Depreciation is defined as “the loss of value of an asset or class of assets, as they age.” (1). Depreciation represents the consumption of capital, or the consumption of the benefits of an asset. From an accounting perspective, the depreciation calculated over some period measures how much value of an asset has been “used up.” From the perspective of an asset manager, depreciation is a measure of how much closer an asset has moved toward the end of its useful life.

Depreciation is calculated when it is necessary to adjust an asset’s value over time. If an asset’s value is based on the initial cost of constructing or purchasing the asset, the value at a later point should be depreciated. If one is using a market or economic perspective to establish value, then it may not be necessary to calculate depreciation. In such cases, depreciation may need to be calculated if adjusting a prior calculation of asset value. However, it is preferable to simply revalue the asset by repeating the calculation of value performed as described in Chapter 4.

Depreciation is closely related to deterioration, or decline in the physical condition of an asset. Generally speaking, as an asset ages, its benefits are consumed and it deteriorates. However, the consumption of benefits (as measured by depreciation) and the decline in condition (as measured by deterioration) often occur at different rates. For example, in accounting it is common to assume accelerated depreciation, in which asset value is assumed to decline more rapidly for a new asset than an older one.

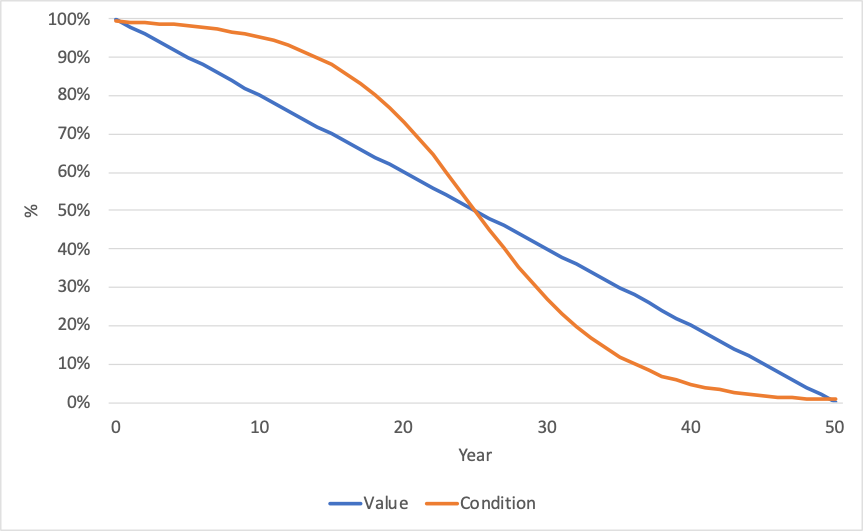

Below is an example illustrating how a deterioration curve can be used to calculate depreciation. Here value and condition are both depicted as a percentage of the value for a new asset. In this case, depreciation is assumed to be linear. Thus, the value of the asset decreases linearly from its initial value to its residual value. Condition of the asset follows an s-shaped curve (a logistic curve), in which the condition declines gradually near the beginning and end of an asset’s life, and more rapidly in the middle of its life. In this example it is further assumed that the asset is operated in the same manner over its entire life. Thus, the fact that physical conditions are declining more rapidly or slowly at different points in its life is immaterial: the key question is that of the remaining life of asset, which may need to be revised based on the asset’s condition. This example is representative of assets such as pieces of equipment that remain in service until the end of their life, and are used in the same manner generating the same benefits as long as they are safe to operate.

When the benefits derived from an asset depend upon its physical condition, the situation is different. In these cases, depreciation may be directly tied to deterioration, and therefore age is no longer an appropriate approximation. For example, for rail cars one might consider that as a vehicle ages riders suffer greater discomfort from riding on the vehicle and are more prone to experiencing delays in service. For pavement, user costs increase as pavement condition worsens. In such cases, the pattern of depreciation may better match the pattern of deterioration and a condition-based depreciation approach is best suited.

Depreciation may incorporate other factors beyond deterioration, as well. One key issue is technical obsolescence. Estimates of asset useful life typically incorporate assumptions concerning obsolescence, but this is not a factor incorporated into deterioration estimates. Assets can become obsolete due to technological or functional factors. For instance, a traffic controller may be in excellent physical condition, but would be considered to be obsolete if it no longer met industry technical standards and/or if it was no longer feasible to obtain replacement parts for the asset. Likewise, a bridge may be considered obsolete if designed to outdated functional standards for clearances and load carrying capacity. Typically once an asset is obsolete it assumed to be fully depreciated.

Another complicating factor that may be considered in calculating depreciation is the level of use of an asset, which may change either as a function of time, asset condition, or other factors. For example, a transit agency may use an older vehicle in poor condition less, utilizing newer, more reliable vehicles instead where feasible. On the other hand, for highway assets, traffic may continue to increase over time regardless of the condition of the asset, suggesting accelerating rather than decelerating depreciation.

Determining the various benefits an asset yields and how these vary over time can be an involved process. However, for most applications various simplifying assumptions are made to reduce the complexity. The different approaches can be grouped into three basic types, representing different levels of complexity in the calculations and data requirements. Table 6-1 lists the basic types of deprecation approaches and summarizes the strengths and weaknesses of each approach.

Table 6-1. Approaches for Calculating Depreciation

| Approach | Description | Strengths | Weaknesses |

|---|---|---|---|

| Actual Age | Depreciation increases linearly as a function of actual age | Straight-forward to calculate for new assets Requires few additional assumptions | Historic data may not be available, particularly for asset components Data on last treatment may be needed to establish age |

| Condition-Based | Depreciation increases linearly as a function of age adjusted for condition | Accommodates consideration of a wide range of treatments Can be calculated without historic data Supports evaluation of treatment selection and timing for TAM | Requires collecting condition data, frequently at a component level Can be a challenge to relate condition to remaining life, particularly for assets in very good or very poor condition |

| Non-Linear Benefit Consumption | Pattern of depreciation is determined based on a tailored analysis of how benefits are consumed | Flexible approach Consistent with U.S. and international accounting standards Best approach for matching actual pattern of use of an asset | Involves supplemental analysis Results may be dependent on parameters such as traffic growth and discount rate which are outside the control of an asset manager |

The simplest approach to calculating depreciation is to assume “straight-line depreciation” based on asset age. In this approach, one establishes the age of an asset or asset component, and then assumes depreciation increases in a linear fashion over the asset’s useful life. Thus, the value of the asset is presumed to decline by a constant value each year, dropping from the initial value to the end-of-life residual value. The virtue of this approach is its simplicity. When given an initial value, residual value, useful life, and asset age one can quickly determine asset value without any additional assumptions.

For any asset where very limited data exist, this relatively simple approach provides the asset manager with a functional method to determine a depreciation value. This approach can be applied to assets for which limited inventory data are available, assuming a distribution of asset age based on a model or sample data. Such approaches can be used to estimate value for assets such as signs and drainage structures which are numerous, but for which agencies may not have comprehensive data. Also, depreciating based on age can help address cases where an older asset becomes technically obsolete regardless of its physical condition.

In many cases, simply basing depreciation on an asset’s age can be too simple for supporting TAM applications. Often the age of an asset is a poor predictor of its remaining life, particularly if treatments have been performed to extend its life. Including effects of treatments further complicates the calculation. Replacing an asset resets its age, but what is the impact of a preservation action or a rehabilitation action? Further, many treatments impact one component of a complex asset but not others (e.g., the deck of a bridge but not the substructure; or the propulsion system of a rail car but not the carriage). Thus, when considering treatments short of replacement, one may need to track age and treatment effects at a component level.

A further complication is that it is frequently difficult to determine the age of an asset, particularly at a component level. We may know that a given section of a highway was constructed 40 years ago, but that does not necessarily imply that the pavement surface of the highway is 40 years old, let alone accompanying signs, guardrails, and other supporting assets.

Asset managers routinely contend with these challenges when modeling assets in their asset management systems. For some asset classes, such as guardrails and ITS, the asset’s age remains the best predictor of how the asset will perform and what treatments may be needed. Technical obsolescence can be a major factor for assets such as ITS devices. In some cases, there may be changes in standards or technical requirements that render assets obsolete sooner than would have been expected based upon their age. For complex assets, such as roads, bridges and facilities, information on asset age is supplemented with measurements of condition to better support TAM.

Where age data are unavailable or do not provide a reliable estimate of the remaining life of an asset, it may be preferable to base depreciation on an asset’s physical condition. If available, information on an asset’s condition can be used to obtain an improved estimate of the remaining life of an asset, and by extension, its effective age. There are many different approaches for utilizing condition data, but the approach that is recommended here can be generalized as follows: one obtains a revised, effective age for an asset using the available condition data, and then can proceed with asset valuation using this new effective age rather than actual asset age.

Note that the conversion of condition to age may involve a simple conversion and/or additional business rules. For instance, one may define a mapping of condition to percentage of life remaining, but decide to base the effective age on the actual age if the age or condition reach some threshold value. The key points are that condition is used in some manner to refine the estimate of an asset or asset component’s remaining life, and depreciation is assumed to proceed linearly once an age is established.

An alternative approach utilizing condition is to base depreciation strictly on condition without translating condition into an effective age. With this alternative approach it is implicitly assumed that benefits are consumed in proportion to the decline in condition, (which is typically a non-linear function). This approach is not recommended unless supported by additional analysis to verify the assumption that benefit consumption and condition change in direct proportion to one another. Where this alternative approach is used, it falls in the domain of a non-linear benefit consumption pattern as described further in the next section.

The basic advantage of calculating an effective age is that it leverages available condition data to provide a better estimate of how much of an asset’s value actually remains. Also, with this approach one can incorporate effects of treatments in the calculation of current value without specific knowledge of the treatment history of an asset. On the other hand, calculating effective age is practical only if condition data are actually available. Frequently, asset managers face limits to the available data, so in many cases, they rely on results of visual inspections and/or measurements of surface distresses. Needless to say, there are many challenges in relating the available data to the remaining service life of an asset.

With both of the general approaches described above, benefit consumption is assumed to be linear with respect to asset age (either actual or effective). A linear model should be assumed for depreciation unless there is evidence to suggest otherwise. This approach follows the maxim often attributed to Albert Einstein: “Everything should be made as simple as possible, but not simpler.”

However, in some cases an asset manager may have reason to believe that an asset will depreciate in some other manner. The final group of depreciation approaches encompasses the set for which benefits are consumed in a non-linear manner. When using a non-linear approach, one must carefully consider what benefits are being modeled and how these are actually consumed. Once a pattern is established, it can be mapped to actual or effective asset age to calculate depreciation.

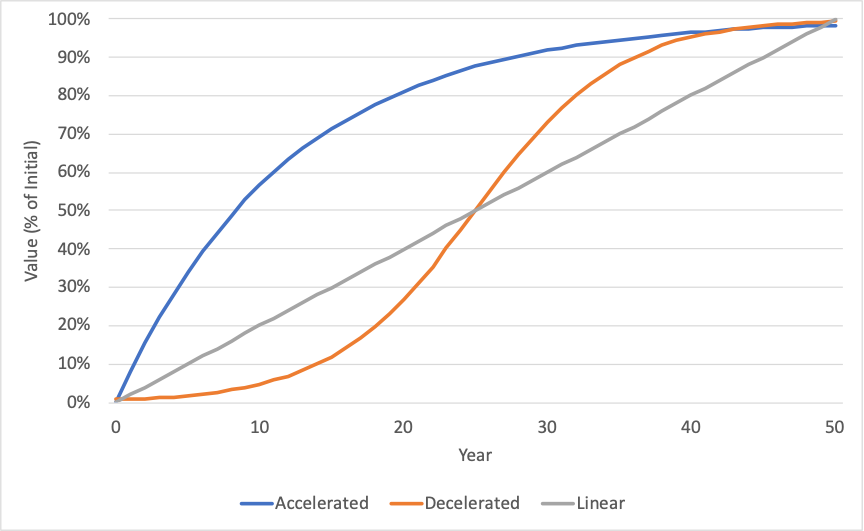

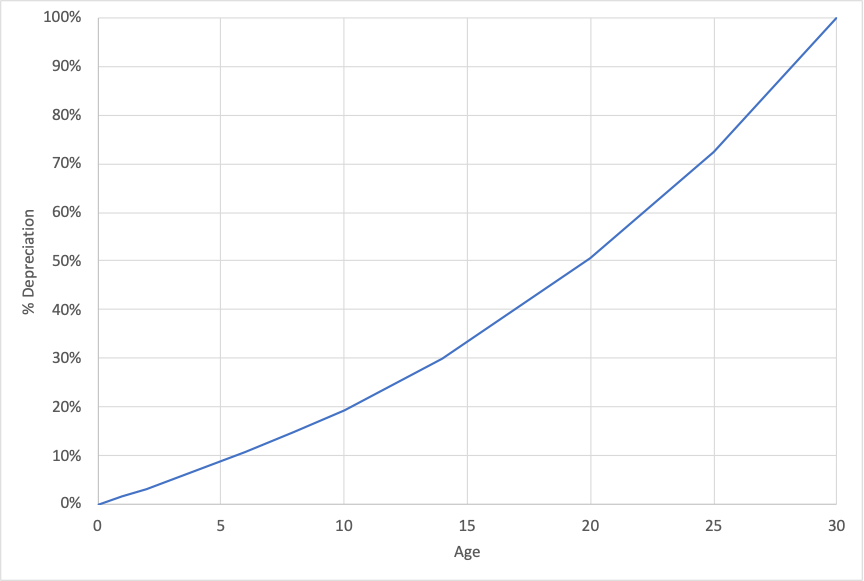

Figure 6-2 provides an example illustrating the impact of different non-linear benefit consumption patterns. In both cases depreciation is shown as a percentage of an asset’s initial value with an assumed residual value of 0. Here the asset is assumed to have a useful life of 50 years.

In the case of the lower, concave curve depreciation is accelerated: the asset loses more of its value initially and less towards the end of its useful life. This curve was developed using an exponential function of the following form:

\begin{align*} D(t) &= (V(t_0) - RV) * (1 - (1 - r)^t) \end{align*}

where:

This pattern of depreciation is applicable if the use of an asset decreases as it ages, such as in the example of a revenue vehicle described above. It can be used to support certain traditional accounting approaches, including “declining balance depreciation” and “double declining balance depreciation” as described in by Dojutrek, et. al. (35). To use declining balance depreciation, one would set r to be equal to \frac{1}{N} where N is the useful life of the asset. To use double declining depreciation, one would set r to be \frac{2}{N}.

For the upper curve depreciation is decelerated: the asset loses less of its value initially, but then depreciation accelerates towards the end of the asset’s useful life. This curve was developed using a logistic function of the following form:

\begin{align*} D(t) &= \frac{V(t_0) - RV}{1 + e^{c_1 + c_2t}} \end{align*}

where c_1 and c_2 are constants.

This functional form may be applicable in cases where use of an asset is increasing over time, and/or where an asset’s benefits are proportional to asset condition. For instance, in the case of pavement, asset value may be represented using a condition index that is inversely proportional to road user costs.

The approach of defining a customized, non-linear depreciation curve to match the pattern of consumption of an asset’s benefits is flexible, and consistent with U.S. and international accounting standards. Also, it is highly compatible with the economic perspective of asset value. If one has calculated initial asset value based on economic value, then establishing a specific pattern of depreciation can be performed using the same data compiled to calculate initial value.

The challenge with this approach is that it can be time consuming to perform the analysis required to establish an alternative benefit consumption pattern. Also, the results may hinge on assumptions outside the control of the asset manager, such as traffic growth. An asset manager may ask whether “the juice is worth the squeeze” before undertaking the additional analysis required for this approach.

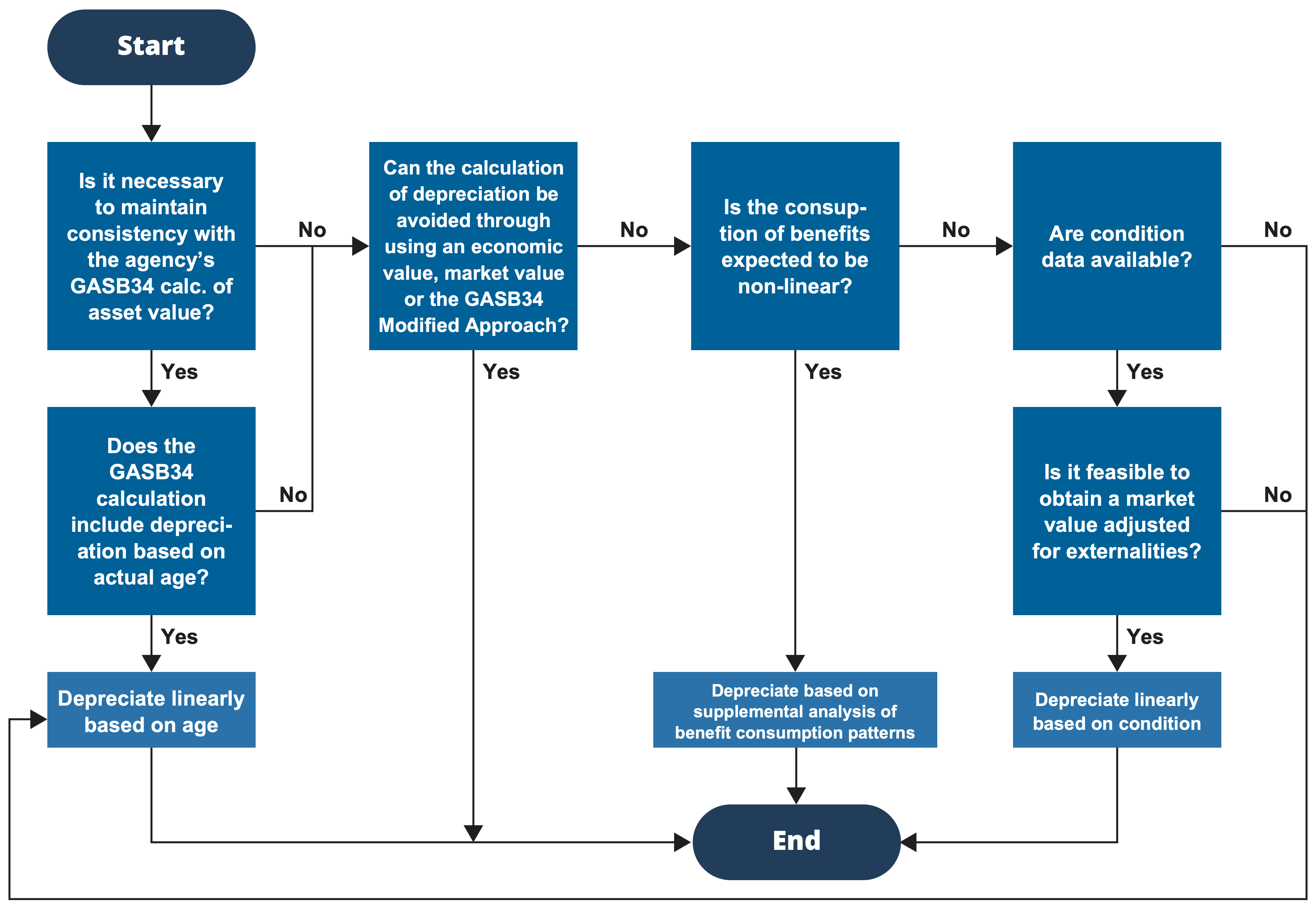

While all of the approaches for calculating depreciation are valid, various approaches are preferable for certain TAM applications and depending on what data one has available. Figure 6-3 is a flowchart recommending an approach for calculating depreciation. Following the chart, results in a recommendation to either avoid the depreciation calculation entirely, depreciate linearly based on actual age, depreciate linearly using a condition-based approach, or perform supplemental analysis to establish the depreciation pattern if there is reason to believe it is non-linear. The basic logic reflected in the flowchart is:

- In certain cases, it is not necessary to calculate depreciation. If one is using the GASB 34 modified approach a cost to maintain is calculated using an organization’s management systems, but depreciation is not specifically calculated. In cases where one requires the current value of the asset and obtains this from the calculation of initial value – e.g., in the case of economic or market value – then additional calculation of depreciation is not needed. In all other cases, depreciation should be calculated.

- Linear depreciation based on actual age should be used as the basis for depreciation if this approach was used for financial reporting based on GASB 34 and the agency seeks to maintain consistency with its financial reporting. GASB 34 does not require that agencies assume linear depreciation based on asset age, but this is the approach that is almost invariably used except in cases where an agency uses the GASB 34 modified approach.

- Depreciation is important when using the replacement cost method because it indicates asset condition. Replacement cost alone only provides the “worst-case” estimate of asset cost. By accounting for depreciation, agencies demonstrate a commitment to maintaining the asset and avoiding the single, large replacement cost at the end of the asset’s life.

- In cases where depreciation is calculated and consistency with the approach used for financial reporting is not strictly required, then one must next ask whether there is reason to believe the pattern of benefit consumption may be non-linear. If this is the case, then further analysis will be required to establish the specific depreciation approach.

- Otherwise, one should use condition data to establish effective age if condition data are available and provide a meaningful estimate of the remaining life of an asset. Actual age should be used if condition data are unavailable, or if asset condition does not help predict remaining life (e.g., for assets that tend to be replaced due to obsolescence).

Note that based on the flow chart does there may arise a case where it is preferable to base depreciation on condition, but condition data are unavailable. In the flow chart one is directed to use an age-based approach in this case. However, this raises a broader question of what data an agency collects on its assets and how to assess data needs. NCHRP Report 956 (17), Chapter 7 of the AASHTO TAM Guide, Second Edition (5), and Chapter 8.5 of the AASHTO TAM Guide, First Edition (36) are all valuable references for further discussion of this topic.

This section describes the specific steps involved using the three different depreciation approaches addressed in this chapter: linear depreciation based on actual age (“age-based”); a linear-based depreciation using a condition-based approach (“condition-based”); and non-linear depreciation established through analysis of the pattern of benefit consumption (“non-linear”).

Note that the steps presented here describe the case in which depreciation is calculated for an individual asset or component since the point at which the initial value was calculated as described in Chapter 4, or since the last treatment, if a treatment was performed more recently than the time of the initial value calculation. However, depreciation can be calculated for other contexts using the same basic steps. For instance, one can use the steps described here to calculate the cumulative depreciation of an asset looking back in time prior to a recent valuation, predict future depreciation when testing different scenarios or treatment assumptions, or calculate depreciation for an inventory rather than an individual asset.

The steps for calculating depreciation using an age-based approach are described below. The steps describe the case where depreciation is calculated relative to the last treatment, or relative to the calculation of initial value described in Chapter 4 – whichever is later. If the only treatment being considered in the analysis is the construction or reconstruction of an asset, then depreciation is calculated since the asset was first purchased, constructed or reconstructed. If additional treatments are included, then depreciation is calculated from the time of asset purchase or construction until a treatment occurs. Overall asset value is a function of the initial asset value, value added through treatments, and value lost from depreciation. The overall calculation process is discussed further in Chapter 7.

Note that depreciation can never be greater than asset value, or an asset’s value would be deemed to be negative, and thus the asset would become a liability.

- Step 1 – Compile Data:

For each asset class and type of component being valued, compile the available data on the asset inventory and its age. Also compile the key parameters established through prior steps, such as useful life and residual value. If treatments other than asset purchase, construction/reconstruction are included, compile the available data on asset treatment history. The assumptions developed previously regarding the level of detail in the analysis and treatments to include may need to be revisited based on what data are available.

- Step 2 – Determine Asset Age:

Specify age at the level of detail established for the calculation – e.g., by individual asset or as a distribution of ages for the inventory. Refer to Chapter 13 of Measuring Capital (11) for guidance on estimating age distributions based on useful life if age data are unavailable.

- Step 3 – Calculate Depreciation:

Use the following equation to calculate depreciation D at time t:

\begin{align*} D(t) &= \frac{(V(t_0)-RV) * (A(t) - A(t_0))}{UL - A(t_0)} \end{align*}

where:

V(t_0) =value at time t_0;RV =residual value;UL =useful life;A(t) =asset age at time t;A(t_0) =asset age at time t_0;Note that when the initial value is based on current replacement cost and residual value is 0 this simplifies to the following:

\begin{align*} D(t) &= \frac{Replacement Cost * A(t)}{UL} \end{align*}

Generally the steps followed using a condition-based approach are similar to those described above for an age-based approach, with two important differences. That is, the determination of asset age is more involved in this case. The condition may be used as the sole determinant of effective age, or as a factor that modifies the effective age. Further, in the event that effective age is based strictly upon an asset’s condition then historic asset data is technically not needed in this case (though presumably would be used to established technical parameters such as unit costs and useful lives).

- Step 1 – Map Asset Condition to Effective Age:

For each asset class and type of component being valued, determine how asset condition relates to age. If condition is the best predictor of remaining life, then a simple function or lookup table can be defined to predict effective age for each feasible condition value. Alternatively, one may predict effective age based on condition, actual age and/or other variables. Refer to NCHRP Report 713 (18) for detailed guidance on modeling asset life.

- Step 2 – Compile Data:

For each asset class and type of component being valued, compile the available data on the asset inventory and its condition. If the calculation of effective age requires knowledge of actual age, also compile data on asset age and prior treatments that impact age. Also compile the key parameters established through prior steps, such as useful life and residual value. The assumptions developed previously regarding the level of detail in the analysis and treatments to include may need to be revisited based on what data are available.

- Step 3 – Determine Asset Age:

Specify effective age at the level of detail established for the calculation using the approach established in Step 1.

- Step 4 – Calculate Depreciation:

Use the following equation to calculate depreciation D at time t:

\begin{align*} D(t) &= \frac{(V(t_0)-RV) * (E(t) - E(t_0))}{UL - E(t_0)} \end{align*}

where:

V(t_0) =value at time t_0;RV =residual value;UL =useful life;E(t) =asset age at time t;E(t_0) =asset age at time t_0;Note that when the initial value is based on current replacement cost and residual value is 0 this simplifies to the following:

\begin{align*} D(t) &= \frac{Replacement Cost * E(t)}{UL} \end{align*}

The final option for calculating depreciation is the most complicated of the three. With this approach, one must understand how the benefits of an asset are actually being consumed over time, and structure the depreciation function accordingly.

For this approach it is necessary to define what the benefits of an asset are, and then establish a function for predicting how these benefits are consumed. Factors to consider in establishing asset benefits are:

- Level of use – traffic volume or ridership patterns over time. As described above, for highway assets often traffic is assumed to increase over time, which tends to result in accelerating depreciation. On the other hand, if an asset is utilized less as it ages then depreciation may decelerate over time.

- Travel time, operating and social costs – generally the benefit of a transportation asset is that it supports mobility. Thus, in many cases the basic benefit an asset provides can be measured in terms of the savings in travel time, operating and social costs experienced if the asset is in service in good condition relative to the case where the asset is allowed to deteriorate. For instance, as a road deteriorates its surface roughness increases, potentially increasing traffic congestion – and thus user travel time and social costs of transportation – and increasing vehicle operating costs.

- Asset failure – as an asset deteriorates it is more likely that the asset will fail in some manner, requiring emergency repairs, as well as temporary or complete closure. Where the likelihood of asset failure can be related to asset condition these costs tend to increase over time.

Once the benefits of an asset are established, it is necessary to define a function for representing how benefits are consumed over time. There is no single functional form that can be used for this step, though exponential and logistic curves provide flexibility for capturing a range of different depreciation patterns. A common approach is to use “declining balance depreciation,” in which an asset loses a specified percentage each year. Various other approaches have been defined in the accounting literature, most of which result in accelerated depreciation early in an asset’s life, such as double declining balance and sum of year’s digit’s appreciation. The following steps describe a basic approach to establishing the depreciation relationship considering a non-linear depreciation pattern.

- Step 1 – Quantify Asset Benefits:

For each asset class and type of component being valued, establish what benefits the asset yields, and how these vary over the life of an asset. Consider agency, user and social costs and benefits, and how these vary over time, as well as based on an asset’s condition.

- Step 2 – Establish the Depreciation Curve:

Determine the functional form of the depreciation curve based on the results of Step 1. If the pattern of benefit consumption can be approximated using a linear relationship, then revert to using a linear model. Otherwise, determine whether the depreciation pattern is accelerated or decelerated relative to linear depreciation.

If the depreciation pattern is accelerated, evaluate whether a fixed depreciation rate can be used, resulting in use of an exponential curve as described in Section 6.1. If the depreciation pattern is decelerated related to linear depreciation, evaluate whether a logistic (s-shaped) curve can be used as described in Section 6.1. Otherwise develop a customized depreciation function.

- Step 3 – Compile Data:

For each asset class and type of component being valued, compile the available data on the asset inventory and other data required to support the depreciation calculation approach defined in Step 2. The assumptions developed previously regarding the level of detail in the analysis and treatments to include may need to be revisited based on what data are available.

- Step 4 – Calculate Depreciation:

Calculate depreciation using the relationship determined in Step 2 with the data compiled in Step 3.

The following are hypothetical examples illustrating the different depreciation approaches described in Section 6.2.

An agency has a bridge, initially constructed in 1960 with an expected lifespan of 70 years. In 2010, the asset was reconstructed and brought back to “like new” condition, resetting the its age to zero in 2010. The replacement cost of the bridge, in today’s dollars, is $5 million with a residual value of $1 million. The depreciation in year 2021 is calculated using the following formula from section 6.2.1:

\begin{align*} D(t) &= \frac{(V(t_0)-RV) * (A(t) - A(t_0))}{UL - A(t_0)} \newline D(t) &= \frac{(5,000,000 - 1,000,000) * (11 - 0)}{(70 - 0)} \newline D(t) &= 628,570 \end{align*}

where:

The new value of the asset is $4.37 million.

This example illustrates that how an age-based approach can be utilized in cases where a treatment has the effect of resetting the age. It is more challenging to apply this approach to a case where a rehabilitation is performed that improves the condition of the asset but does not restore it to “like new” condition.

An agency has installed a set of 100 fareboxes on its buses. Each farebox cost approximately $5,000 in current dollars to install. The agency maintains maintenance records on its fareboxes documenting their condition. However, the agency decides to calculate depreciation based on age given fareboxes typically are replaced on a 15-year cycle as a result of technical obsolescence rather than deteriorated condition.

Based on these assumptions the agency determines that a farebox depreciates by $5,000/15 = $333.33 per year until it reaches 15 years. The table below shows a set of example calculations assuming fareboxes of varying age. Based on the table, the initial value of the 100 fareboxes is $500,000. Depreciation totals $265,000, resulting in a current value of $235,000.

Table 6-2. Example Calculation of Asset Value for an Inventory of Fareboxes

| Age (years) | Count | Initial Value ($) | Depreciation ($) | Current Value ($) |

|---|---|---|---|---|

| 0 | 5 | 25,000 | 0 | 25,000 |

| 1 | 6 | 30,000 | 2,000 | 28,000 |

| 2 | 5 | 25,000 | 3,333 | 21,667 |

| 3 | 4 | 20,000 | 4,000 | 16,000 |

| 4 | 3 | 15,000 | 4,000 | 11,000 |

| 5 | 0 | 0 | 0 | 0 |

| 6 | 11 | 55,000 | 22,000 | 33,000 |

| 7 | 10 | 50,000 | 23,333 | 26,667 |

| 8 | 13 | 65,000 | 34,667 | 30,333 |

| 9 | 9 | 45,000 | 27,000 | 18,000 |

| 10 | 5 | 25,000 | 16,667 | 8,333 |

| 11 | 4 | 20,000 | 14,667 | 5,333 |

| 12 | 7 | 35,000 | 28,000 | 7,000 |

| 13 | 4 | 20,000 | 17,333 | 2,667 |

| 14 | 6 | 30,000 | 28,000 | 2,000 |

| >15 | 8 | 40,000 | 40,000 | 0 |

| Total | 100 | 500,000 | 265,000 | 235,000 |

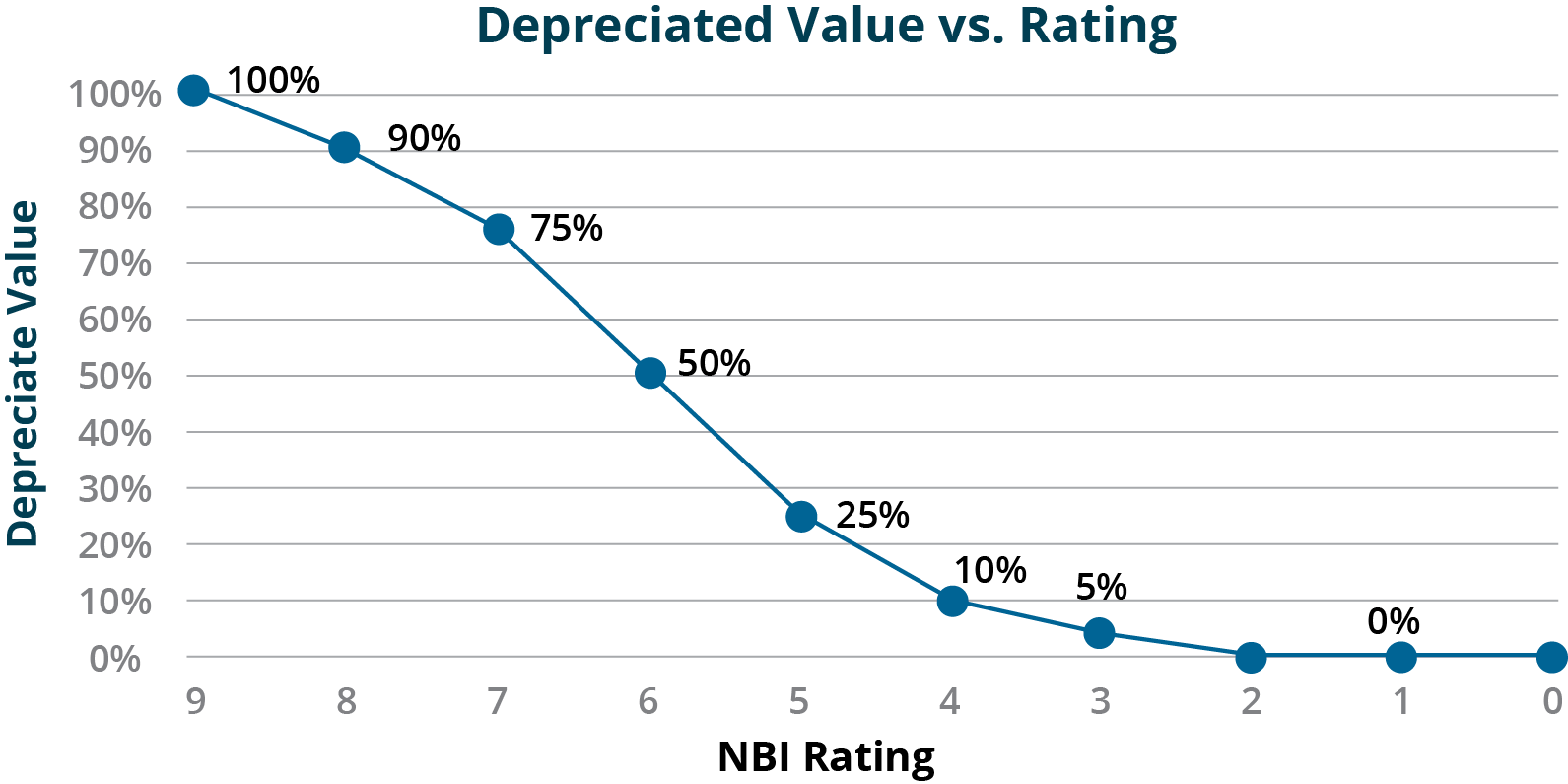

The Kentucky Transportation Cabinet (KYTC) uses a condition-based depreciation approach for valuing assets in its TAMP (37). For bridges KYTC bases depreciation on the NBI condition ratings for the deck, superstructure, and substructure of each bridge. For each value in the NBI scale KYTC has established an equivalent percent of depreciated value, as shown in Figure 6-4.

In Table 6-2 this depreciated value is mapped to an effective remaining service life using KYTC’s assumed useful life of 75 years for a new bridge. The remaining asset life can be substituted into the equation shown in Example 6-1 to calculate depreciation in dollars as a function of condition. The table shows an example of the calculations for a component with an initial value of $10 million.

Table 6-3. Effective Remaining Life and Depreciation Calculations by Condition Rating

| Condition Rating | Depreciated Value (see Figure 6-4) | Effective Remaining Useful Life (years) | Depreciation Given Initial Value of $10M ($M) | Current Value Given Initial Value of $10M ($M) |

|---|---|---|---|---|

| 9 | 100% | 75.00 | 0.0 | 10.0 |

| 8 | 90% | 67.50 | 1.0 | 9.0 |

| 7 | 75% | 56.25 | 2.5 | 7.5 |

| 6 | 50% | 37.50 | 5.0 | 5.0 |

| 5 | 25% | 18.75 | 7.5 | 2.5 |

| 4 | 10% | 7.50 | 9.0 | 1.0 |

| 3 | 5% | 3.75 | 9.5 | 0.5 |

| 2 | 0% | 0.00 | 10.0 | 0.0 |

| 1 | 0% | 0.00 | 10.0 | 0.0 |

A highway agency is interested in analyzing the pattern of consumption of benefits for pavement. Pavement management staff model the benefit of a pavement section as providing mobility for road users, reducing travel time and operating costs relative to an alternative of using other roads in the event the pavement section was out of service. Over time the use of the pavement increases, in theory yielding greater benefits. However, as the pavement ages roughness increases, reducing benefits obtained from the pavement.

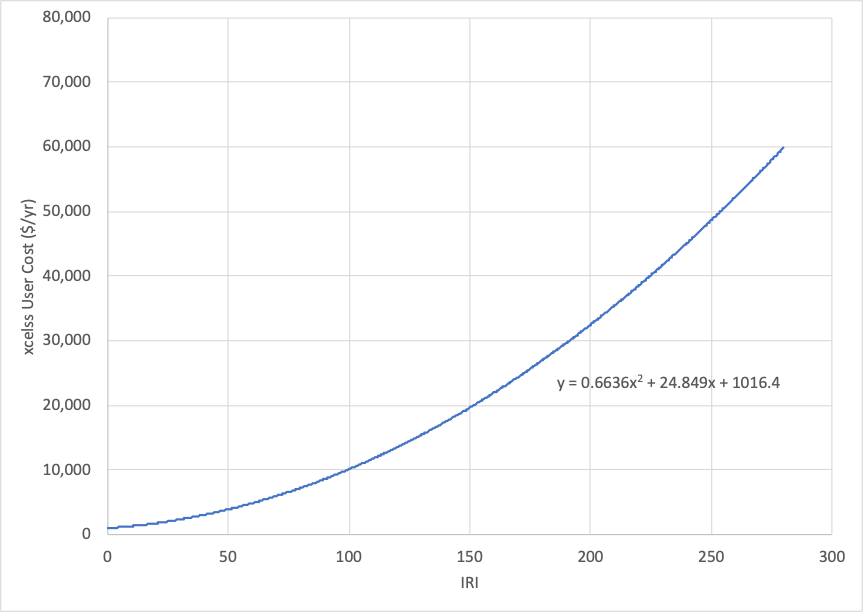

To model these effects the agency staff utilize the model of pavement user costs detailed in NCHRP Report 866 (38). Using the model provided with this report they predict the excess user costs for different representative pavement sections. Figure 6-5 shows the excess user cost as a function of IRI for a 1-mile urban principal arterial with daily traffic of 1,000 vehicles calculated using this model.

The staff use relationships obtained using the NCHRP report to estimate the benefits realized from a pavement section over time. This is then used to estimate the depreciation curve for pavement. Figure 6-6 shows an example curve for a one-mile section with 1,000 daily vehicles, assuming 5% annual growth in traffic.

This section provides examples of “emerging,” “strengthening,” and “advanced” practices with respect to calculation of depreciation. Maturity levels are defined for each of the for two basic cases described in the guidance, that one has age data, or that one has condition data. In both cases there is an additional option to assume a linear pattern of depreciation with respect to age/effective age, or to perform a supplemental analysis to analyze the pattern of benefit consumption for the asset. In the table an emerging practice is one that supports the guidance with minimal complexity, an advanced practice illustrates a “state of the art” example in which an agency has addressed some aspect of the asset value calculation in a comprehensive manner, and strengthening practice lies between these two levels.

Asset age is not well established. Costs by asset class are calculated by year and depreciated without associating costs to specific assets.

Asset or component age is known or can be estimated based on inventory and treatment data, supporting calculation of depreciation at an asset class, asset and/or component level.

Asset age or component age is known or can be estimated based on inventory and treatment data. An analysis is performed of the consumption of asset benefits. A custom pattern of benefit consumption is used if supported by the analysis. Depreciation is calculated based on the selected approach by asset class, asset and/or component.

Condition data are sufficient for estimating the condition distribution at a network level. Condition is mapped to effective age and depreciation is calculated by asset class based on current condition.

An assessment is performed to determine how best to calculate effective age, potentially using actual age and/or condition. Depreciation is calculated based on effective age by asset class, asset and/or component.

An analysis is performed of the consumption of asset benefits. A custom pattern of benefit consumption is used if supported by the analysis. Otherwise, an assessment is performed to determine how best to calculate effective age, potentially using actual age and/or condition. Depreciation is calculated based on the selected approach by asset class, asset and/or component.