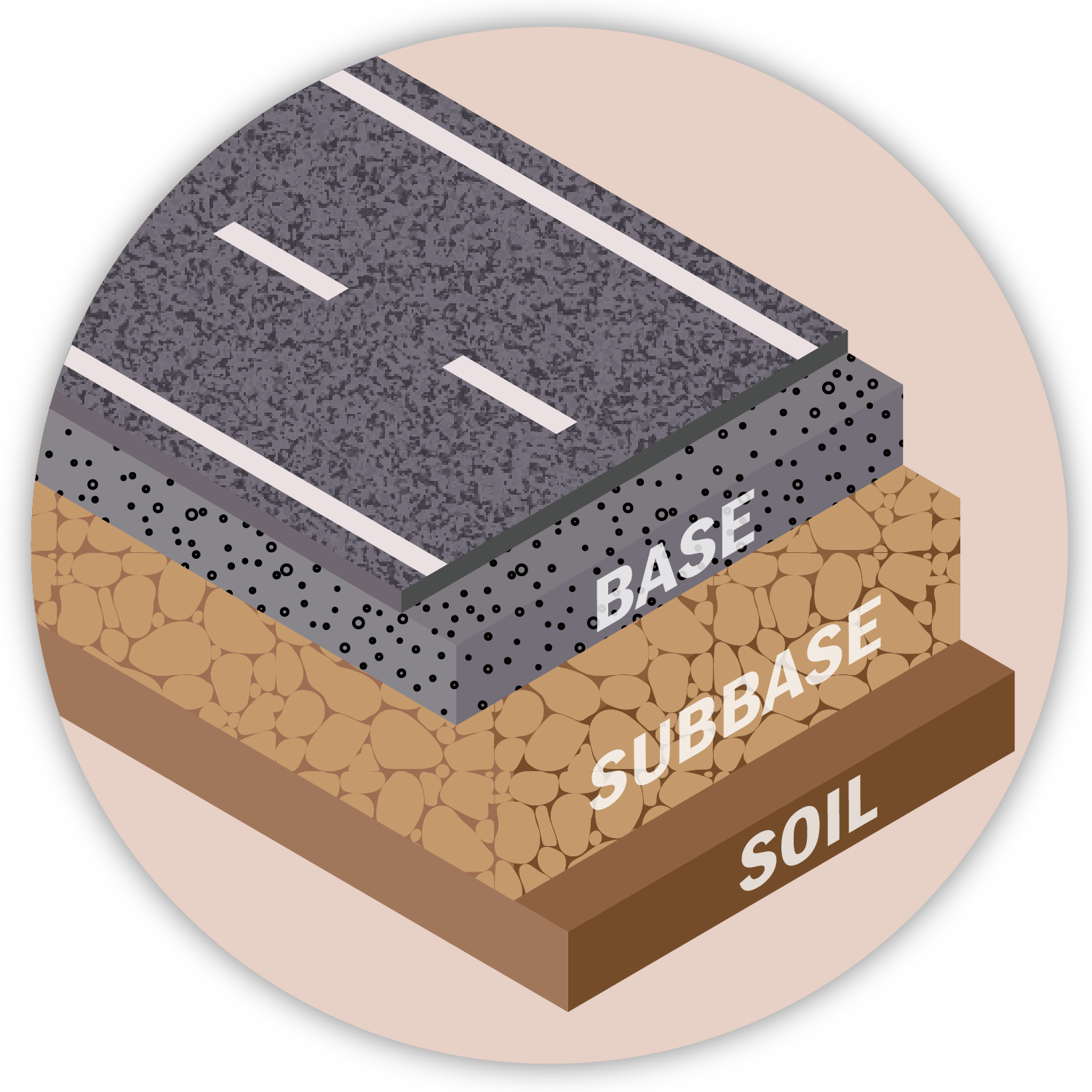

Pavement may be split into components, but doing so is the exception rather than the rule in U.S. practice. Where pavement is componentized, typical components include the pavement surface, base, subbase, and subsurface, as illustrated in Figure 3-3. This approach is used by agencies such as New Hampshire DOT TAMP (25), and recommended in by Austroads (26).

The challenge in valuing individual pavement components is that most condition data collected for pavement, such as roughness, rutting, cracking and faulting, are measures of surface distresses. Limited data are available regarding the underlying condition of the pavement structure and base, though increased surface distress may result from deterioration of the pavement structure. A further consideration is that while it is possible to treat the pavement surface without treating the pavement structure, the converse is not true: any treatment that impacts the structure or base of the pavement also effect the surface.

The basic approach that one can use to address the complexity of pavement without breaking it into components is to calculate an effective age for a pavement section that adjusts the actual age of the pavement (which captures the age of the base and structure) using condition data (which best represents the surface of the pavement). Also, agencies typically introduce business rules in developing their lifecycle strategies to limit the number of times that an overlay or other surface treatment can be performed without more extensive rehabilitation of the pavement structure.

Structures

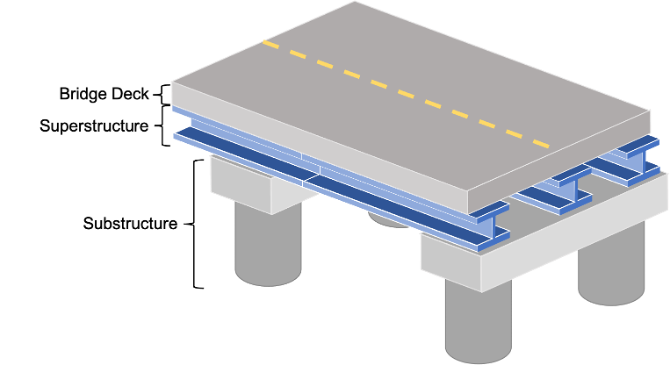

Structures – particularly bridges and tunnels – are complex assets that typically meet the criteria provided above for componentization. Where bridges are componentized, the typical components are the bridge deck, superstructure and substructure as depicted in Figure 3-4. The NBI includes visual ratings of these components, simplifying the task of componentizing for U.S. highway bridges. To support a componentized approach, one must determine what portion of the asset value is comprised by each component, and then value each component separately. Chapter 8 provides an example of a component-level calculation of asset value for structures.

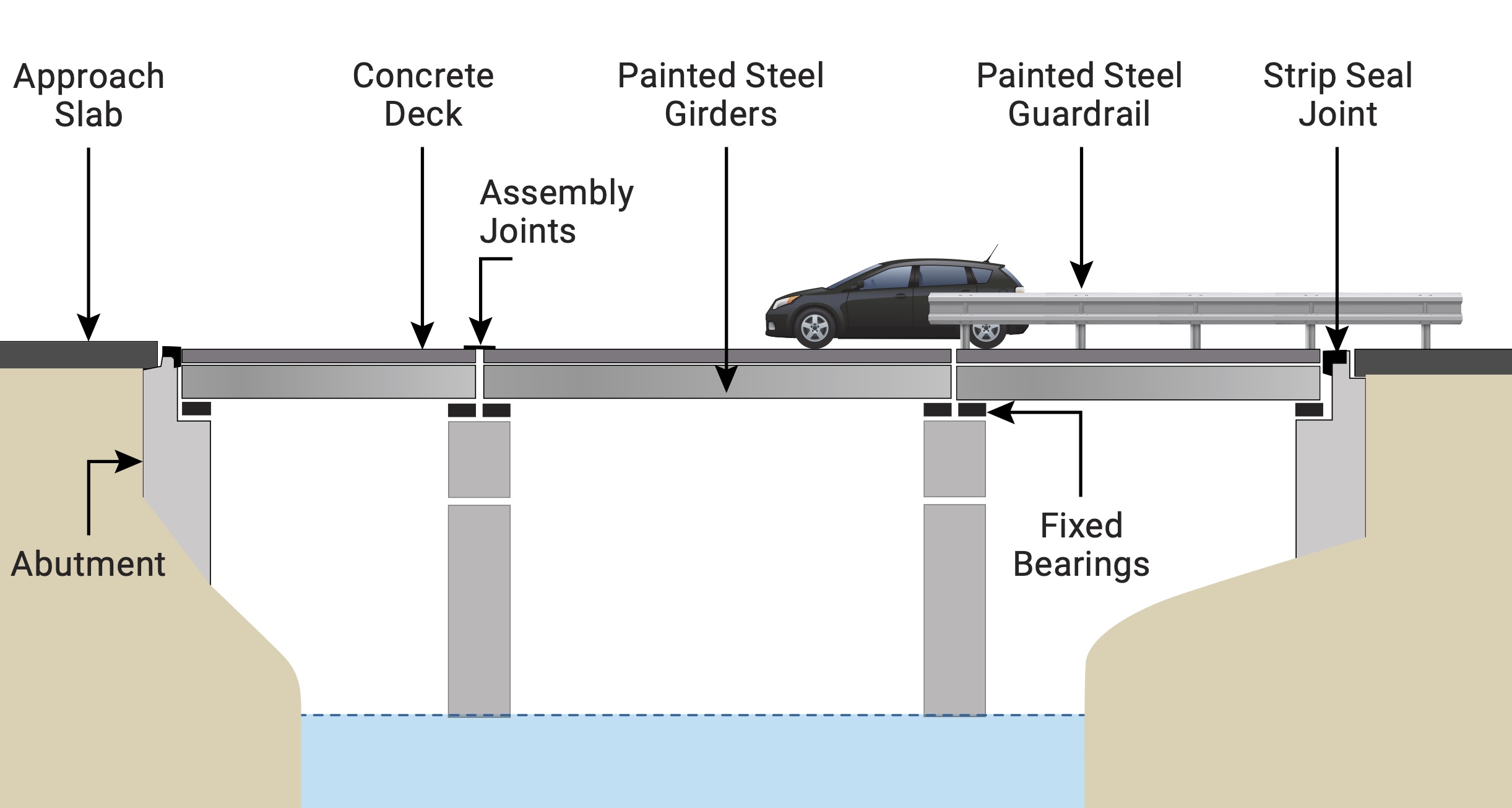

For all NHS bridges and many other state-owned bridges, state DOTs also collect more detailed condition data for structural elements based on AASHTO specifications. This data provides the basis for componentizing at an even greater level of detail if desired. Figure 3-5 shows an example of the structural elements of a bridge.

Tunnels are extremely complicated structures and should be valued using a componentized approach where feasible. Components of highway tunnels are defined by FHWA in the Specifications for the National Tunnel Inventory (27). These include: structural elements (similar to bridges); civil elements (e.g., barriers and railings), mechanical systems (e.g., ventilation and drainage); electrical and lighting systems; and fire and life safety systems.

Other Assets

Facilities and fixed guideways are examples of asset classes that may be componentized, depending on data availability and the specific application of the asset value calculation. There are no widely accepted standards for assessing or componentizing highway facilities in the U.S. Regarding transit facilities, FTA has developed guidance for inspection of facility systems, subsystems, and components such as the substructure, shell, interiors, plumbing and electrical systems (28). Transit agencies assess conditions of their facilities and report their overall condition to the NTD. Fixed guideway is a complex asset and ideally should be componentized (e.g., into track, communication, and electrification subclasses). However, there are no specific standards in the U.S. for how to componentize and assess different guideway assets.