An important part of performing the asset value calculation is accounting for asset treatments and their effects. Treatments are important in two basic ways:

- It is important to consider what treatments are typically performed on an asset to determine an asset’s useful life and “residual value,” or value when an asset reaches the end of its useful life.

- In some cases, one may wish to specifically include additional treatments in the asset value calculation besides asset acquisition/construction and reconstruction. This is particularly important if one is predicting future asset value.

To calculate asset value, one should establish what treatments are performed on an asset. An asset lifecycle strategy describes the different treatments that are typically performed on an asset following its initial construction or acquisition. Defining a lifecycle strategy is consistent with best practice in TAM. Also, State DOTs are required to define lifecycle strategies for pavements and bridges in their NHS TAMP.

At a minimum, basic information on what asset treatments are typically performed on an asset is useful in establishing asset life and residual value as described further in subsequent subsections of this chapter. For instance, for the purpose of valuing service vehicles, one would set the life of the asset assuming that various treatments are conducted based on the asset’s lifecycle strategy, such as routine maintenance and replacement of brakes, tires and other vehicle components.

For certain applications it may be necessary to go a step further, and include the costs and effects of various asset treatments explicitly in the asset value calculation. This is particularly important if the intended application of the asset value calculation is to predict future asset value. In this case one may wish to account for what treatments are expected to be performed, and may wish to compare treatment strategies. In this case there are two reasons may wish to include a given treatment in the calculations:

- Specifying the Impact of Treatments on Remaining Asset Life. For some complex assets, such as pavement and bridges, treatments may be performed – short of outright replacement of the asset – that have a significant impact on the remaining asset life. For instance, if a pavement is overlayed or a bridge is rehabilitated, its useful life is expected to be much longer than if these treatments are not performed. In these cases, incorporating past treatments may yield a more accurate calculation of current asset value – if sufficient data are available to support the calculation.

- Demonstrating Effects of Treatments on Future Value. If the asset value calculation is being performed to demonstrate the effects of a given treatment, then the treatment needs to be accounted for in some manner to show how the value changes if the treatment is performed. For instance, one might calculate future asset value with and without performing the treatment.

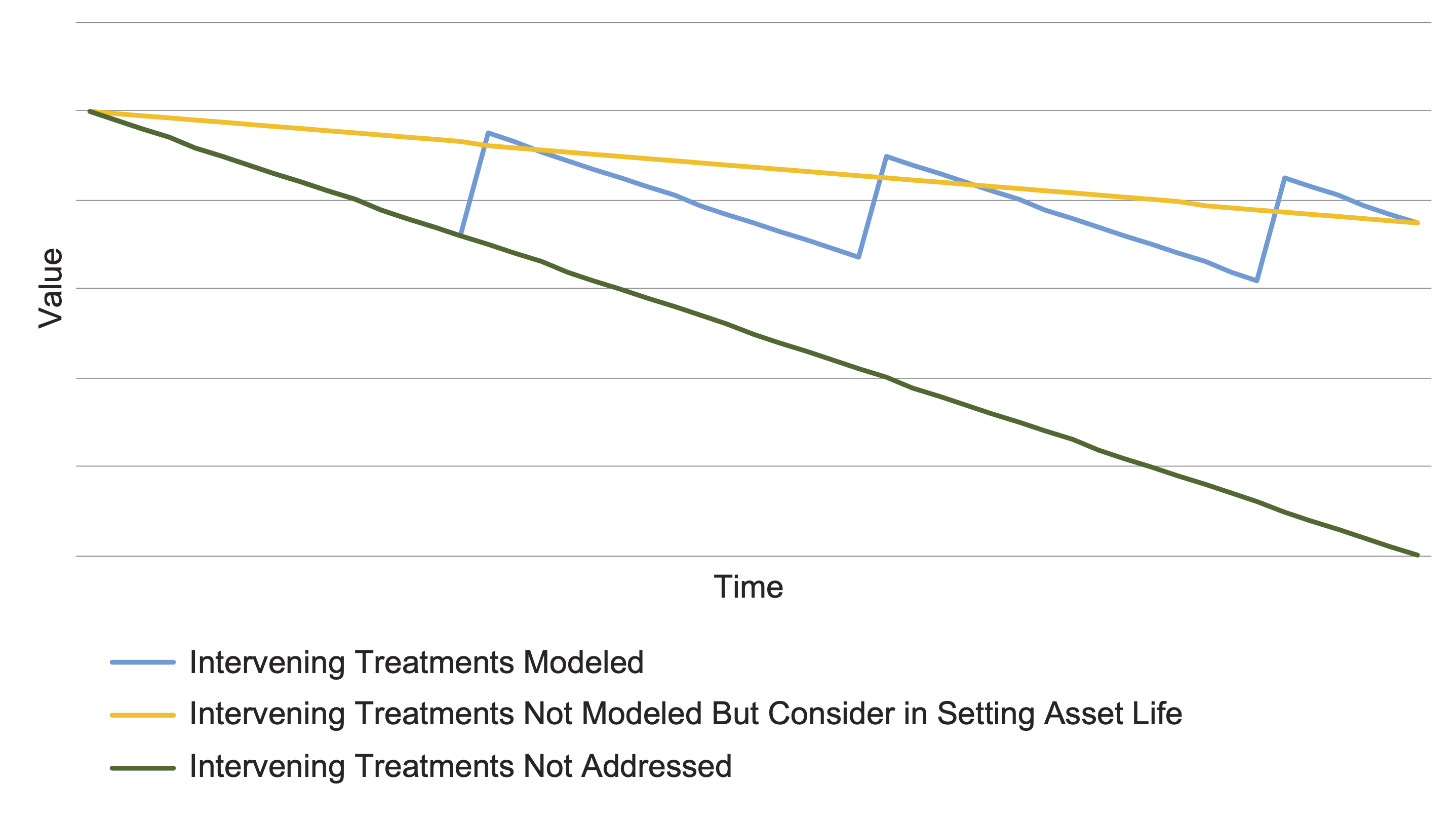

Figure 5-1, adapted from the Edgerton’s discussion of this topic (12), illustrates the importance of considering renewal treatments for certain assets, referred to by Edgerton as “cyclical maintenance assets.” This figure shows three lines illustrating the value of an asset over time. The jagged line in the figure below shows asset value if renewal treatments are explicitly modeled: these add value and add life to the asset. The straight upper line shows how asset value is calculated if the effect of renewal treatments is approximated through a revised estimate of asset life. In this case, asset treatments are not explicitly modeled. The lower line is demonstrably incorrect. In this case, renewal treatments are not modeled, but the asset life has not been modified to account for these treatments. This results in systematic understatement of asset value.

To determine what treatments to model it can be helpful to review multiple sources, such as guidance on what treatments are recommended for an asset, models in an agency’s management systems, and the data an agency actually tracks on its treatments. This is complicated since the same treatment may be represented in different ways between different organizations and/or systems.

For other applications where the goal is to calculate current asset value, it is generally not necessary to explicitly account for all of the different treatments that have been performed on an asset in the past. It is recommended that defining additional treatments be avoided in this case if possible. However, one may wish to consider additional treatments if value is based on historic costs, or if the depreciation approach is based on the actual time since the last treatment. Depreciation is discussed further in Chapter 6.

For each treatment that is modeled one must establish how much the treatment costs and what effect the treatment has on an asset. The approaches described in Chapter 4 for calculating replacement costs are equally applicable to calculating the cost of other treatments. Generally speaking, the calculation of treatment costs should be made in today’s dollars (constant dollars), removing the effects of inflation from the analysis. This approach allows for directly comparing costs incurred at different times. If calculations are made in current rather than constant dollars, one must be careful to state the year of the expenditure and avoid comparing costs in different years without inflation adjustments. However, in the case that one is basing asset value on historic costs all costs should be expressed in year of expenditure dollars.

Concerning treatment effects, the most straightforward case to consider is that the treatment has the effect of restoring the asset to “like new” condition, resetting its age to 0. Alternatively, a treatment might extend the life of the asset and/or improve its conditions. Both of these effects can be translated into a change in the effective age of the asset. If the impact of the treatment cannot be translated into a change in condition or effective age then it should not be explicitly considered.

When considering treatments and their effects, a key issue is how assets have been componentized. If a complex asset is represented using components, then this may simplify the specification of treatment effects, and allow for the consideration of additional treatments. For example, a common treatment for a bridge is to rehabilitate or replace the bridge deck, which resets the age of the bridge deck but may not impact the age of the bridge superstructure or substructure. If a bridge is represented in components consisting of a deck, superstructure and substructure, then the effect of a deck replacement can be easily modeled: it resets the age of the deck to 0 and improves its condition to a “like new” condition. If one is modeling the overall bridge, then the effect of a deck replacement is more difficult to ascertain. One can approximate the effect in this case, or simply assume that deck replacement occurs on a regular cycle and not attempt to model this treatment.

Once the analyst makes a decision about what treatments to explicitly model and what treatments are assumed to occur over the life of an asset, they can then establish the asset’s expected useful life. Asset life is an important parameter for the depreciation calculation described in Chapter 6.

The goal here is to determine how long the asset would be expected to remain in service provided:

- An asset is removed from service either when it is more cost effective to replace the asset or when it is obsolete;

- The treatments that are assumed to occur in the analysis actually do occur, including planned maintenance, cyclical treatments that are needed to achieve the asset’s useful life, and any other treatments that may impact the life of the assets if they are omitted; and

- The life-restoring treatments distinguished from general maintenance are not assumed to occur, as their contributions to asset value and life will be accounted for separately.

The above criteria have some important implications. One is that we are not concerned with how long an asset would remain in service in the abstract case that no treatments are ever performed on an asset. Instead, we would like to know what the useful life is given treatments such as routine maintenance are performed. But this means that estimates of useful life are contingent on the assumed set of treatments performed on an asset, also called the agency’s lifecycle strategy for the asset.

Another implication of the above criteria is that it is completely feasible for an asset to remain in service past its useful life. This may occur because it is still cost effective to maintain a specific asset, or because it has simply not been feasible to replace the asset and it continues to be maintained despite the fact that a replacement may be more cost effective.

Assets of historical significance are unique in this manner, for they are maintained beyond the useful life that would otherwise be defined for them. These assets require special treatment. Specific estimates may be required of the time until major rehabilitation action is required to retain such assets in service – or such assets can be componentized.

Various references are available which summarize typical useful lives of transportation assets and provide techniques for calculating agency-specific values. Two references are of particular note. Volume 1 of NCHRP Report 713 (18) is a guidebook for measuring the life expectancy of transportation assets. This report details how to define asset end-of-life, describes quantitative approaches for establishing asset life, and presents typical values for selected asset classes.

The OECD manual Measuring Capital (11) summarizes approaches for estimating useful lives for the purpose of calculating asset value, including techniques, such as development of Winfrey Mortality Functions and Weibull distributions. It also presents typical values for different asset classes based on a review of the literature. One application described in this manual uses an assumed distribution to approximate the age distribution of an asset inventory where detailed data are unavailable. For TAM applications it is assumed that sufficient data are available to determine the age distribution of an asset inventory, but the reader should consult the discussion in Chapter 12 of Measuring Capital where this is not the case.

Table 5-1 below summarizes typical useful lives for transportation assets based on NCHRP Report 713, Measuring Capital, NCHRP Synthesis 371 (19), and FTA guidance for vehicles (33). As noted above, all of the assumptions regarding asset life are assumed to incorporate a given treatment strategy. One should review the assumptions and their own data carefully when performing an analysis.

Table 5-1. Typical Useful Life Values for Transportation Assets

| Asset Class | Component | Typical Useful Life (years) | Notes |

|---|---|---|---|

| Pavement | Overlay - Asphalt | 11-20 | NCHRP Report 713 Vol. 1 (summary of the literature) |

| Overlay - Concrete | 20-34 | ||

| Full Depth - Asphalt or Concrete | 50 | ||

| Bridges | Deck | 58-79 | NCHRP Report 713 Vol. 2 (time to reach a rating of 3 or 4 based on model fit to NBI data) |

| Superstructure | 64-83 | ||

| Substructure | 59-78 | ||

| Culverts | Pipes | 50 | NCHRP Synthesis 371 (mode of survey results) |

| Box Culverts | 55-85 | ||

| Traffic Signals | Signal Head | 15 | NCHRP Report 713 Vol. 2 (time to reach a rating of 3 or 4 based on model fit to NBI data) |

| Structural Components (stell or aluminium) | 25-30 | ||

| Traffic Detector | 10 | ||

| Traffic Controller | 15 | ||

| Traffic Controller Cabinet | 20 | ||

| Lighting | Structural Components (steel or aluminium) | 25-30 | NCHRP Synthesis 371 (mode of survey results) |

| Ballast | 10 | ||

| Control Panels | 20 | ||

| Signs | Sheeting | 15 | NCHRP Synthesis 371 (mode of survey results) |

| Sign Posts (steel or wood) | 10-15 | ||

| Overhead Sign Structure | 30 | ||

| Sidewalks and Curbs | Asphalt | 10 | NCHRP Synthesis 371 (mode of survey results) |

| Concrete, Block or Brick | 20 | ||

| Vehicles | Automobile | 8 | FTA Useful Life Benchmark (ULB) Defaults |

| Cutaway Bus | 10 | ||

| Bus | 14 | ||

| Light or Heavy Rail Vehicle | 31 | ||

| Commuter Rail Coach or Locomotive | 39 | ||

| Ferryboat | 42 |

The final topic addressed in this portion of the asset value calculation is the determination of the residual value of the asset, or the value of the asset once it has reached the end of its useful life. Note this topic is addressed separately for the case where one calculates economic value, as discussed in Chapter 4. When one calculates value using a cost or market perspective, two basic approaches may be considered for determining this parameter: calculating the salvage value of the asset or calculating the cost to restore the asset to “like new condition.”

For assets that are completely replaced at the end of their useful life, the residual value should be based on the salvage value of the asset and may be 0. For instance, the salvage value for a vehicle might be set based on the price expected at auction. Assets that are discarded at the end of their life and not repurposed in some way have a salvage value of 0.

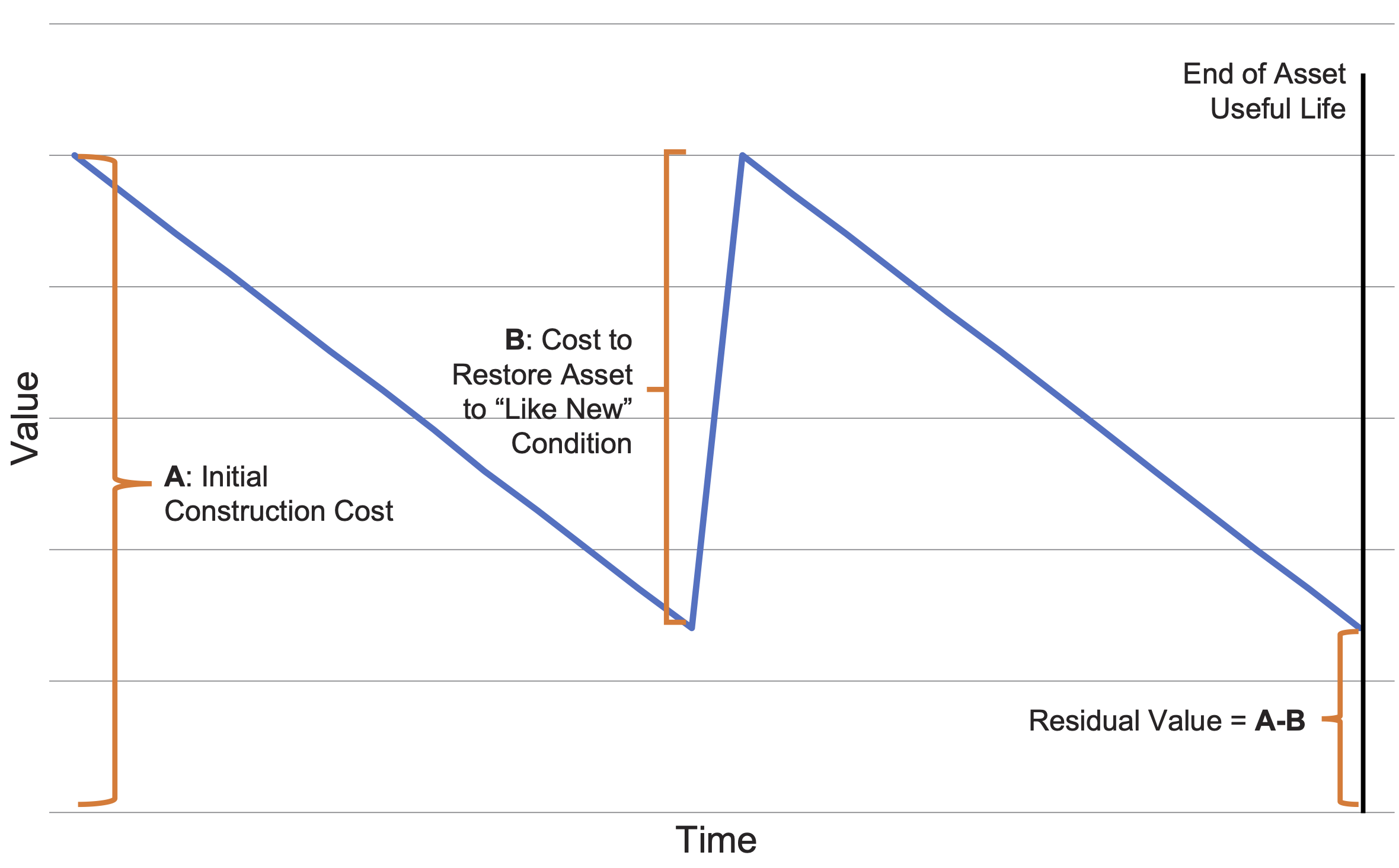

A different approach is recommended in cases where an asset is periodically rehabilitated and restored to a “like new” condition at a cost less than the initial construction or acquisition cost. In these cases, it is recommended that the residual value is equal to the difference between the cost of replacing the asset and the cost to restore the asset to “like new” condition at the end of its useful life. This approach is illustrated below in Figure 5-2. As demonstrated in the figure, this approach has the effect of restoring the value of the asset to that of a new asset when a complete rehabilitation treatment is applied. This method includes the aspects of an asset that do not depreciate or which depreciate very slowly in the residual value, such as foundations and earthworks, design, and land. Note that in this example it is assumed that the asset is restored to “Like New” condition. However, depending on the asset and treatment it may or may not be feasible to restore the asset to this condition.

This section describes the specific steps involved in the four basic activities addressed in this chapter: identifying treatments; determining treatment costs and effects; determining asset useful life; and determining residual value.

- Step 1 – Review Treatment Data:

For each asset class and type of component being valued, review the asset lifecycle strategy and/or other available agency data to determine what treatments are typically performed on an asset class or component, and what treatment data are consistently tracked.

- Step 2 – Identify Mandatory Treatments:

Identify treatments that will be considered independently in the valuation calculation, in addition to the initial construction or acquisition of an asset. These include treatments that reset the asset age or restore an asset to “like new” condition.

- Step 3 – Select Potential Additional Treatments:

Determine whether additional treatments should be considered in the analysis. Consideration of additional treatments is typically unnecessary for calculating current asset value, but can be important for predicting future value. Treatments may be added to the analysis if they have some impact on asset remaining life or condition and if adding them to the analysis will help support TAM decisions. Any treatments not explicitly modeled are assumed to occur based on the agency’s lifecycle policy.

- Step 1 – Collect Data on Past Treatments:

Collect data on cost and treatment timing for each treatment being considered for each asset class and subcomponent. Data are not required for treatments that are assumed to occur and incorporated in the estimate of asset useful life.

- Step 2 – Assess Available Data:

Decide whether historic data are sufficiently detailed to support use of actual costs, or if unit costs will be used to estimate changes in value from past treatments. For most applications it is more practical to use unit costs. An exception to this is where value is being calculated for a specific asset (e.g., a toll road) based on historic costs.

- Step 3 – Develop Treatment Unit Costs:

Develop unit costs as described in Chapter 4, resulting in unit costs for each treatment.

- Step 4 – Determine Treatment Effects:

For each treatment determine the effect the treatment has on an asset. The effect can be specified in terms of the change in asset life or the change in condition. Condition changes are equated to asset life in calculating depreciation, as described in Chapter 6.

- Step 1 – Review Available Agency Data:

Collect and review records on when assets have been replaced. Ideally data on past replacements should be accompanied by information on what motivated the replacement.

- Step 2 – Review Defaults and Past Assumptions:

Review other sources of data for asset life assumptions, including information on treatments compiled as described in Section 5.2.1, past calculations performed by the agency (e.g., for previous TAMPs or financial reports), asset-specific analyses, the defaults listed in Table 5.2, and the TAM literature.

- Step 3 – Specify the Useful Life by Asset Class/Component:

Determine a useful life for each asset class and component being valued using either the agency’s data or the defaults. The useful life should be developed assuming treatments occur according to the agency’s lifecycle strategies.

Refer to NCHRP Report 713 and Chapter 13 of OECD Measuring Capital for more discussion of advanced approaches for establishing asset useful life.

- Step 1 – Classify Assets and Components:

For each asset class and component being valued, establish whether or not the asset is periodically rehabilitated or renewed using treatments that differ in cost from the initial purchase or construction of an asset. This determination depends on the nature of the treatments performed on the assets and the determination of which treatments are being modeled.

Complex assets such as pavements and bridges are periodically rehabilitated or renewed. However, the analyst has the choice concerning whether to consider rehabilitation/renewal treatments or assume these occur according to the agency’s lifecycle strategy.

- Step 2 – Calculate Salvage Value:

For assets not subject to periodic rehabilitation or renewal calculate the residual value as the salvage value of the asset, or the value obtained for an asset that has reached the end of its useful life and is being replaced. Refer to the OECD document Measuring Capital for discussion of how to establish this value for complex cases when the distribution of asset useful life cannot be easily approximated.

- Step 3 – Calculate the Cost Difference:

For assets that are subject to periodic rehabilitation or renewal, calculate the residual value as the difference between the cost of initial purchase or construction and the cost of asset rehabilitation or renewal.

The following are hypothetical examples illustrating application of the steps described in Section 5.2.

A highway agency needs to calculate asset value for pavements and bridges to support development of its TAMP. The agency is interested in exploring two different approaches to asset valuation, both of which utilize replacement cost for the calculation of initial value: a simplified approach in which only asset construction/reconstruction is considered in the calculation, and a more comprehensive approach that more accurately reflects the impacts of rehabilitation and preservation treatments on asset value.

The agency starts by reviewing different pavement and bridge treatments performed by the agency. This process is complicated by the fact that different terms are used for describing asset treatments in different systems. The agency reviews existing TAMPs to determine how different treatments have been represented by other agencies. Table 5-2 provides an example of the mapping of different treatments between pavements and bridges based on data presented in the Louisiana Department of Transportation Development (LADOTD) TAMP (34). The table shows, for pavements and bridges, the five work categories described by FHWA in its TAMP requirements, corresponding work types used when reporting data for federally-funded projects in the FHWA Financial Management Information System (FMIS), and the treatments actually considered by the agency’s asset managers. As shown in the table, for any one of the FHWA work categories there may be between zero and four corresponding different work types in FMIS. The work types in FMIS may map to a number of different specific treatments.

Table 5-2. Example Mapping of FHWA Work Categories, FMIS Work Types and Agency Treatments

| FHWA Work Category | FHMIS Work Types | TAM Treatments |

|---|---|---|

| Pavement | ||

| Initial Construction | 01-New Construction Roadway | New Roadway Construction |

| Maintenance | N/A | Seal Joints and Cracks Polymer Surface Treatment |

| Preservation | 05-4R Maintenance Resurfacing | Microsurfacing Thin Overlay Medium Overlay In Place Stabilization |

| Rehabilitation | 06-4R Maintenance Restoration/Rehabilitation | Structural Overlay Minor Rehab Major Rehab |

| Reconstruction | 03-4R Reconstruction - Added Capacity 04-4R Reconstruction - No Added Capacity 07-4R Relocation | Reconstruction Unbonded Concrete Overlay |

| Bridge | ||

| Initial Construction | 08-Bridge New Construction | Bridge New Construction |

| Maintenance | N/A | N/A |

| Preservation | 40-Special Bridge 47-Bridge Preventative Maintenance 48-Bridge Protection 59-Bridge Deck Resurfacing | Painting Deck Scour Mitigation Cleaning, Refurbishing or Replacing Service Elements |

| Rehabilitation | 13-Bridge Rehabilitation - Added Capacity 14-Bridge Rehabilitation - No Added Capacity | Re-Decking Widening Paint with Major Structural Steel Repairs Scour Mitigation with Major Substructure or Other Major Bridge Work |

| Reconstruction | 10-Bridge Replacement - Added Capacity 11-Bridge Replacement - No Added Capacity | Remove Existing Structure Replace Existing Structure |

All of the specific agency treatments listed in the table could conceivably be included in the asset valuation calculation. Adding treatments supports a more detailed and potentially more accurate calculation of how asset value varies over time, but entails quantifying more data.

Table 5-3 shows the results of the agency’s assessment, indicating which treatments the agency will include in the asset value calculation using each approach. For the comprehensive approach the agency elects to include a number of additional treatments, given these improve asset condition and result in shortening asset life if needed treatments are not performed.

Table 5-3. Treatments Included Using Simplified and Comprehensive Approaches

| Treatment | Include in Value Calculation | Notes | |

|---|---|---|---|

| Simplified | Comprehensive | ||

| Pavement | |||

| Construction | Yes | No | |

| Overlay | No | Yes | Includes thin and medium overlays |

| Other Maintenance and Preservation | No | No | Includes crack sealing, surface treatment, and microsurfacing |

| Rehabilitation | No | Yes | Includes structural overlay, minor rehab and major rehab |

| Reconstruction | Yes | Yes | |

| Bridge | |||

| Construction | Yes | Yes | |

| Deck Repair | No | Yes | |

| Other Maintenance and Preservation | No | No | Includes cleaning, element repairs, spot painting, and deck protection |

| Deck Replacement | No | Yes | |

| Superstructure Rehabilitation | No | Yes | Includes paint replacement and major steel repairs |

| Substructure Rehabilitation | No | Yes | |

| Rehabilitation | No | Yes | |

| Reconstruction | Yes | Yes | |

The agency described in Example 5-1 next quantifies the cost and effects of the different treatments. The agency uses treatment costs from its management system, together with a separate assessment of the cost of initial construction of a pavement or bridge performed as described in Chapter 4.

Treatment effects are established based on a combination of expert judgement and parameters from the agency’s management systems. Table 5-4 shows the resulting assumptions concerning treatment effects. For pavement, treatment effects are expressed in terms of a treatment’s impact on Pavement Condition Index (PCI). This is an agency-specific measure of pavement condition expressed on a scale from 0 to 100. Pavement treatments have the effect of resetting pavement age and returning PCI to 100, setting PCI to a specific value, or increasing PCI by a specified amount.

For bridges treatment effectives are expressed in terms of a treatment’s impact on the deck, superstructure, and/or substructure ratings defined in the NBI. These are expressed on a 0 to 9 scale, with 9 representing the best condition obtained for a new bridge. Bridge treatments have the effect of resetting age and returning all ratings to 9, or setting one or more ratings to a specific value.

Table 5-4. Example Treatment Effects

| Treatment | Treatment Effect | |

|---|---|---|

| Simplified | Comprehensive | |

| Pavement | ||

| Construction | Age = 0, PCI = 100 | Age = 0, PCI = 100 |

| Overlay | None | PCI increases by 10 |

| Rehabilitation | None | PCI set to 90 |

| Reconstruction | Age = 0, PCI = 100 | Age = 0, PCI = 100 |

| Bridge | ||

| Construction | Age = 0, Deck/Super/Sub Ratings = 9 | Age = 0, Deck/Super/Sub Ratings = 9 |

| Deck Repair | None | Deck Rating = 6 |

| Deck Replacement | None | Deck Rating = 7 |

| Superstructure Rehabilitation | None | Superstructure Rating = 7 |

| Substructure Rehabilitation | None | Substructure Rating = 7 |

| Rehabilitation | None | Deck/Super/Sub Ratings = 7 |

| Replacement | Age = 0, Deck/Super/Sub Ratings = 9 | Age = 0, Deck/Super/Sub Ratings = 9 |

Based on the assessment of treatment effects, the agency establishes that with the more comprehensive approach it would be necessary to represent bridges at a component level, modeling the deck, superstructure and substructure of a bridge separately, given that several of the treatments have an impact on only one component.

The agency described in the previous example seeks to establish useful lives for bridges for the simplified and comprehensive cases outlined in the previous examples. The agency uses NCHRP Report 713 (18) for guidance. Following the approach described in this report, the agency first defines end-of-life criteria for its bridge components. The agency’s bridge managers recommend that when a deck, superstructure or substructure deteriorates to a rating of 5 on the 9-point NBI scale (classified as fair condition) the component has reached the end of its useful life, given the agency typically schedules rehabilitation work at this point to prevent the bridge from deteriorating into poor condition. Note that if the end of life was defined as the point when replacement of the bridge is required, then a lower rating value would be used as the definition for end-of-life. The agency uses the national defaults in Appendix B of Report 713 to estimate the time required for bridge components to deteriorate to a value of 5. These were developed using NBI data and implicitly include effects from routine maintenance. The national estimates in the report are:

- Deck – 42 years

- Superstructure – 48 years

- Substructure – 45 years

These values are used for the comprehensive case described in the above examples, in which bridges are represented at a component level, and rehabilitation treatments are included in the analysis.

For the simplified analysis the agency performs a separate analysis to determine a useful life for bridges assuming that maintenance, repair and rehabilitation work is performed consistent with the agency’s lifecycle policy. The agency reviews data on recent projects to establish a typical life, omitting projects where replacement was triggered by an external factor (e.g., the bridge crossed a roadway that was being widened to increase capacity). The agency compares this to the NCHRP Report 713 values for the time for component ratings to reach a value of 3, a point at which the agency would schedule replacement of a bridge. These are as follows:

- Deck – 79 years

- Superstructure – 83 years

- Substructure – 78 years

Based on review of agency data and other sources the agency establishes a useful life of 75 years for a bridge for the simplified case in which maintenance, repair and rehabilitation treatments are assumed to occur in a timely fashion over a bridge’s life.

A transit agency seeks to calculate residual value for its vehicles, facilities, track and equipment. Based on the guidance in Section 5-2, the agency calculates residual value for selected assets as shown in Table 5-5.

Table 5-5. Example Approaches for Calculating Residual Value for Transit Assets

| Asset Class | Subclass | Calculation Approach | Notes |

|---|---|---|---|

| Vehicles | Buses | Resale or auction value | Feasible when vehicles are auctioned or sold at the end of their useful life |

| Rail Vehicles | Scrap value | Assumes asset is used until it is scrapped | |

| Facilities | Administrative/Maintenance Facility | Difference between construction and rehabilitation cost | Complex assets that are rarely completely reconstructed |

| Passenger Facility | |||

| Infrastructure | Track | ||

| Structures | |||

| Power | 0 | Typically obsolete when replaced – minimal resale or scrap value | |

| Signals | |||

| Equipment | Service Vehicles | Resale or auction value | Feasible when vehicles are auctioned or sold at the end of their useful life |

| Other Equipment | Scrap Value | Assumes asset is used until it is scrapped |

This section provides examples of “emerging,” “strengthening,” and “advanced” practices for defining treatments and treatment effects. Maturity levels are defined for each of the four areas defined in the guidance. In the table an emerging practice is one that supports the guidance with minimal complexity, an advanced practice illustrates a “state of the art” example in which an agency has addressed some aspect of the asset value calculation in a comprehensive manner, and strengthening practice lies between these two levels.

Asset purchase or construction and reconstruction are included in the asset value calculations. Supplemental analysis is not performed to consider inclusion of other treatments.

An analysis is performed to determine what treatments to include in the analysis, and what treatments are assumed to occur based on the agency’s life cycle strategy. The analysis is conducted separately from establishing asset life cycle strategies.

An analysis is performed to determine what treatments to include in the analysis, and what treatments are assumed to occur based on the agency’s life cycle strategy. The analysis is conducted as part of the development of asset life cycle strategies and/or strategies are updated as appropriate following the analysis.

The analysis is limited to asset purchase or construction and reconstruction. Asset reconstruction is assumed to have the same cost and effect as initial construction.

Treatment costs are established through a one-time analysis of project data and updated in subsequent years based on inflation. Treatment effects are based on expert judgement or a one-time analysis.

Treatment cost and effects are established through a well-documented process that includes: analysis of treatment data; assessment of how assets should be grouped for analysis (e.g., by system, material, and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Asset useful life is estimated based on expert judgement and/or industry defaults.

A one-time analysis is performed to establish asset useful life based on analysis of historic data and/or asset models.

Asset useful life assumptions are based on models used in an agency’s management systems. The assumptions are periodically validated and updated through a well-documented process.

The analysis is limited to asset purchase or construction and reconstruction. Asset reconstruction is assumed to have the same cost and effect as initial construction (resulting in a residual value of 0).

A determination is made for each asset class and component concerning whether to calculate residual value based on salvage value or the difference between asset construction and reconstruction. Salvage values are established based on expert judgement.

A determination is made for each asset class and component concerning whether to calculate residual value based on salvage value or the difference between asset construction and reconstruction. Salvage values are established based on analysis of historic data.