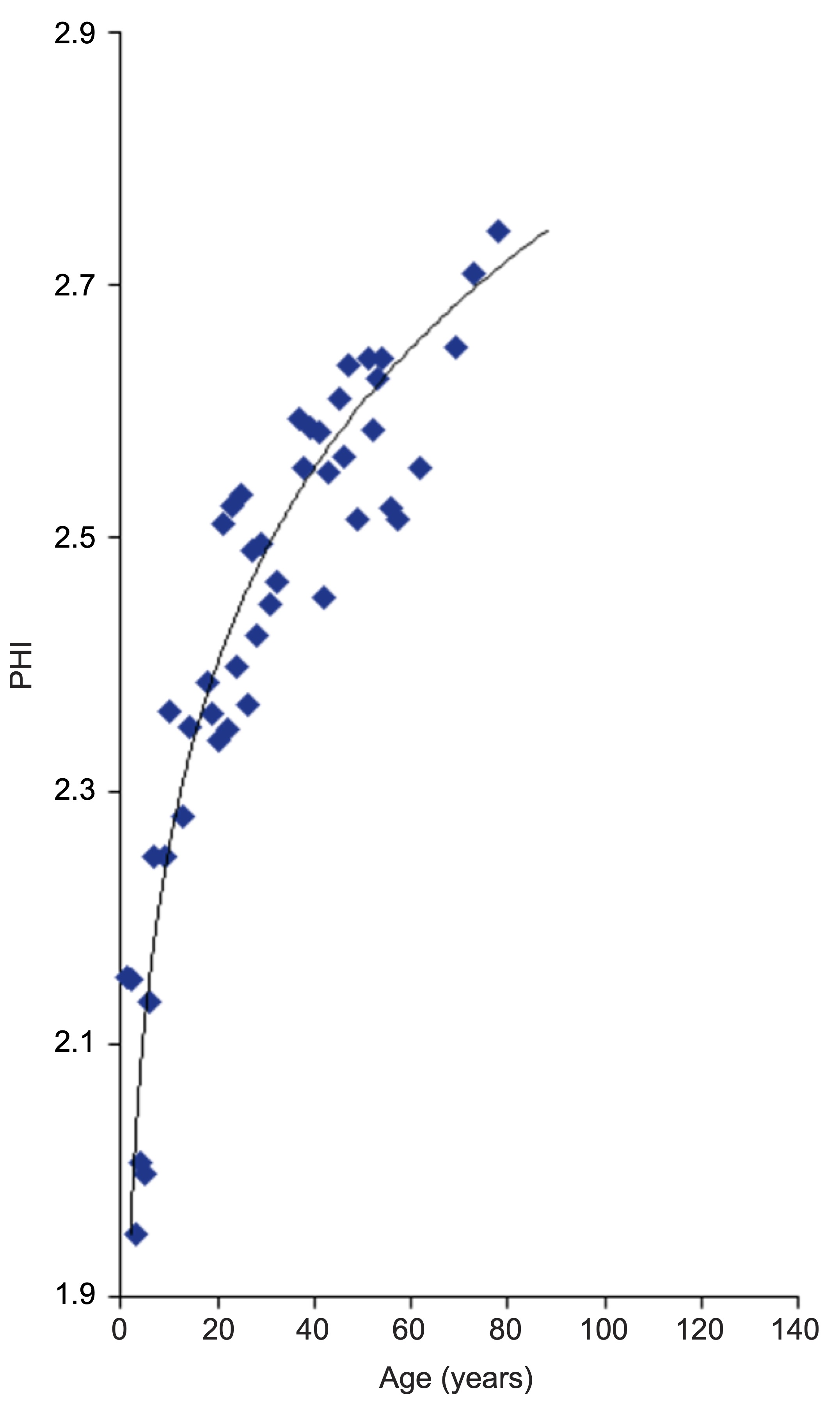

Determining the value of a transportation organization’s physical assets is important for both financial reporting and transportation asset management (TAM). In financial reporting, determining asset value is a fundamental step in preparing a balance sheet for financial statements to inform regulators and investors. For TAM, presenting data on the value of physical assets, such as pavement, bridges, and facilities, communicates what an organization owns and what it must maintain. Furthermore, information about asset value and how it is changing can help establish how the organization is maintaining its asset inventory and helps support investment decisions.

Calculating asset value for TAM is not simply good practice; it is also required of state Departments of Transportation (DOT) by Federal regulations. Title 23 of the Code of Federal Regulations (CFR) Part 515 details requirements for State DOTs to develop a risk-based Transportation Asset Management Plan (TAMP).

These regulations, initiated by the legislation Moving Ahead for Progress in the 21st Century (MAP-21), include a requirement for DOTs to calculate the asset value for National Highway System (NHS) bridges and pavement in their state. DOTs must also determine the cost required to maintain the value of their NHS assets.

To comply with the Government Accounting Standards Board (GASB) Statement 34, agencies also record their assets’ book value in annual financial reports. GASB 34 allows for either a standard (i.e., historic cost with straight-line depreciation) or modified approach. Many agencies struggle to reconcile financial asset valuation for GASB reporting with asset valuation for the purposes of asset management and the TAMP.

Reporting asset value is required in various documents, such as the financial reports of U.S. public agencies, which are prepared to comply with General Accounting Standards Board (GASB) Statement 34 (1), and National Highway System (NHS) transportation asset management plans. However, there are many nuances concerning how to perform the calculations, and a variety of different approaches has been used in the past for different applications.

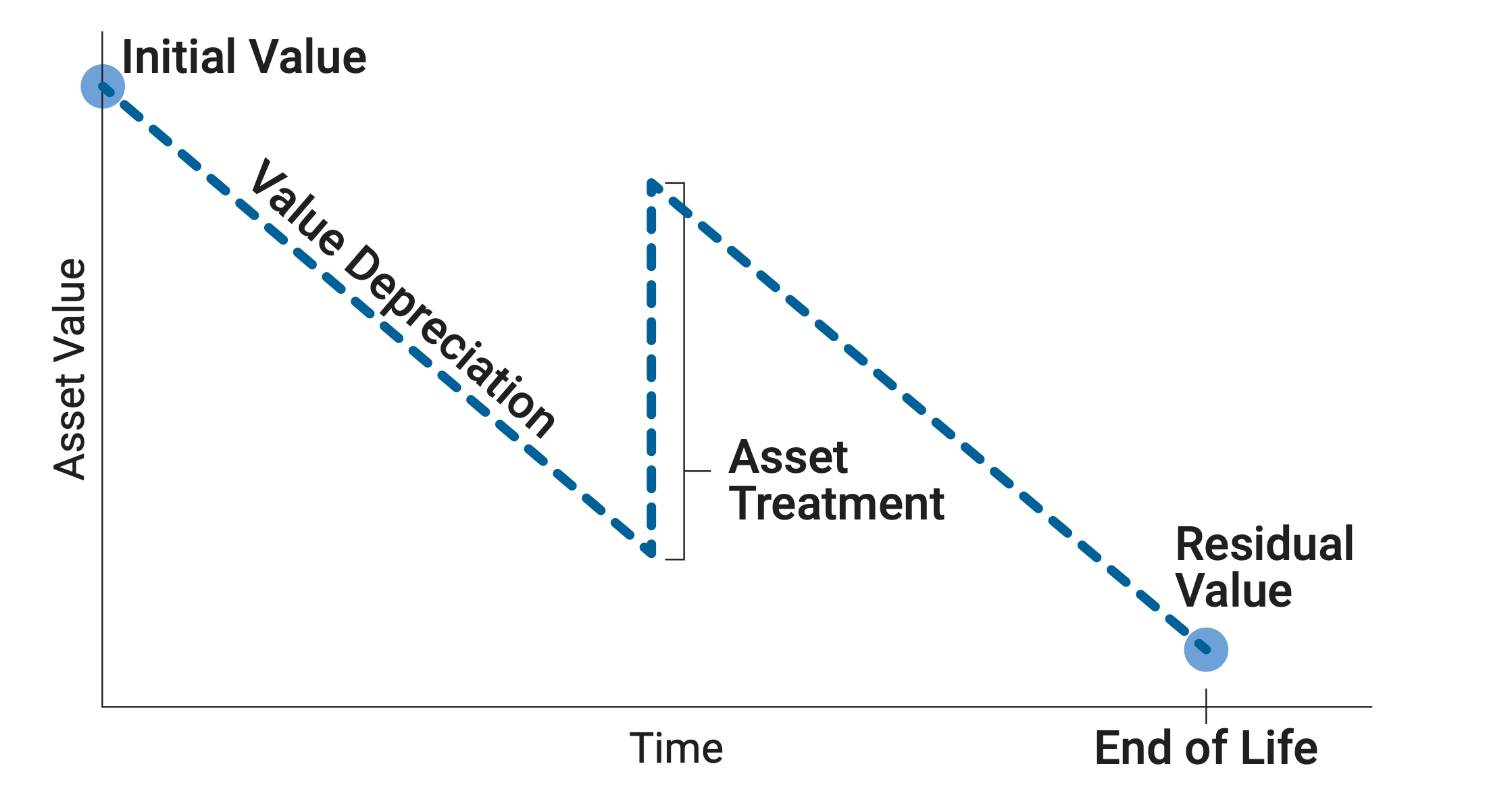

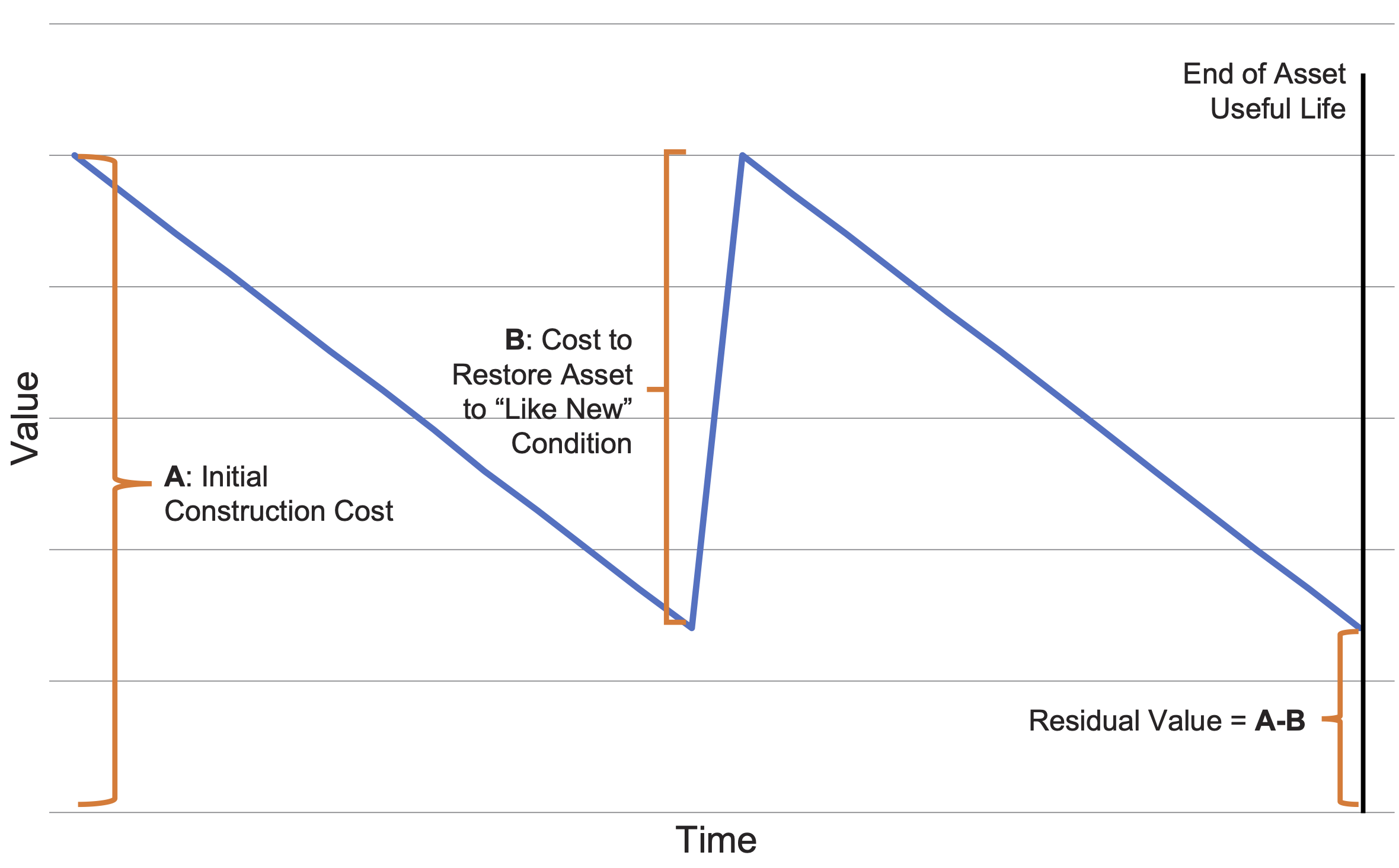

Figure 1-1 depicts the value of an asset over time, and illustrates the different facets of the value calculation. The left side of the figure shows the value of the asset when it is first constructed or obtained. Over time the asset value tends to decline. The amount of value the asset loses, also called depreciation, represents the consumption of the asset’s benefits. If treatments are performed that extend asset life, such as rehabilitation, then the asset may regain some or all of its value. When the asset reaches the end of its life, it is valued at its residual value, also called salvage value.

At each step of the asset value calculation illustrated in the figure, an analyst may choose how to perform the calculation. Specifically, he or she may use different approaches for calculating the initial value of an asset when first constructed or obtained, for establishing how value depreciates, for determining what treatments should be considered in the calculation and what their effects are, and for calculating residual value.

In truth there is no single correct way to calculate asset value, and there are good reasons why one may choose one approach over another or how much detail to incorporate into the calculation. The different approaches result from the fundamental considerations an analyst faces. These include:

- Different applications of asset value. The best approach for calculating asset value depends on how the valuation will be used. A private company may be interested in establishing fair market value of its assets to determine the profit to be gained by selling them. For public agencies, the primary purpose of financial reporting is to provide an accurate account of how the agency is spending resources to ensure the agency is financially sound and following regulations. In TAM, asset value supports decisions regarding investments to maintain and extend the life of assets. Another application of asset value is using it to understand the economic benefit or cost of the transportation system to society.

- Tension between simplicity and complexity. Often, improving a given approach to calculating asset value requires more data and/or more intensive calculations. For instance, straight-line depreciation is frequently used to determine asset value over time for the financial asset register. However, one can arguably obtain a more meaningful and useful estimate of depreciation for TAM applications by utilizing data on asset condition to establish asset value for the technical asset register. In these situations, it is important to balance the desire for a more accurate calculation with the benefit of having a simple, repeatable, and sustainable approach.

- Limits on what a single measure can provide. Once calculated, the value of an asset provides a powerful and compelling measure. Yet no single number, however well-conceived, is sufficient for conveying all of the information one may wish to communicate regarding an asset. Thus, a valuation approach should be adapted so that it provides the information of greatest use in decision-making. For instance, an agency may wish to tailor the calculation such that annual depreciation approximates the cost to maintain asset value. However, this limits the ability to use the change in asset value in other ways, such as for showing how a proactive preservation strategy could be more cost-effective than a reactive strategy.

The objective of this guide is to provide step-by-step guidance for calculating asset value in support of asset management applications. It describes an approach to calculating value that includes six basic steps, offering alternative approaches for each step to account for the considerations described above, as well as for differences in the scope of the calculation, available data, and other factors.

It is important to note that while the guidance presented here is intended to be consistent with best practices in public sector accounting, this document is not intended as an accounting standard or as a guide for calculating asset value in support of agency financial reports. Several accounting standards exist for valuing assets to support financial reporting that do address these topics. The predominant standard for U.S. public agencies is the aforementioned GASB Statement 34 (1), and its international counterpart is the International Public Sector Accounting Standards (IPSAS). IPSAS standards are based on standards of the International Accounting Standards Board (IASB), particularly International Accounting Standard (IAS) 16: Property, Plant and Equipment (2) and International Financial Reporting Standard (IFRS) 13: Fair Value Measurement (3). International Standards Organization (ISO) 55002 asset management standard (4) discusses additional important concepts for relating asset value to asset management, such as the distinction between value generation and value determination. While important to the industry and general understanding, these standards are not the focus of this guidance.

The recently-updated ISO55002 standard discusses the differences between value generation, the benefits from use or ownership of assets defined as “value from”, and value determination, an asset’s valuation for purposes of sale defined as “value of.”

Using a rental car company as an example, rental vehicles lose sale value (“value of”) immediately after purchase, but the company continues to generate value (“value from”) by renting their cars to users. The rental car company is then able to make a profit from assets which are losing value. In traditional business cases, asset owner investment decisions are more often guided by “value from” than “value of.”

This guidebook consists of nine chapters, a glossary and additional technical appendices. The first two chapters, including this one, introduce the content and key concepts. Chapters 3 to 8 provide step-by-step guidance for calculating asset value. Chapter 9 provides a set of worked examples of the calculations.

The contents of the remaining chapters are as follows:

- Chapter 2 – Asset Value Overview introduces the concept of asset valuation. It defines asset value from the cost, market, and economic perspectives, identifies applications of asset value for supporting TAM, and presents the simplified steps for calculating asset value. The chapter concludes with a summary of U.S. and international accounting standards and their underlying assumptions.

- Chapter 3 – Asset Valuation Scope outlines the different factors one should consider when establishing their asset valuation calculation approach. This includes selecting which assets and systems to include in the calculation, reviewing available data, and determining the level of detail at which the calculation will be performed, and specifically whether to break complex assets into components.

- Chapter 4 – Initial Asset Value describes how to calculate the initial value of an asset when it is first constructed or obtained. The chapter describes four basic approaches to performing the calculation reflecting different perspectives on asset value: historic cost, replacement cost, market value, and economic value.

- Chapter 5 – Treatment Effects identifies and defines which treatment effects should be included in the asset value calculation. It discusses treatment costs, treatment effects, and the concept of residual value.

- Chapter 6 – Depreciation describes how to calculate the loss in value of an asset over time. The chapter describes three basic approaches to calculating depreciation. Each approach focuses on a different basis for depreciation: asset age, condition, or the pattern of benefit consumption for the asset.

- Chapter 7 – Measure Calculation brings together all of the steps from Chapters 3 to 6 to calculate the overall asset value. Also, it describes how to calculate additional supporting measures, such as the cost to maintain value, asset sustainability ratio, net present value, asset renewal funding ratio, and asset consumption ratio.

- Chapter 8 – Using Asset Value to Support TAM Decisions addresses the interpretation, communication, and application of asset value. It explains how to test different treatment scenarios using asset value, and it clarifies when and how asset value can support prioritization. The chapter also explains when and how to use sensitivity analysis to understand the asset value results.

- Chapter 9 – Case Studies presents a set of case studies undertaken to demonstrate the process outlined in this guide. The case studies illustrate scenarios for calculating and applying asset value from a range of different agencies and asset types.

This guide is intended for use by public agencies seeking to calculate asset value in support of TAM and TAM decisions. This includes, but is not limited to, applications such as:

- Using asset value to communicate the extent of assets an agency owns or maintains;

- Reporting asset value in a TAMP;

- Determining how value is expected to change over time given an agency’s investment strategy;

- Calculating the cost to maintain asset value; and

- Evaluating the impact of different treatment options on the value of a given asset or asset class.

This guide is designed for use by all U.S. public agencies managing transportation assets, including state and local DOTs, transit agencies, port authorities, airport operators, and others. Key users of the guide include engineers, planners, and analysts charged with managing transportation assets, calculating asset value, and/or helping support investment decisions. The guidance may also be useful for accountants and financial analysts responsible for agency accounting and financial reporting for purposes such as comparing TAM asset value calculations to those developed for financial reports or other applications.

The guide is designed to support a variety of different uses; it offers an explanation of essential concepts, step-by-step guidance, examples, and different levels of maturity in applying the guidance. These applications are discussed below.

Basic Overview of Asset Value and Related Concepts

Each chapter provides an overview of key concepts that help develop an understanding of the subject matter. Chapter 2 introduces concepts related to calculating asset value. Chapter 3 discusses key considerations involved in calculating asset value. In Chapters 4 to 8 the first section of each chapter further details concepts important for applying the guidance in the chapter. For additional information on TAM concepts, the reader should refer to the American Association of State Highway and Transportation Officials (AASHTO) TAM Guide (5) and National Cooperative Highway Research Program (NCHRP) Report 898: A Guide to Developing Financial Plans and Performance Measures for Transportation Asset Management (6).

Step-by Step Guidance

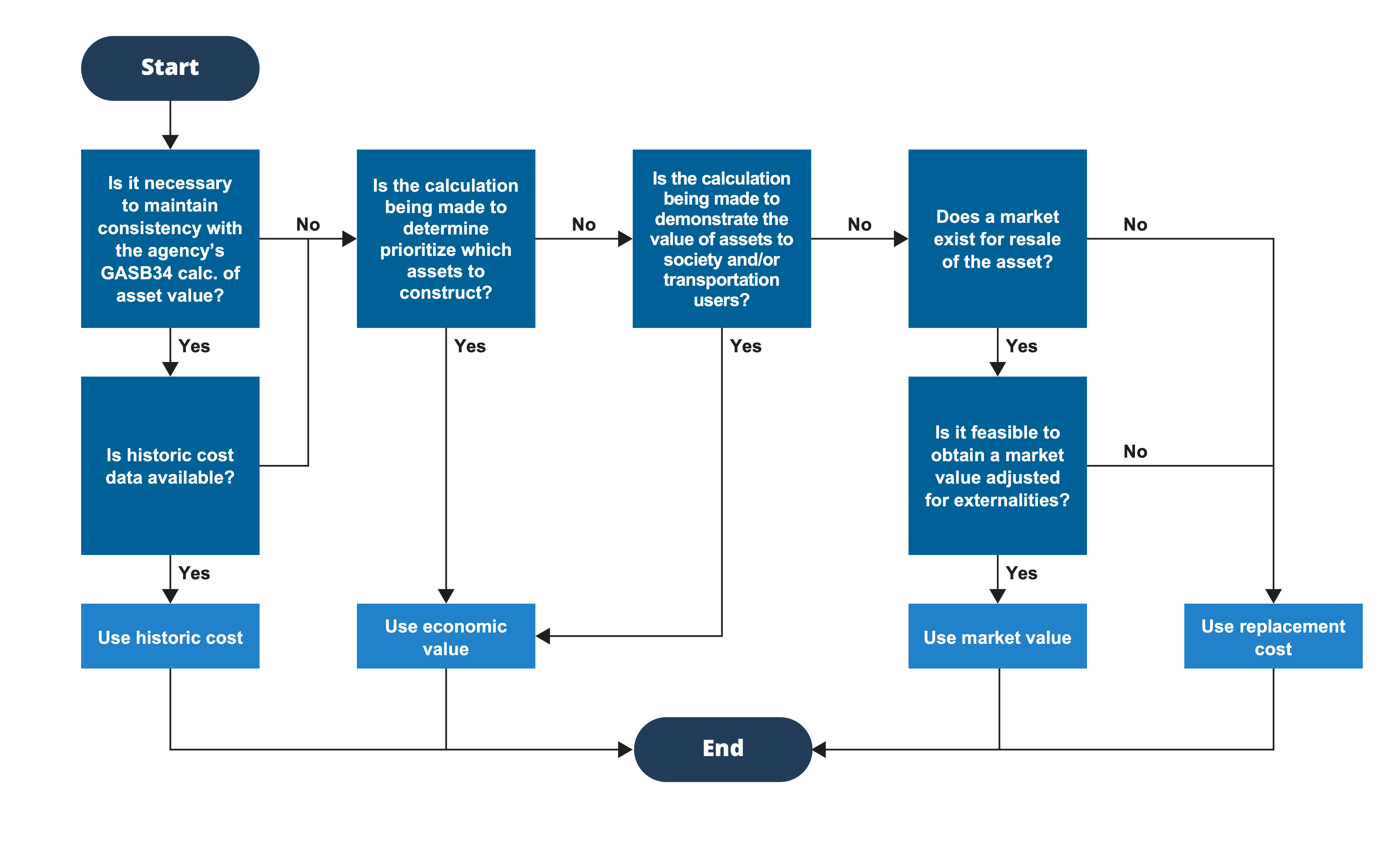

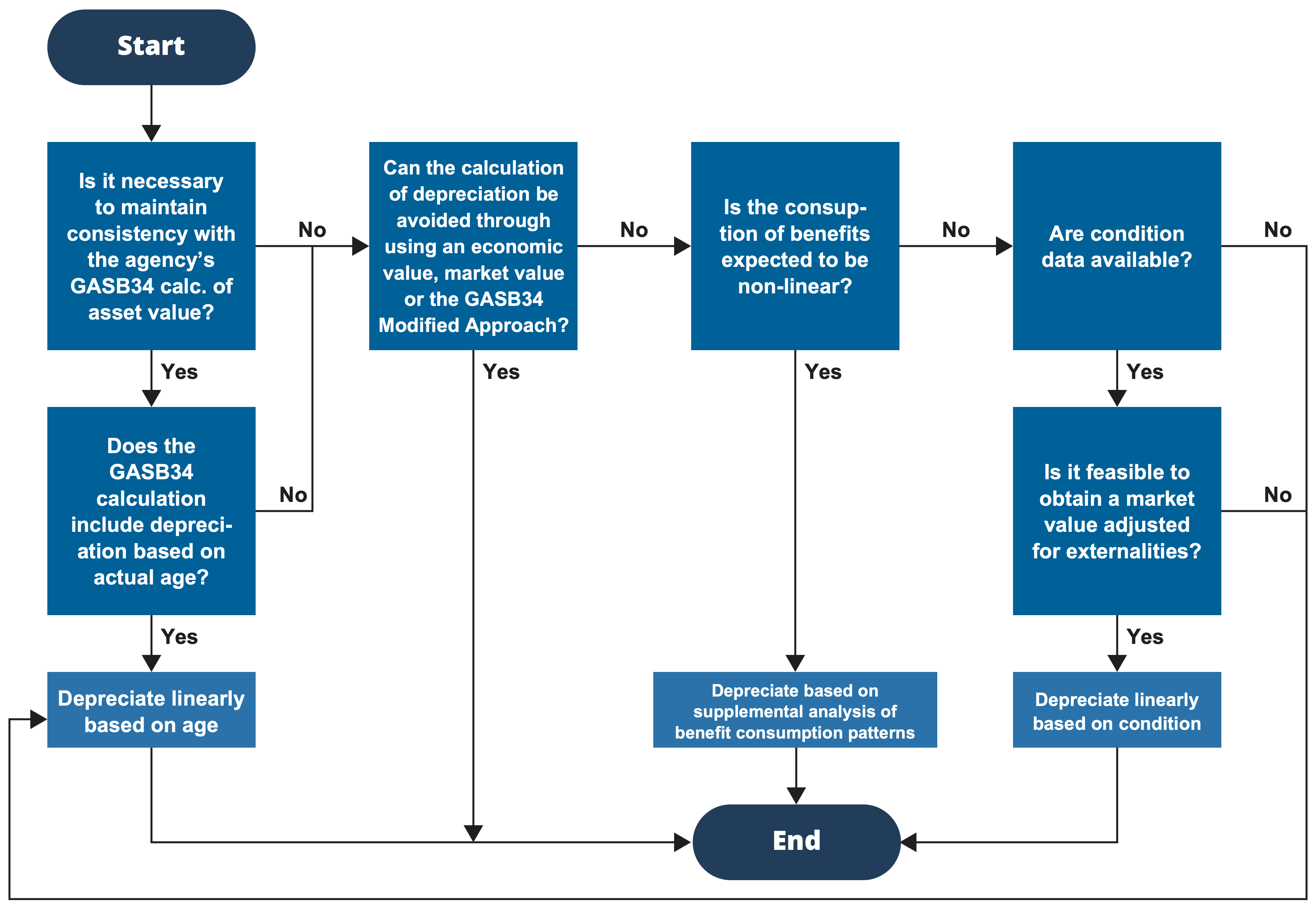

Chapters 3 to 8 provide step-by-step guidance for calculating asset value. Each chapter describes the options an agency has in determining how to calculate asset value at each key decision-point. These chapters include flowcharts to assist the decision-making process, such as determining how to calculate the initial value of an asset and how to calculate depreciation.

Practice Examples

There are numerous practice examples in each chapter of the Guide. Chapter 3 offers examples from other agencies illustrating the typical scope selections and their impacts on the valuation. Chapters 4 to 8 include examples of how different agencies have addressed issues discussed in the guidance. Chapter 9 details a set of worked example walking through the asset value calculation from beginning to end.

Practice Assessment

Chapters 4 to 8 each include a section titled “Practice Assessment.” This section provides examples of “emerging”, “strengthening”, and “advanced” practices with respect to different aspects of the asset value calculation. All of the practices described illustrate how the guidance can be applied, albeit with varying levels of complexity. In this context, an emerging practice is one that supports the guidance with minimal complexity, an advanced practice illustrates a “state of the art” example in which an agency has addressed some aspect of the asset value calculation in a comprehensive manner, and strengthening practice lies between these two extremes.

Note that the labels applied to the practice examples is designed to be consistent with the maturity scale used in the AASHTO TAM Guide. This resource describes additional tools and approaches for assessing TAM maturity.

Knowing what a physical asset is worth – its value – can be very useful both for financial reporting and for supporting asset management. Even if the notion of asset value is somewhat abstract, an asset owner generally prefers that the value of their assets increases or at least remain constant over time. Fundamentally, tracking and reporting asset value helps a transportation agency monitor the state of its assets and provides a sense of whether the inventory is improving or in a state of decline. Transportation agencies use data on asset value in a variety of ways to support asset management. Major applications of asset value aiding an overall asset management program are described below.

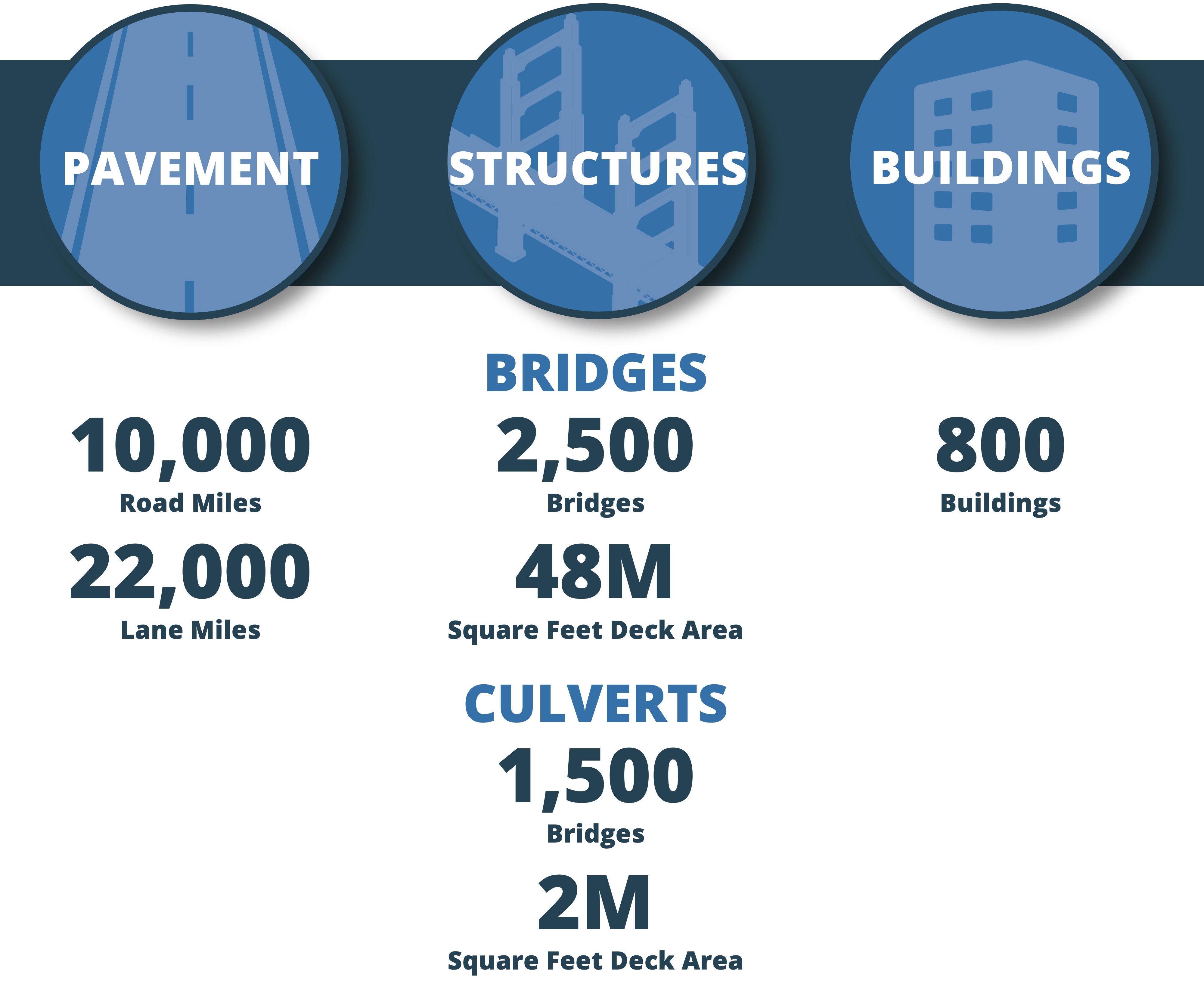

Asset value is used to communicate what assets an agency owns, their extent, and the agency’s responsibility for maintaining the asset inventory. Each asset has its own unit of measure: pavements may be summarized in terms of lane miles, bridges in terms of deck area, and other assets in terms of a count. However, it can be hard to relate these different units and to summarize their asset portfolio as a whole. For instance, how does one lane mile compare to 1,000 square feet of bridge deck or 100 culverts?

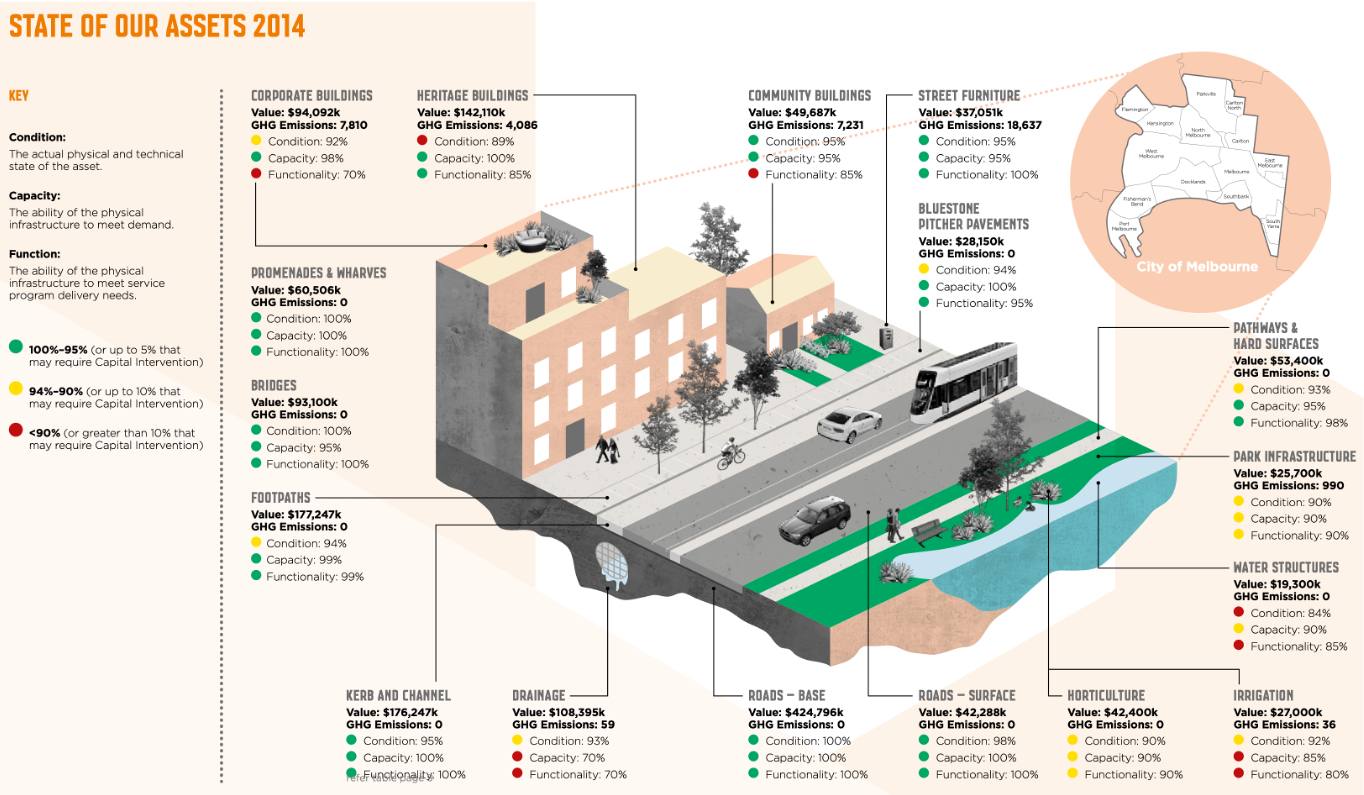

Figure 2-1, reproduced from the Melbourne Asset Management Plan (7), depicts the assets owned by the agency, including the roadway surface, roadway base, bridges, footpaths, drainage, buildings, and various other assets. Each type of asset is illustrated and labeled with its value and annual greenhouse gas (GHG) emissions. The City of Melbourne uses these two numbers to communicate the state of their assets to the public and other stakeholders.

Figure 2-2 shows an example from the TAMP prepared by Carver County, Minnesota (8). Here asset quantities and conditions are summarized for 13 transportation asset classes. Asset replacement value and current asset value are shown for the ten asset classes for which Carver County Public Works is responsible. The two asset values help communicate the state of the county’s assets to the public as well as providing a financial account of the publicly-owned assets.

Various measures have been formulated that use asset value and changes in value to demonstrate that an agency is managing its assets responsibly. The basic premise is that as assets deteriorate or depreciate in value, an agency should invest to maintain their value. Public agencies in Australia and New Zealand have used asset value in this manner for over a decade. The Australian Infrastructure Financial Management Manual (AIFMM) details recommended measures and practices for monitoring and applying asset value (9). A key measure in Australia is the Asset Sustainability Ratio (ASR), or ratio of spending on asset renewal and replacement to annual depreciation.

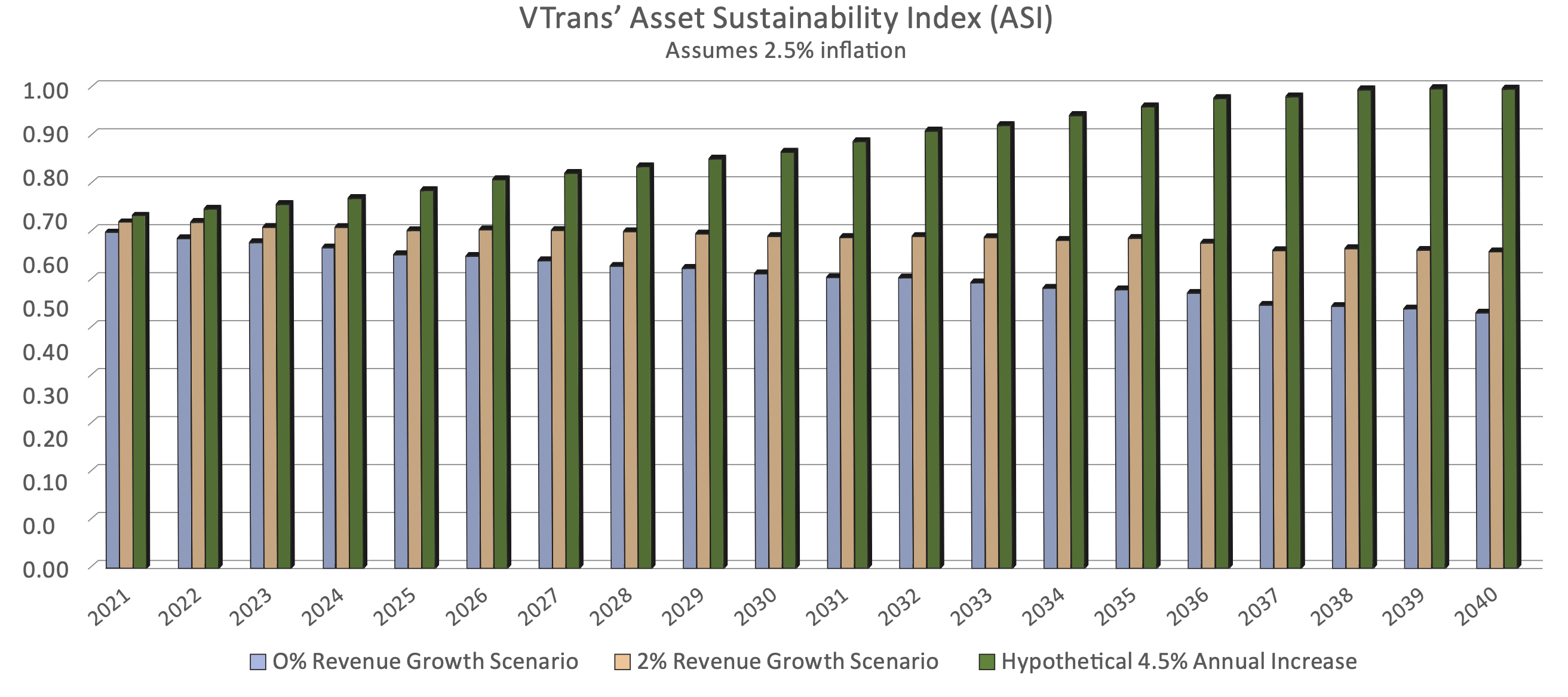

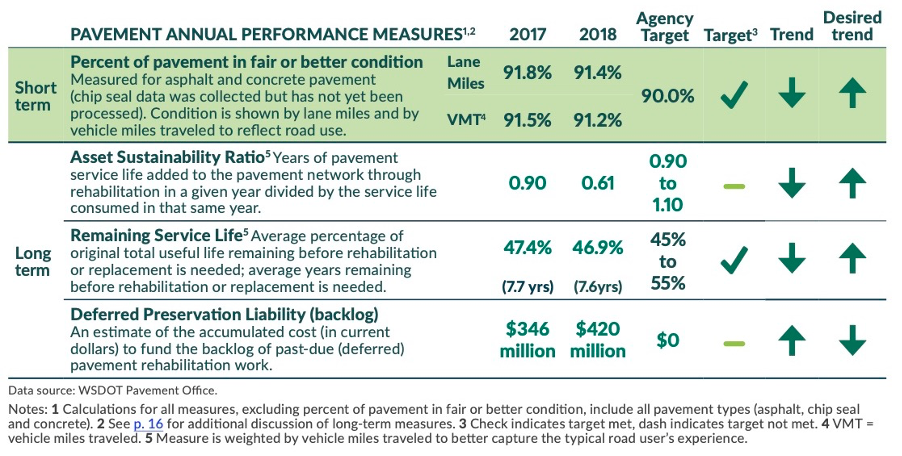

In the U.S., several agencies have calculated similar measures. Figure 2-3, reproduced from the Washington State Department of Transportation (WSDOT) Gray Book (10) includes several long-term measures for pavement assets related to asset value. The Gray Book is a quarterly performance report which covers a variety of aspects related to WSDOT’s transportation system and assets. The Gray Book from the fourth quarter of 2019 includes the following long-term measures for pavement: ASR, Remaining Service Life (RSL), and Deferred Preservation Liability (backlog). In this case, ASR is calculated as the years of pavement life added through different treatments divided by life consumed.

Asset value can be used to help illustrate the difference between alternative investment strategies, such as when comparing a strategy of performing recommend preservation treatments on an asset over its life to an alternative strategy in which preservation treatments are deferred, resulting in worse relative condition and potentially a shorter asset life.

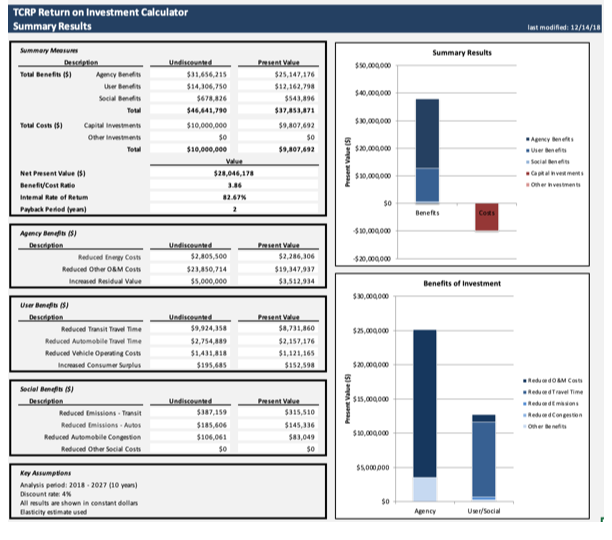

One way to compare different investment strategies for a given asset is to perform a life cycle cost analysis (LCA). In such an analysis, the costs for an asset are computed over time for a given scenario relative to a base case. A results of a given investment strategy can be summarized by calculated the net present value for the strategy, where NPV is the sum of the discounted benefits of the asset less the sum of discounted costs.

Asset value is potentially relevant to such an analysis in two ways. If one adopts an economic interpretation of asset value, as discussed further in the next section, NPV can serve as the definition of asset value. However, even when asset value is computed differently from NPV, it can be used to represent the residual value of the asset at the end of the analysis periods. This provides a way to compare investment scenarios that result in different condition and/or remaining

asset life.

Another potential application of asset value for supporting TAM is helping compare and understand asset investment options. While asset value alone is insufficient for prioritizing investments, when used in conjunction with life cycle cost analyses it can provide a complete view of the asset’s worth. In particular, asset value can help prioritize decisions such as:

- Resilience investments;

- Reconstruction; or

- Decommissioning

Asset value provides insights for assets identified for decommission or reconstruction by pitting their intrinsic value (including the replacement cost and socio-economic importance) against the costs necessary to maintain or replace the asset. Asset value also supports investment decisions for resilience investments by placing an emphasis on the importance of asset renewal to mitigate future risks and by directly accounting for the potential costs associated with a risk.

In these applications, asset value is defined broadly, considering the cost of constructing the asset and its value to road users and society. For example, in determining which bridges to focus on for a set of resilience investments, one might consider the cost of replacing or improving each bridge, the risk to the bridge as a result of flooding or other events, the level of service the bridge provides, and the impacts to mobility in the event the bridge is closed. The inclusion of asset value in the investment decision could lead to the renewal of the asset to withstand the risks, or it could suggest an asset should be allowed to fall into obsolescence. Either way, it provides context to the investment decision.

Thus far, we have discussed how asset value can be used to support TAM but not what it actually represents. This begs the question, what is asset value? According to the definition established by Organisation for Economic Co-Operation and Development (OECD), in its report Measuring Capital (11), a physical asset has no intrinsic value. Instead, its value results from the benefits it yields, be they to the asset owner, a set of transportation system users, society as a whole, or some combination thereof. As an asset ages, it depreciates, or loses value, when its benefits are consumed.

Speaking generically about capital and its value, OECD discusses that capital has a dual nature; it serves both as a means to store wealth and as a source of capital services. OECD further discusses the different perspectives on asset value as well as the fact that the best perspective depends on one’s “analytical purpose.”

Asset Value: the discounted stream of future benefits that the asset is expected to yield.

Depreciation: loss in the value of an asset as it ages, equivalent to the consumption of fixed capital.

Source: OECD, Measuring Capital (11)

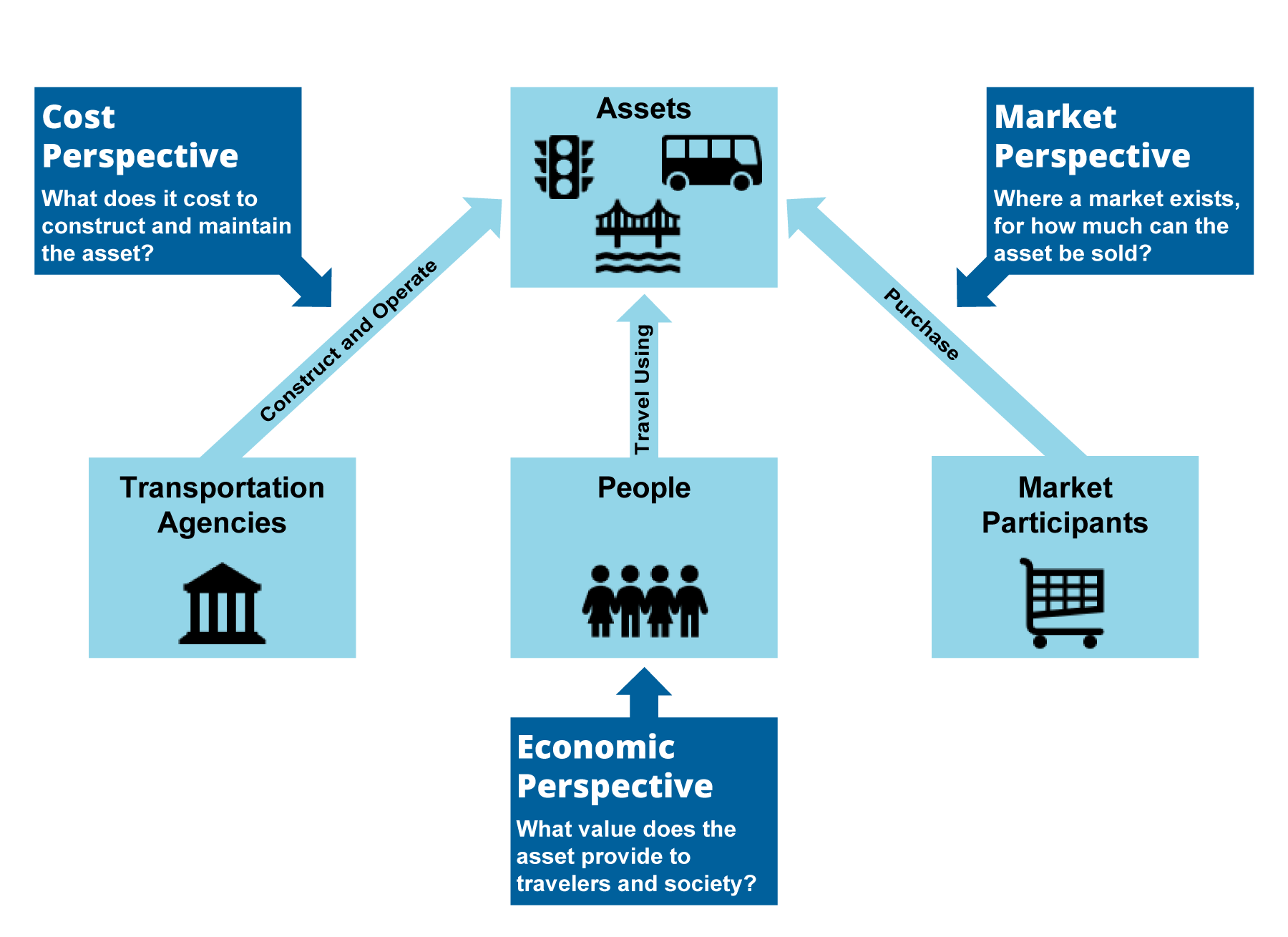

Figure 2-4 illustrates the different perspectives on transportation asset value, adapting concepts from the OECD discussion. The figure illustrates three perspectives: a market perspective, a cost perspective, and an economic perspective. Each perspective is discussed further below.

The cost perspective focuses on capital costs incurred by the asset owner. When establishing value from this perspective one asks: “How much does it cost us to acquire this asset and operate it over time?”

In cases where a competitive market exists for an asset, the cost and market perspectives yield the same result for the initial value of an asset; the cost is notionally the price of the asset on the market. However, this perspective still yields a value in cases where no market exists, or where the market is not competitive. Even if there is no market for an asset, there is still a cost incurred in purchasing, constructing, and operating the asset over time.

One important consideration in adopting the cost perspective is to establish whether to use historic or current costs. The historic cost of an asset is the cost that was actually paid for the asset. The current cost is the cost of replacing the asset in today’s dollars, regardless of what was actually paid in the past. GASB Statement 34 specifically requires agencies to report the historic costs of asset purchase or construction, as is consistent with U.S. Generally Accepted Accounting Principles (GAAP). U.S. GAAP emphasize the use of conservatism, or avoiding the overstatement of net assets and income. Thus, U.S. agencies must report asset values using historic costs or estimated historic costs in their financial reports to be consistent with either method in GASB 34, even if they calculate value in other ways to support TAM.

For supporting TAM, and for financial reporting outside the U.S., asset owners tend to use the asset’s current replacement cost in today’s dollars rather than the asset’s purchase price. The use of the current replacement cost is recommended for calculating the fair value of an asset as defined in IFRS Number 13. This cost is used as a proxy for the price that would be charged for the asset in the event that a market existed. Also, it is the cost that is most relevant to an asset manager trying to make investment decisions that involve spending money in today’s dollars.

The basic issue with the cost perspective is that it leaves no daylight between cost and value; these are one and the same. If one asks what value will be derived from spending $1 million to reconstruct a road, from the cost perspective the answer is “$1 million, of course.” Consequently, the cost perspective can help answer questions about how best to manage assets, but it is ill-suited for addressing questions concerning the underlying value of transportation assets to society. For answering such questions, one must instead turn to the economic perspective.

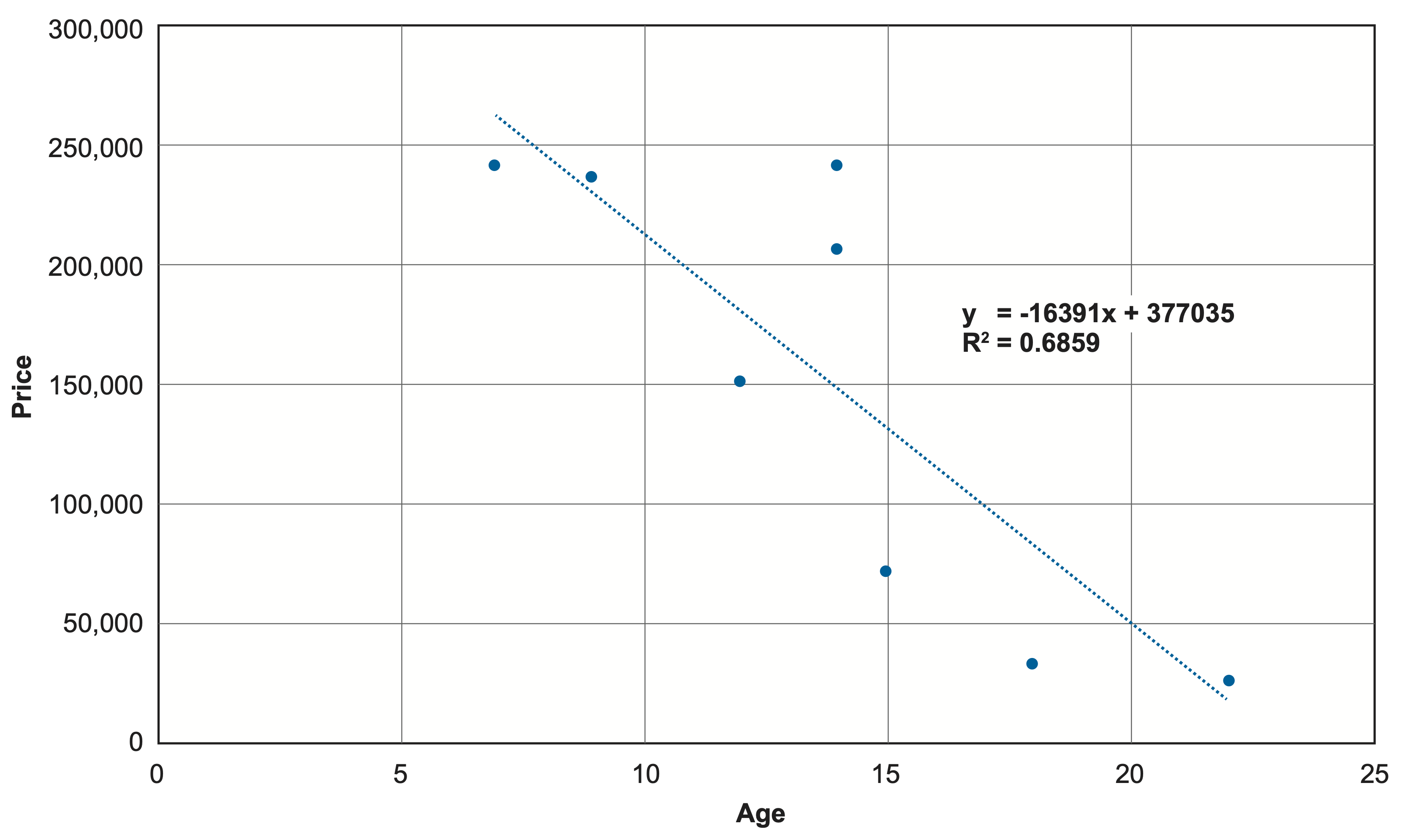

The market perspective focuses on the price of an asset on the open market. When establishing value from this perspective one asks: “For how much can an asset be sold on the market?” For example, when valuing an automobile one might seek to determine the resale value should the car be sold through an auction or to a reseller.

The virtue of this perspective is that it leverages the behavior of free markets to determine how much value an asset is expected to yield in the future. If the market for an asset is competitive, then the asset’s market value should theoretically account for the future benefits provided to the buyer. After all, nobody would want to purchase an asset at a cost greater than its expected benefit. The competitive nature of the market should ensure that no asset is sold at less than this value. Thus, this perspective is extremely valuable where a well-defined market exists for an asset.

The challenge with adopting this perspective is that it can be hard to identify a market, let alone a competitive one, for many types of transportation assets. Markets typically exist for assets that are manufactured and can be readily exchanged between different parties, including many types of vehicles, equipment, facilities, and land. Fixed assets, such as the roads and bridges necessary to provide mobility to society, are not particularly mobile themselves, and they do not lend themselves to being resold once constructed because they do not generate revenue. Markets can exist for toll roads and bridges, but it is important to note that the prices in these markets may not be wholly indicative of the asset’s condition, as they typically involve the leasing, not the sale, of an asset for an allotted period of time. Also, the market price does not account for externalities – costs and benefits placed upon others and not perceived by the buyer. An example of a positive externality is the support of emergency services such as ambulances; negative externalities include items such as air pollution, congestion, and noise. Depending on the application, it may be necessary to adjust the market price for externalities.

One approach for calculating a market value for fixed assets is to examine cases in which infrastructure has been privatized, such as where a private firm bids to own, operate, and maintain a highway. The asset value considerations and applications for private infrastructure are explored further in Chapter 4. For now, to use this as the basis for establishing value for other assets one must ask:

- To what extent can the price of a given privatization contract or other transaction be generalized to other transportation assets? For instance, it may not be reasonable to apply the value of a specific toll road to other non-toll roads and bridges. These assets’ risks, costs, and revenues depend on unique characteristics, such as the length of the contract or local traffic flow, which are not easily generalized or tracked.

- Does the market price account for the full range of benefits and externalities? In the example of a toll road, one can use the transaction price to determine the value of future tolls for a specific road. However, this does not account for impacts of traffic diverted to or from other roads as a result of the toll road, changes in consumer surplus to road users being tolled, environmental impacts, and a host of other issues.

- Is the market competitive? Certainly, a public agency awarding work always seeks a competitive market, but in large, high-cost bids there may be a small number of bidders, and it may be difficult to establish whether a competitive market actually exists. If the market exists but it not competitive, then it is possible to establish a market price, but it may be a different price than that of a truly competitive market.

However it is established, the market value of an asset is viewed as the best representation of asset value based on international accounting guidance. Based on the IFRS 13 standard, the fair value is the price that would be set for an asset in a market, in the event one existed, regardless of whether such a market actually exists. Where no such market exists, IFRS 13 describes using the cost of the asset as a proxy, consistent with the cost perspective.

Fair Value: the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Source: IFRS, Standard Number 13: Fair Value Measurement (3)

The economic perspective focuses on the benefits generated by an asset. When establishing value from this perspective one asks: “What are the benefits of the asset to travelers and society?” In general guidance for asset value (11, 12), this perspective is also called the “income perspective”, as it involves calculating the income generated by an asset.

The valuation of an asset is a fundamental area of economic analysis, especially in the context of a benefit-cost analysis (BCA) conducted to determine whether improvements to an asset are worthwhile. When conducting a BCA, one determines the cost of an investment as described above for the cost perspective and calculates economic benefits by observing the choices people make to infer the value they derive. Transportation facilities do not intrinsically generate value. Instead, value is generated when a facility is used to transport people or goods. Analysis of the different values incorporates forecasts of roadway uses, which are typically obtained from travel demand models that frame transportation choices through a nested set of decisions, including whether or not to take a trip, and if the trip is taken, which destination, mode, and route is chosen. Since operating a wide network of roadways expands transportation choices, and thus the implicit value of exercising an option to travel, a fundamental purpose of asset management is to maintain existing facilities so that their use generates value.

The cost, market, and economic perspectives on asset value differ in subtle and important ways. For example, a cost perspective generally starts from an implicit assumption that a facility is worth maintaining at the level of service for which it was originally planned and constructed. The actual use of the facility does not factor into the assessment except when it is used to indirectly estimate the rate of deterioration and maintenance schedule. In comparison, the market approach directly considers the value of the facility to users in addition to the cost to maintain it. The market approach can be considered from the perspective of a concessionaire who could evaluate the facility based on their opportunity to recover their cost and earn a profit, through revenue collection. Accordingly, the number of users and their willingness to pay for using the facility are key determinants of value. Note also that this willingness to pay is typically associated only with users’ potential for saving time or out-of-pocket costs.

In contrast, an economic measure of asset value stems from a more comprehensive value, based on the use of a facility. Economic asset valuation is an analytical exercise that establishes a rationale on whether and when a facility ought to be constructed or improved. Academic literature and practitioner-oriented documents and guidelines discuss two ways in which a transportation facility provides economic value (13, 14). A user-based measure of value draws directly from separable and additive accounting of key benefit categories, such as travel time, out-of-pocket expenditures, accident risk, pollutant externalities, and pavement maintenance, and some potential site-specific impacts that arise from facility use or location. Alternatively, where transportation facilities lower the cost of mobility, they can induce more productive investments in capital and labor, key measures of gross domestic product (GDP), and a macroeconomic indicator of transportation value. There are various challenges in linking economic benefits to specific changes in GDP. The approach presented here addresses the economic benefits of transportation assets without making an explicit linkage between these benefits and GDP.

There are several important dimensions in a user-based, economic valuation of transportation assets that one must consider when valuing assets from an economic perspective. These include the following:

- Relative value. Since a transportation facility has no intrinsic value (beyond its use), economic valuation of an existing facility constructs a counterfactual case (e.g., an alternative design, route or mode) for comparison with current conditions. Depending on the asset management context, several different types of alternatives could be established for comparison.

- Measures of value. Transportation investment has a number of different impacts both positive and negative. A variety of different measures are needed to quantify the value from an investment. These include, but are not limited to, travel time savings, vehicle operating costs, crash costs, emissions costs, costs from environmental impacts, changes in property value, and agency costs.

- Consideration of the stream of costs and benefits. The time span over which asset value is measured creates complexities since many roadways are already or will become long-lasting corridors that communities develop around. The present value of a facility’s future uses must be determined, and this is directly determined by a discount rate intended to reflect the present value decision-makers place on any future uses.

- Changing contexts. It is not enough to manage assets assuming current valuation conditions will remain in perpetuity. For example, the value of a transportation asset may change if policy perspectives shift toward free-access facilities versus revenue-generating ones or if climate conditions render facilities more vulnerable to extreme events.

Each asset value perspective emphasizes a specific aspect of how transportation assets are constructed and utilized. All three perspectives are valid, and can provide insights that help communicate information about assets and support decision-making.

While each of the perspectives supports some of the applications described in Section 2.1, many public agencies rely on the cost perspective for their calculation of asset value. The cost perspective helps an agency directly relate its expenditures on assets to changes in their value, and it supports a large number of TAM-related applications. Also, where a market exists, the cost of replacing the asset, depreciated based on its age or use, tends to correlate closely to its price. Where no market exists, the depreciated replacement cost serves as a proxy for its market price.

Regarding the relationship between the cost and economic perspectives, the cost of an asset does not provide direct insight into the economic benefits generated by an asset, and cannot support decisions that rely on this information. However, if one assumes that an existing asset is worthy of maintenance, the expectation is that its benefits over time must at least equal, and may greatly exceed, its replacement cost. Further, whatever the benefits may be to transportation users and society, those benefits will continue to accrue provided the asset remains in service. Thus, for many TAM applications it is sufficient to focus on the cost to the agency of keeping the asset in service through efficient maintenance and planning, with the assumption that doing so is inherently worthwhile.

This section outlines the basic steps in calculating asset value. Though they are intended to support the different applications described in Section 2.1, the steps are the same regardless of the specific application, and regardless of which perspective described in Section 2.2 one assumes. The steps explicitly acknowledge the different applications and perspectives, and they walk the analyst through the key decisions for calculating asset value. Figure 2-5 summarizes the steps to calculate asset value, and the following subsections describe each step further.

Define the Analysis Scope

The first step is to determine the scope of the analysis. Here, one must determine the assets for which they will calculate value, and the level of detail at which the calculations will be performed. The selected approach depends upon the intended application of the asset value calculation.

When deciding which assets to incorporate, one must consider both the specific asset classes and the systems or networks included in the analysis. For example, to comply with Federal requirements for TAMPs, State DOTs must calculate asset value for two asset classes – pavements and bridges – under one system – the NHS.

All asset classes identified in the requirements should be included in the calculations, and no asset should be included in multiple classes. However, when calculating the value for pavement, one must decide if this includes the value of shoulders, guardrails, signs and traffic signals, and Intelligent Transportation Systems (ITS). Ideally, the decision of what asset types to include is supported by a review of a comprehensive asset register and a consideration of the available data.

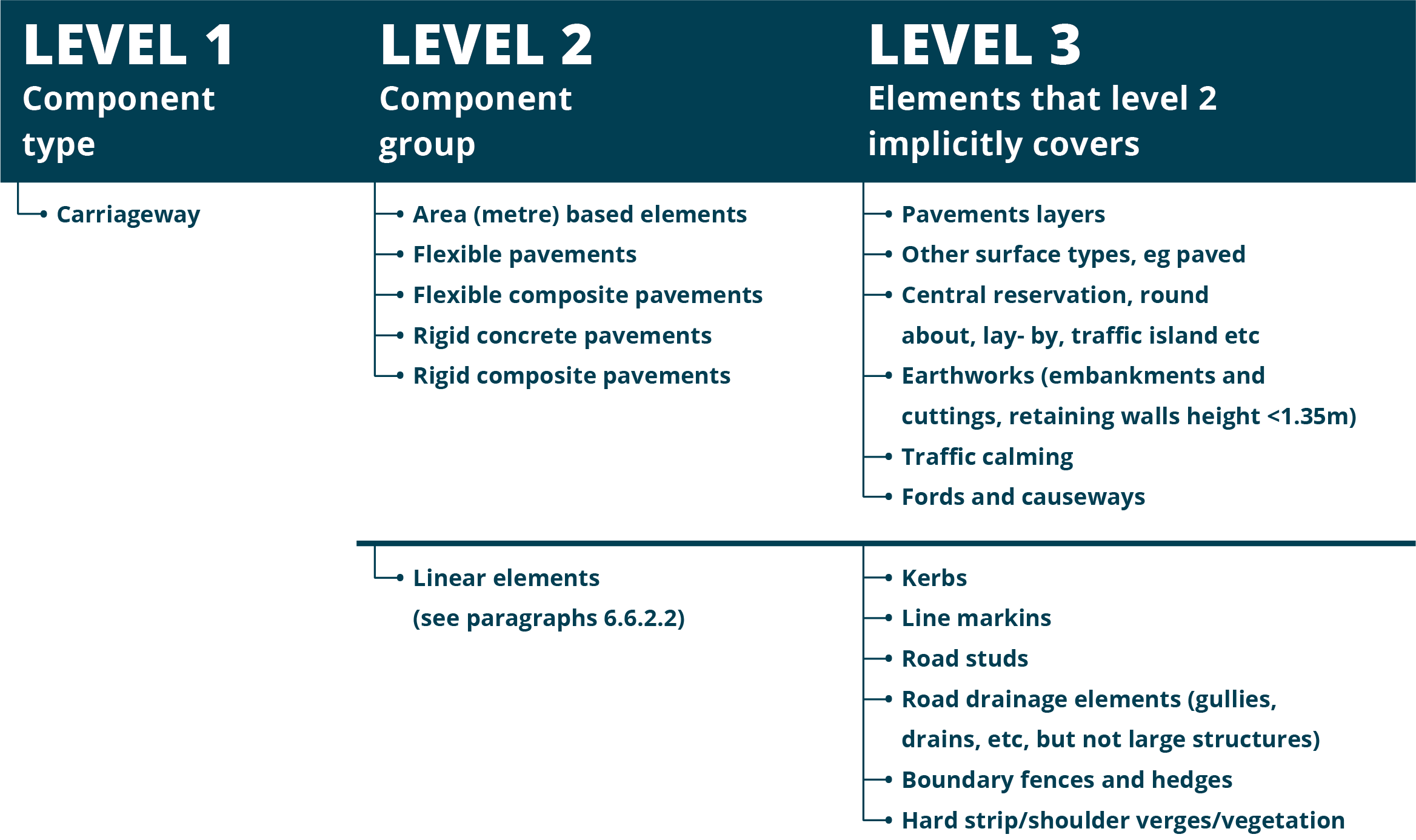

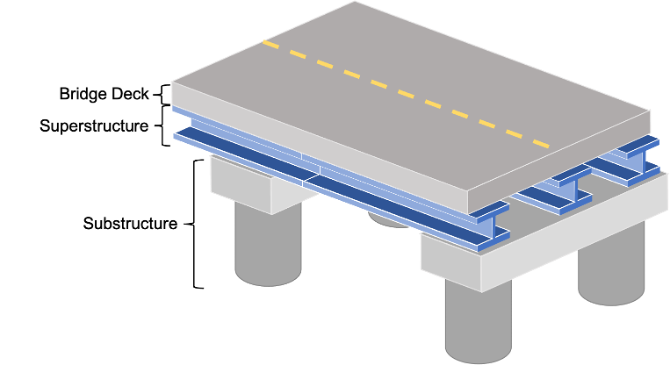

The level of detail required for the analysis is a function of the intended applications of the asset value calculation and the availability of data. In concept, the level of detail should be sufficient for specifying the impact of different treatments considered in the calculation, though this topic is discussed further in Step 3 – Determine Treatment Effects. Ideally, one should include treatments that add life to an asset and analyze assets at a level of detail that accounts for treatment effects. For instance, it may be necessary to consider major components of a bridge (deck, superstructure, substructure) separately in the analysis, given these components have different lifespans and some treatments may extend the life one component but not another (e.g., deck replacement or substructure repair).

Establish Initial Value

Once the analysis scope has been established, the next step is to decide how to calculate the initial value of an asset. This step accounts for the different applications and perspectives of asset value.

For many TAM applications, the preferred approach is to establish the initial value based on the asset current replacement cost in today’s dollars. As discussed in Section 2.2, this approach supports decisions regarding how an agency should spend its available budget on its assets. This approach tends to be the most straightforward to implement, and it is recommended as a default.

However, for certain applications it may be preferable to use an alternative approach to establish asset value. For U.S. agencies that seek to maintain consistency with their approach to financial reporting, it may be necessary to establish initial value based on purchase price, consistent with GASB 34. For applications that involve considering which assets should be constructed or maintained, an economic perspective may yield a more defensible result. Where market value is available, this is usually preferable, particularly given the ease of calculation relative to other approaches.

Determine Treatment Effects

Another important step in calculating asset value is determining treatment effects. Here, one must establish what treatments will be explicitly considered in the analysis, treatment costs, the assets that a treatment impacts, and the effects of treatment. Depending on the depreciation approach, one may specify treatment effects in terms of change in asset life or change in asset condition (which can then be converted to a change in effective life).

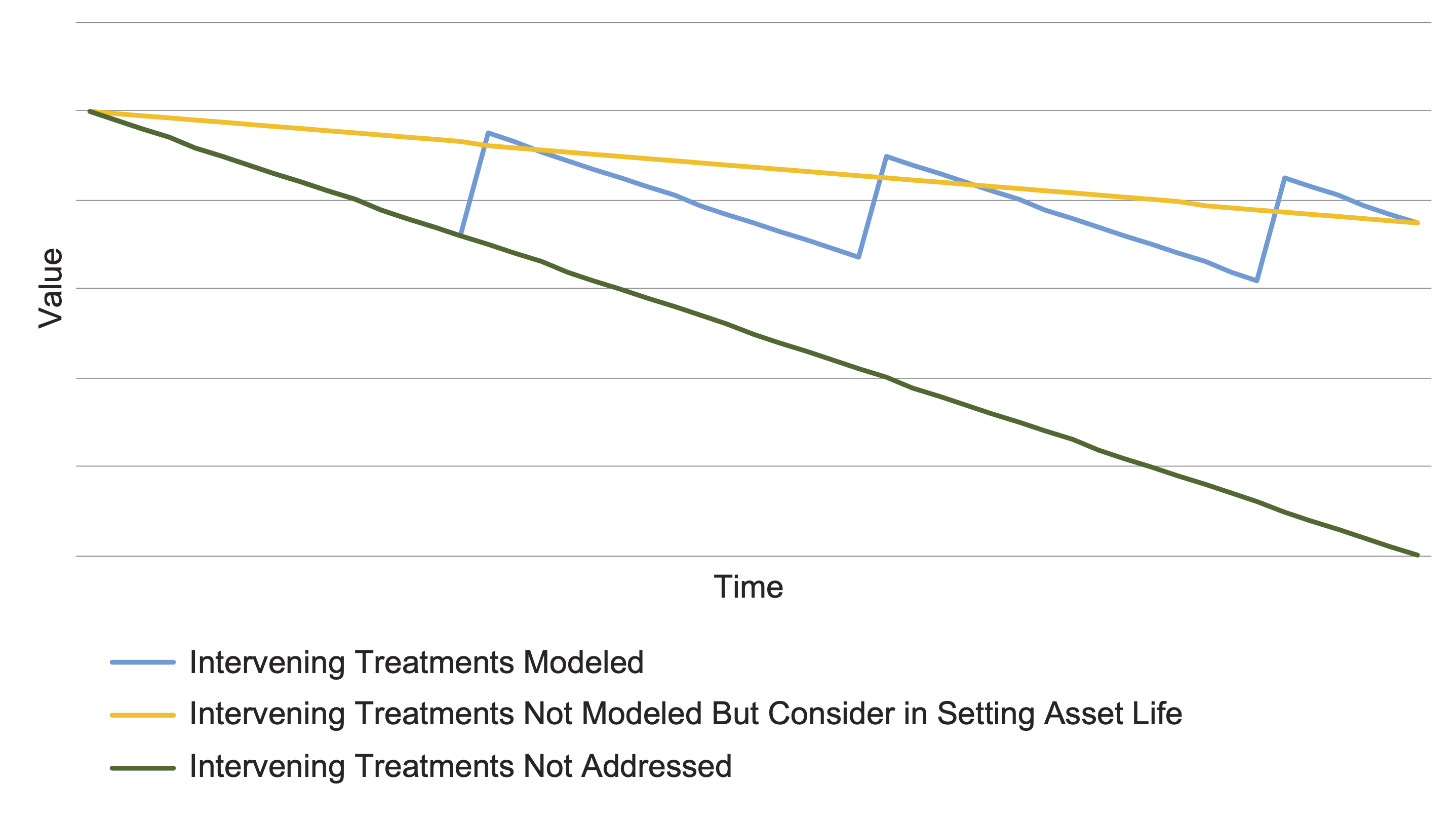

The major question to answer in this step is what treatments to consider. At a minimum one should consider asset replacement or reconstruction, and the treatments identified in an asset’s life cycle analysis should be reviewed as well. Frequently, it is necessary to consider other treatments short of replacement or reconstruction to support TAM applications. For example, when trying to demonstrate the value of performing preventive maintenance activities for pavement, one approach is to show how asset value for a representative pavement section changes over time with and without preventive maintenance.

Once the treatments are established, one must specify treatment costs, what assets or asset components are addressed by a given treatment, and the effects of treatment on asset or component life or condition. Treatments that are assumed to occur but not explicitly considered should be reflected in estimates of asset life; preventive maintenance activities often fall within this category. For instance, an estimate of the life of a new pavement should assume preventive maintenance treatments occur as scheduled.

Establish Depreciation Approach

Depreciation is necessary when calculating how asset value changes with time. Any asset with a finite life loses value over time. As in the case of calculating initial asset value, there are many different approaches to calculating depreciation. The best approach to use depends on the intended application of the calculation, one’s perspective on what value represents, and the data available to support the calculation.

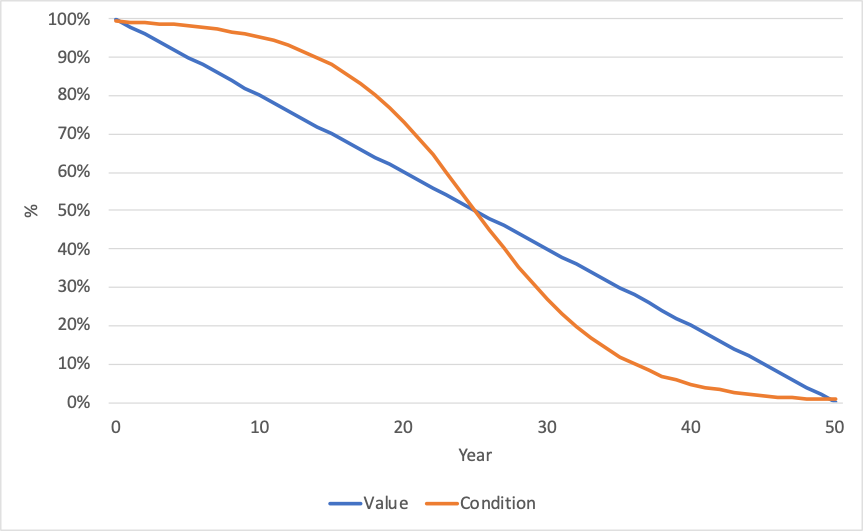

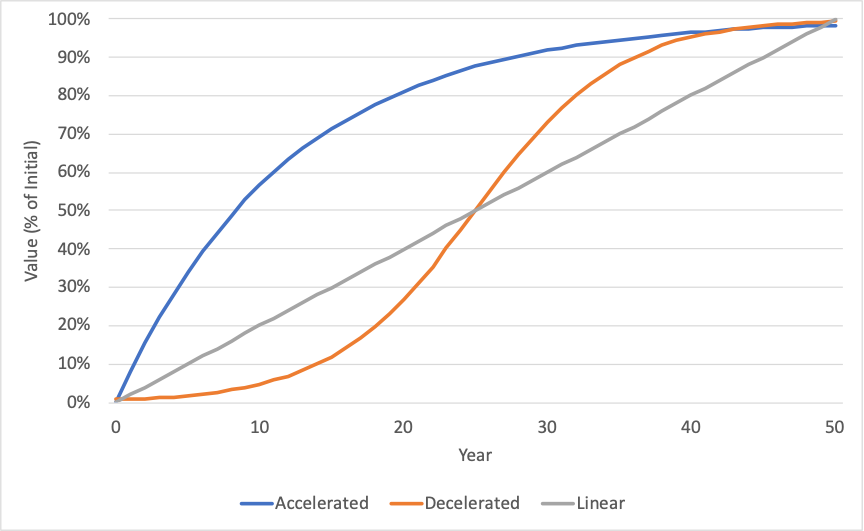

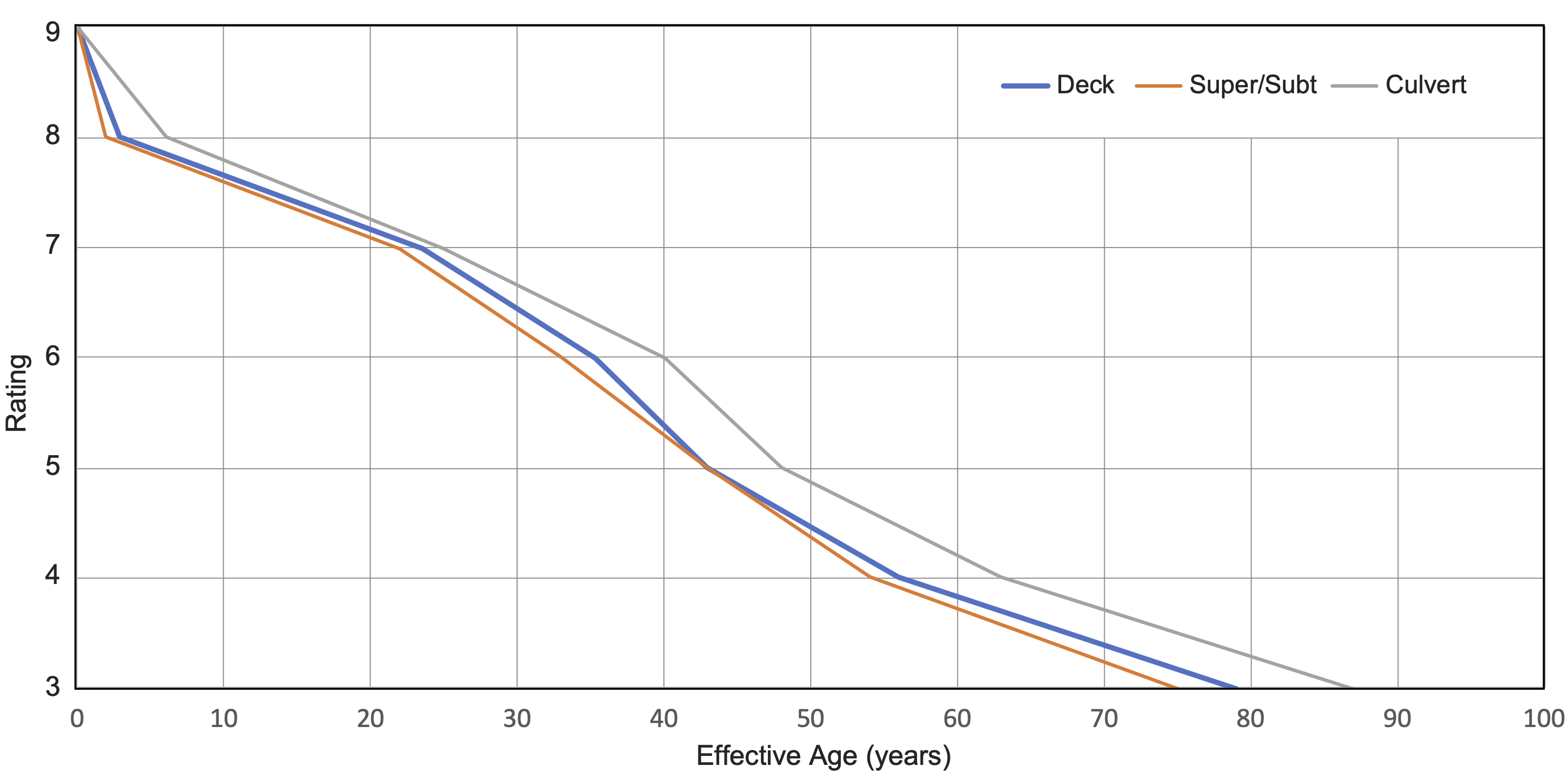

While depreciation tends to increase as an asset ages, the specific relationship between age and depreciation is complex. The most straightforward assumption – and often the best assumption, unless one has the data necessary to define a nonlinear depreciation – is to assume a linear relationship. In a linear relationship, asset value declines at a uniform rate across its lifetime until it reaches a residual or salvage value at the end of its useful life.

Where an asset owner has information on the condition of their assets, they can use this information to establish an effective asset age. An asset may last longer than initially expected because it is deteriorating at a lower rate or because it receives treatments to maintain it. In these cases, the asset may have an effective age much lower than its actual age. Conversely, the effective age of an asset may be greater than its actual age, if it is in poor condition, such as that resulting from accelerated deterioration.

One may need to calculate depreciation in a different manner for certain applications. In particular, a more fine-grained calculation of the pattern of consumption of economic benefits may be needed in some cases, particularly if one is calculating initial value considering the stream of future benefits yielded by an asset based on an economic perspective. Chapter 6 presents additional details on the approaches to calculating depreciation, including guidance and examples.

Calculate Value and Supporting Measures

At this point in the process, all of the decisions about how to determine asset value have been made, and only the calculation remains. Every asset valuation requires calculating the initial value for all assets and components, and typically includes some approach to depreciating that value to obtain a current value. Depending on the specific application, this step may also include calculating:

- The cost to maintain asset value;

- Asset Sustainability Ratio (ASR);

- Asset Consumption Ratio (ACR);

- Asset Funding Ratio (AFR);

- NPV for an asset or group of assets; and/or

- Other measures.

Communicate and Apply the Results

Once asset value has been calculated, the final step is to communicate and apply the results. Various approaches have utilized asset value as a communication tool, with several such examples illustrated in Section 2.1. Also in this step, one may need to interpret the results of an analysis to evaluate the significance of any changes in asset value and the values of supporting performance measures.

It is important to document the approach used for calculating asset value, and the key assumptions made in the calculation process. Depending on the specific application, one may wish to perform a sensitivity analysis to establish the impact of changes in key parameter values on the results of an analysis. A sensitivity analysis is useful for describing the accuracy of the asset valuation calculation and highlighting any variables which have a significant impact on the asset value. While sensitivity analyses are always applicable, they are most beneficial in cases where there are numerous assumptions leading up to the final calculation. Many calculation parameters that are presumed to be invariant and known with uncertainty are, in truth, uncertain and prone to vary in the future.

There are different accounting standards in the U.S. and internationally for valuing assets for the purpose of financial reporting. These standards describe best practices in accounting that agencies should carefully consider when valuing assets to support TAM. However, particularly in the U.S., the approach an agency uses to value assets for TAM often differs from that used for financial reporting. The following subsections provide further detail on U.S. standards and international standards, and the applications of these standards to support TAM.

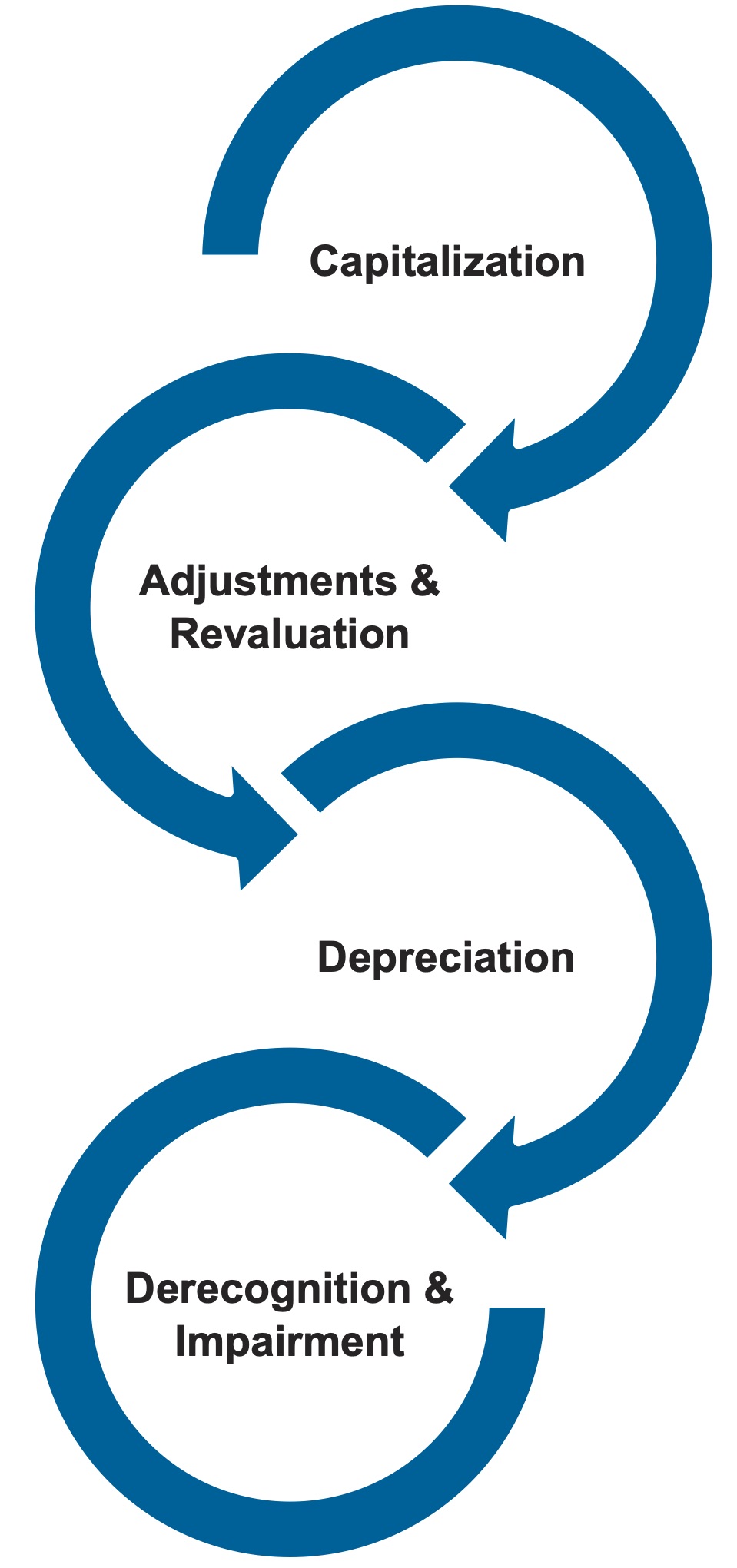

GASB Statement Number 34: Basic Financial Statements – and Management’s Discussion and Analysis – for State and Local Governments published in 1999 (1) describes how U.S. public agencies should prepare their basic financial statements, including the reporting of capital assets. GASB 34 requires agencies to report capital assets by their historic cost, also known as purchase price. This approach is recommended to maintain consistency with the U.S. GAAP.

GASB 34 allows for two different approaches for handling depreciation of capital assets. By default, an asset is depreciated over its estimated useful life. The standard does not specify how depreciation is calculated, only that it should be calculated “…in a systemic and rational manner.” In practice, agencies typically assume an expected useful life by asset class and apply straight-line depreciation.

GASB 34’s alternative approach to account for depreciation is the “modified approach.” In this approach, an asset’s historic cost is reported but no adjustment is made for depreciation. Instead, a separate calculation determines the cost to maintain and preserve the asset at a specific level of service, and this cost is disclosed. The asset is treated as an “ongoing concern”, and the cost of maintaining the asset is considered a part of the cost of operating the transportation system, rather than as an adjustment to the asset value.

The modified approach may be used for infrastructure assets that are part of a network or subsystem of a network. To use the approach an agency must:

- Have an up-to-date asset inventory;

- Perform periodic condition assessments at least every three years and summarize the results;

- Maintain assets “approximately at (or above)” the established condition level based on the three most recent condition assessments; and

- Estimate each year the annual amount to maintain and preserve assets at a specified condition level.

Internationally, the IFRS are the predominant accounting standards. The IFRS Foundation reports that globally 166 jurisdictions and 15 of the 20 G20 countries use its standards (the exceptions are the U.S., Japan, China, India, and Indonesia). As noted in Chapter 1, IFRS standards are not specific to the public sector, and IPSAS standards have been developed for public agency use. However, as a practical matter IPSAS standards typically refer to relevant IFRS standards, so the text here focuses on the relevant IFRS standards.

The IFRS standard IAS 16: Property, Plant and Equipment (2) describes how to calculate costs and depreciation for fixed assets. This standard was developed prior to IFRS Number 13, which is described further below, but it has since been updated to reference it. IAS 16 describes that an organization should recognize an asset at its cost when it is originally acquired. Following the original recognition of the asset, an organization can use one of two models for measuring its value: the cost model or the revaluation model.

The cost model is similar to that described in GASB 34. With this model, the value of an asset is its cost adjusted for depreciation. To calculate depreciation, one must first establish the useful life of the asset considering the expected usage of the asset, expected wear and tear, technical or commercial obsolescence, and legal or other limits on the use of the asset. One must also establish the residual value of the asset once it reaches the end of its useful life and the depreciation method for adjusting its value over time. The standard explains that different depreciation methods may be used and that the selected method should be that which “…most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset.”

The revaluation model may be used as an alternative to the cost model. In this model, the asset is periodically revalued to determine its fair value. Between revaluations, the cost model is used to adjust the valuation. The standards note that revaluation should be made with sufficient regularity to ensure there is no material difference between the calculated cost and the asset’s fair value.

IFRS Number 13: Fair Value Measurement (3) defines fair value. It recommends using the price of an asset for financial reporting, where this can be determined, and it provides guidance on estimating the price where it cannot. The standard also describes a hierarchy used to categorize fair value estimates based on what type of data are used. Ideally, the fair value is established using Level 1 inputs, the asset’s (or an identical asset’s) quoted price in an active market. When Level 1 inputs are unavailable, Level 2 inputs should be used. These include market prices of similar assets or prices from inactive markets and observable data, such as interest rates. Level 3 inputs, “unobservable inputs for the asset or liability”, are relied on when there is no discernable market, and they are accorded to the lowest priority.

IFRS Number 16: Leases (15) includes additional information relevant to fair value calculations for certain situations. In this standard, fair value is defined in the context of a lessor’s account requirements as “the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.”

It is important to note that while international standards allow for use of either historic costs or fair value for valuing assets, the general trend of public agencies in Europe and Australia has been to value assets based on their depreciated replacement cost (DRC), consistent with the fair value approach. This trend is exemplified by recent U.K. and Australian asset valuation guidance for public agencies (12, 16).

The standards described above are applicable to asset valuation for financial reporting. U.S. agencies must follow GASB 34 for financial reporting, but they are under no obligation to use the GASB 34 asset values for other purposes. Furthermore, they are under no obligation to comply with international accounting standards for any purpose. Nonetheless, the U.S. and international standards are important for defining key concepts and establishing best practices. The different accounting standards have been adapted for use in the context of calculating asset value to support TAM with the following considerations:

- While it is not required, some agencies may prefer to maintain consistency between estimates of asset value prepared for financial report based on GASB 34 and for supporting TAM. The guidance describes an approach for maintaining this consistency where desired.

- Agencies using the GASB 34 modified approach have already made a strong linkage between financial reporting and TAM. This approach requires that an agency uses its asset management systems to calculate the cost to maintain its assets. Given that assets are treated as an “ongoing concern” in this approach, they are not depreciated. Ideally, agencies using this approach should utilize the same cost to maintain assets for TAM and for financial reporting. This helps ensure consistency between the financial asset register and technical asset register (e.g., asset values as captured in an Enterprise Asset Management software system).

- While it is not binding for U.S. agencies, IFRS 13 describes best practices for calculating fair value of an asset. The IFRS concepts, terms and guidance are applicable to U.S. agencies calculating asset value using a cost or market perspective.

Other IFRS and IPSAS standards, as well as the standards and guidance of international agencies based on these, help define concepts, terms, and best practices for aspects of the asset valuation calculation process, such as in establishing useful life, calculating residual value, selecting a depreciation method, and deciding how to componentize assets. These concepts are highly applicable to U.S. agencies calculating asset value for TAM.

Information on asset value and how it is changing may support a number of different applications related to both TAM and financial reporting. When establishing the approach to calculating asset value, it is important to consider which applications the calculation is intended to support. This will then guide subsequent decisions concerning how specifically to calculate asset value.

Section 2.1 discusses a range of different applications of asset value for supporting TAM, and provides examples of approaches for using and communicating asset value. Many of the applications of asset value described in this section are complementary to one another. However, some of the applications require a greater level of detail in the calculation, while others may lead to selecting specific options regarding the nuances of the calculation. For the purpose of this step the different applications can be grouped into the following for the purpose of establishing the primary motivation or driver for calculating asset value:

- Maintaining consistency with financial reporting. In this case, an agency wishes to obtain a calculation of current asset value that is consistent with the agency’s calculation of asset value prepared for its financial reports based on GASB 34 and using historic costs.

- Reporting asset value for TAM. Here the primary motivation for calculating asset value is to report value in a TAMP and/or other documents to be read by the agency’s citizens and oversight groups. In addition to calculating current value, one also typically calculates required maintenance costs, and may calculate other measures. In this case, it is not necessary to maintain consistency with the asset value reported in agency financial reports prepared based on GASB 34, though some agencies may choose to do so.

- Evaluating treatment decisions. In this case the asset value calculation is intended to help evaluate what treatments to perform for an asset, such as when defining an agency’s life cycle policies. For this application, it may be necessary to perform the asset value calculations at a greater level of detail, but once performed the calculations can be used in a TAMP or in support of other applications.

- Determining the benefits to transportation users and society. For certain applications it is necessary to determine the benefits of an asset to users and/or society as a whole – e.g., if determining what assets should have highest priority for resilience investments, or whether an asset merits public investment.

Table 3-1 summarizes these drivers and the implications of each for subsequent decisions regarding how to calculate asset value. For each asset value driver the table lists the value perspective that best supports it. Also, it summarizes the implication of selecting the driver for calculation of asset value, calculation of depreciation and treatment selection.

Table 3-1. Implications of Different Asset Value Drivers on the Calculation Process

| Asset Value Driver | Initial Asset Value (Chapter 4) | Treatment Effects (Chapter 5) | Depreciation (Chapter 6) | Measure Calculation (Chapter 7) |

|---|---|---|---|---|

| Maintaining Financial Reporting Consistency | Calculate value based on historic cost. | Establish cost, useful life and treatment history for construction, reconstruction and replacement. | Depreciate value linearly based on asset age. | Asset Value Asset Consumption Ratio |

| Reporting Asset Value for TAM | Calculate value based on replacement cost or market value. | Establish cost and useful life for construction, reconstruction and replacement. Avoid analysis of historic treatments by using condition data where available. | Depreciate value based on effective age determined using condition data. Use linear depreciation unless a non-linear depreciation pattern has been established. | Asset Value Cost to Maintain Value Asset Consumption Ratio Asset Sustainability Ratio Asset Funding Ratio |

| Evaluating Treatment Decisions | Calculate value based on replacement cost | Establish cost, useful life and treatment effects for all treatments being compared. Avoid analysis of historic treatments by using condition data where available. | Depreciate value based on effective age determined using condition data. Evaluate the benefit consumption pattern in determining how to depreciate. | Asset Value Cost to Maintain Value Net Present Value Asset Consumption Ratio |

| Determining Benefits to Users and Society | Calculate value using an economic perspective. | Establish cost and useful life for construction, reconstruction and replacement. | Calculate costs and benefits expected over the life of the asset in lieu of depreciation. | Net Present Value Benefit/Cost Ratio |

As detailed in the table, it is important to maintain consistency with financial reporting then it is important to adopt a cost perspective and base asset value calculations on historic costs. On the other hand, if one seeks to quantify the benefits of an asset to transportation users and society, then one should adopt the economic perspective.

With the other drivers listed in the table one may adopt a cost or market perspective, and may use different approaches for different asset classes. These two drivers differ from each other in the level of detail they imply. More detail is needed to support making treatment decisions than to calculate an overall value without comparing specific treatment decisions. Thus, in cases where treatment decisions are being evaluated a greater level of detail may be required, specifically with regard to calculating depreciation and treatment effects.

Calculating asset value requires data on the asset inventory, on asset age or condition, and on asset treatments. The availability of asset data, or lack of it, may impact what approach an agency uses for calculating asset value. Also, it may impact what assets are included in the calculation and the level of detail at which calculations are performed.

Collecting and maintaining quality asset data can be a significant investment in and of itself. If needed data are unavailable, an agency may be able to expend additional resources to collect additional data and/or improve data quality. Thus, questions about data availability can become questions about resources: are the resources available to collect the desired data? This section discusses what data are needed for calculating asset value and approaches for assessing asset data.

Table 3-2 summarizes data needs for calculating asset value. This information may be available from a range of agency management systems and data repositories. As indicated in the table, certain types of data are required regardless of the approach one uses. Other data may be needed depending on the specific approach. This point at this step is to determine what data are actually available to help support decisions about the scope of the calculation. Key considerations include:

- Inventory data are critical for the calculation, but the level of detail required in the asset inventory depends upon the specific application. Having a comprehensive inventory of all assets is ideal, but often neither achievable nor necessary for the purpose of calculating asset value. Often it is feasible to use summary data on an asset inventory to calculate asset value – e.g., the distribution of assets by age or condition for a given asset class or subclass. Also, assets are frequently included implicitly as part of another asset rather than being inventoried explicitly.

- Some form of data is needed regarding the current condition of the asset inventory using either asset age, condition, or a mix of the two. This is used to depreciate asset value. Chapter 6 discusses issues regarding calculation of depreciation. Often the availability of this data is a limiting factor in calculating value.

- The availability of treatment data is critical for establishing what treatments are considered in the calculation. This topic is discussed further in Chapter 5. For any treatment that is included it is imperative to have a unit cost. If historic costs are used as the basis for the calculation, then ideally one would have historic costs as well, but historic costs can be approximated given unit treatment costs and information on asset age.

- Various other parameters may be required for the asset value calculation, particularly if calculating market or economic value. These approaches are discussed further in Chapter 4.

Table 3-2. Data Needs for Asset Value Calculation

| Inventory Data | |

| Always Needed Asset quantity by:

| May Be Needed

|

Challenges

|

|

| Condition Data | |

Always Needed

| May Be Needed

|

| Treatment Data | |

Always Needed

| May Be Needed Historic data on treatments performed by:

|

Challenges

|

|

| Other Data and Parameters | |

Always Needed

| May Be Neeeded

|

Challenges

|

|

In assessing what data are available, one should also consider the quality and completeness of the data, noting any significant concerns. Common issues in this regard include, but are not limited to:

- Data may be available for a given subset of the inventory (e.g., for a given asset class and/or district), but may not be available consistently across the agency. For many asset classes data on a statistical sample of the assets are acceptable.

- Inventory and/or condition data may be available for a given point in time, but may not be consistently maintained.

- There may be limited data on what treatments have been performed on a given asset since it was first constructed. This can be an issue if one is relying on asset age rather than condition to establish depreciation, particularly if one also seeks to include other treatments besides asset construction/reconstruction in the approach.

- There may be other changes over time that changes in data over time that may difficult to track and that further complicate use of historic data. This may include changes in the network (e.g., which highways are included in the NHS), changes in asset ownership, and/or changes in data collection approaches.

- Information on current and predicted future asset use needed for calculating economic value may be unavailable or difficult to obtain.

The process of assessing the data available for calculating asset value may be performed as part of a broader assessment of an agency’s asset data resources and needs. NCHRP Report 956: Guidebook for Data and Information Systems for Transportation Asset Management presents an approach for assessing an organization’s current data and information management practices in support of TAM, as well as strategies for improving these practices (17). An agency can apply the guidebook comprehensively to all of the organization’s TAM activities or use it to focus on particular components, such as components related to calculating asset value.

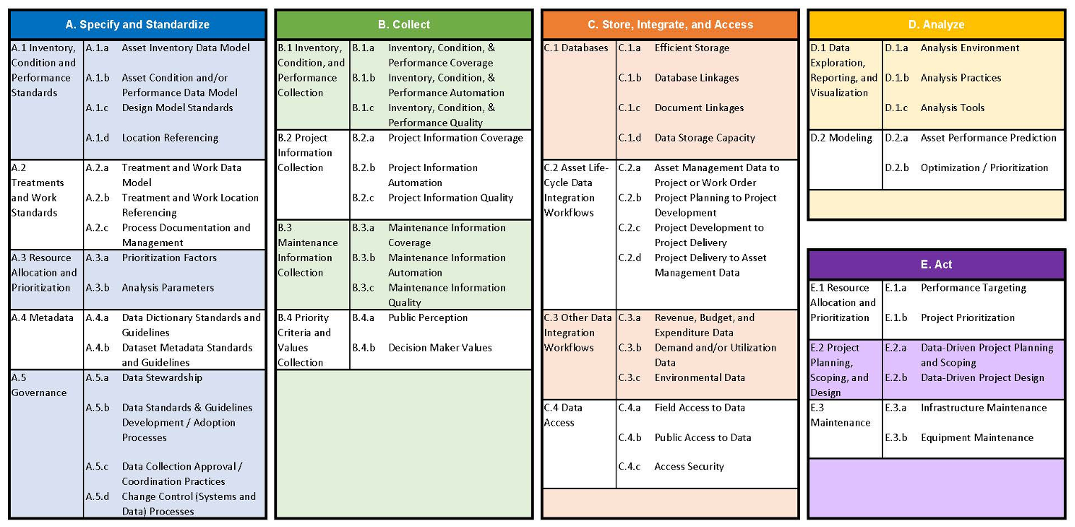

Figure 3-1 reproduces the “Data Life-Cycle Framework” from NCHRP Report 956. This shows the different elements of an organization’s asset data included as part of an assessment. The framework organizes the assessment items into five categories. Of these, two are most relevant for assessment of data for asset valuation: A. Specify and Standardize; and B. Collect.

NCHRP Report 956 is accompanied by a web tool, the TAM Data Assistant, to support the assessment of TAM data needs. Together the guidebook and the tool offer an organized process for evaluating and improving an agency’s data systems. This web tool is hosted by AASHTO and available for public agency use.

The screenshots below show the primary two steps in the tool’s process. First, users assess their data system using benchmarks provided for each of the five areas outlined in Figure 3-1. Then, in the screen on the right, they evaluate their selected improvements to prepare an implementation plan.

In addition to guidance for the TAM Data Assistant, the report provides case studies demonstrating the importance and impact of data improvements across state DOTs and resources for those facilitating the assessment. For more information about the tool and the NCHRP Report, visit www.tamdataguide.com.

Source: NCHRP Report 956 (17)

After establishing the motivation for calculating asset value and reviewing available data, the next step is to identify which assets will be included in the valuation calculation through establishing an asset hierarchy. An asset hierarchy is a framework for organizing a set of assets. It specifies asset classes and sub-classes, as well as any parent-child relationships between different types of assets.

Note that an organization may already have established an asset hierarchy that can be used to support this step. Alternatively, one may establish a hierarchy specifically for the purpose of calculating asset value. In any case, it is important to note that the set of assets included in the asset value calculation may be different from that defined for other purposes. Thus, if one is referencing an existing hierarchy, it will be necessary to further note which assets are included explicitly in the asset value calculation, which are included implicitly as part of some other asset, and which are excluded.

Assets exist within a network, and they rely upon the collective maintenance of the network to function properly. If some assets in these networks are not explicitly valued, their impact should be accounted for implicitly within the valuation. Also, at this point practitioners should establish whether the asset value calculation is focused on specific systems or subsets of assets. Asset subsets comprise its inclusion within a system (e.g., on the NHS or Interstate), ownership of the asset (federal, state, or local), and the asset’s geography.

A final consideration for the asset hierarchy is ensuring that assets excluded from the analysis are not neglected in maintenance or other investments. By analyzing assets within a network or along a corridor, one can weigh all aspects of maintenance for all levels of assets, from geotechnical structures to the pavement markings.

The following subsections describes common classes of transportation assets and considerations in calculating asset value for each.

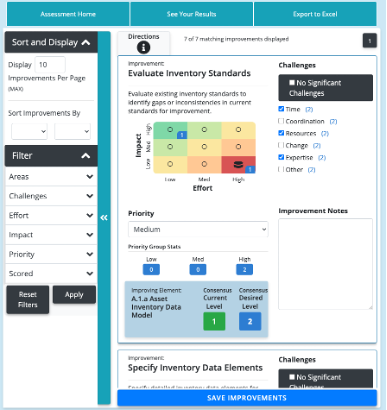

Minnesota DOT (MnDOT) includes calculates value for pavement and bridge assets in its 2019 TAMP, as well as for culverts, tunnels, signs, light towers, noise walls, signals & lighting, pedestrian infrastructure, buildings and ITS. The table displays MnDOT’s full asset hierarchy.

Source: Minnesota DOT (29)

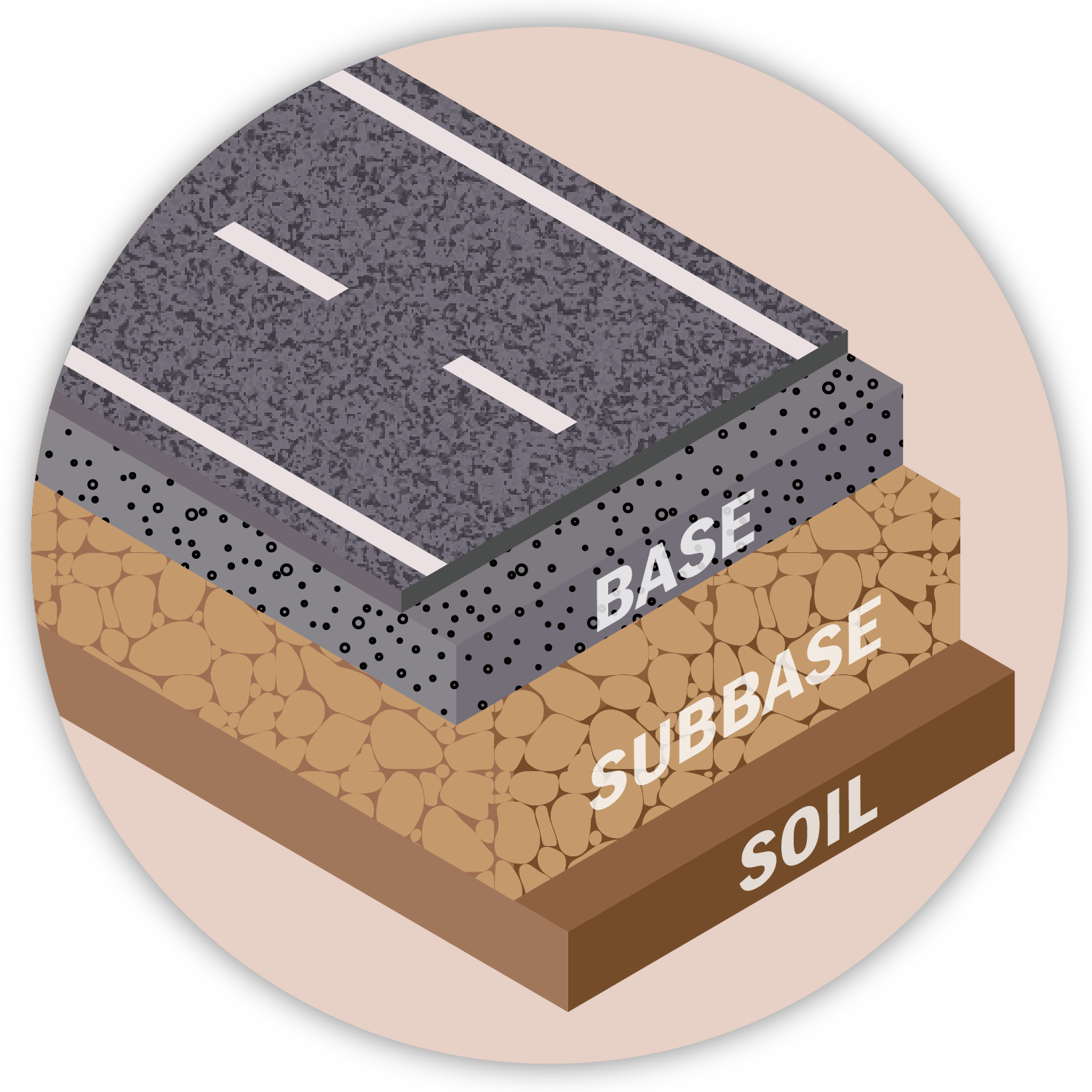

This asset includes the wearing surface of roads, runways, sidewalks and other paved surfaces, as well as the other layers supporting the wearing surface. For highway agencies pavement is typically the asset with the greatest overall value; it is the asset a highway department has the most of. State DOTs are required to estimate the value of their NHS pavement in their TAMPs.

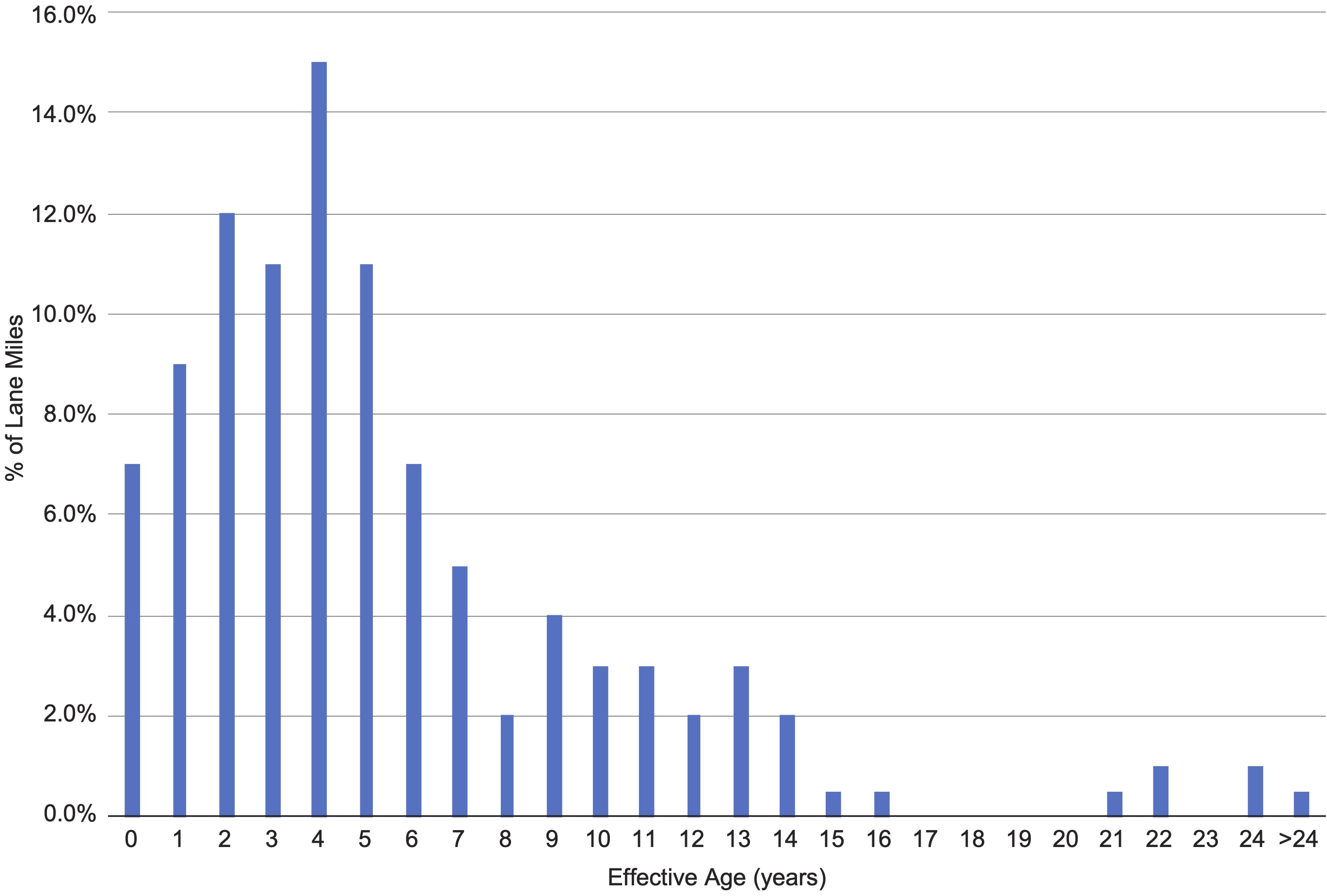

State DOTs are required to maintain an inventory of their roadway pavement through the Highway Performance Monitoring System (HPMS), and to collect condition data for different pavement distresses for pavement on the NHS. A challenge in managing pavement data is that pavement is a linear asset, and can be sectioned in different ways. For instance, condition data may be collected and reported for 1/10-mile sections, while longer management sections are used for predicting future conditions and developing projects.

Frequently, asset value calculations include a number of additional assets as part of the valuation of pavement, to the extent these additional assets may be replaced or reconstructed as part of a project to replace or rehabilitate the pavement. This may include shoulders, curbs, pavement markers/markings, signs, and drainage assets. Also, sidewalks and bike paths, though paved, are often treated as separate assets from roadway pavement.

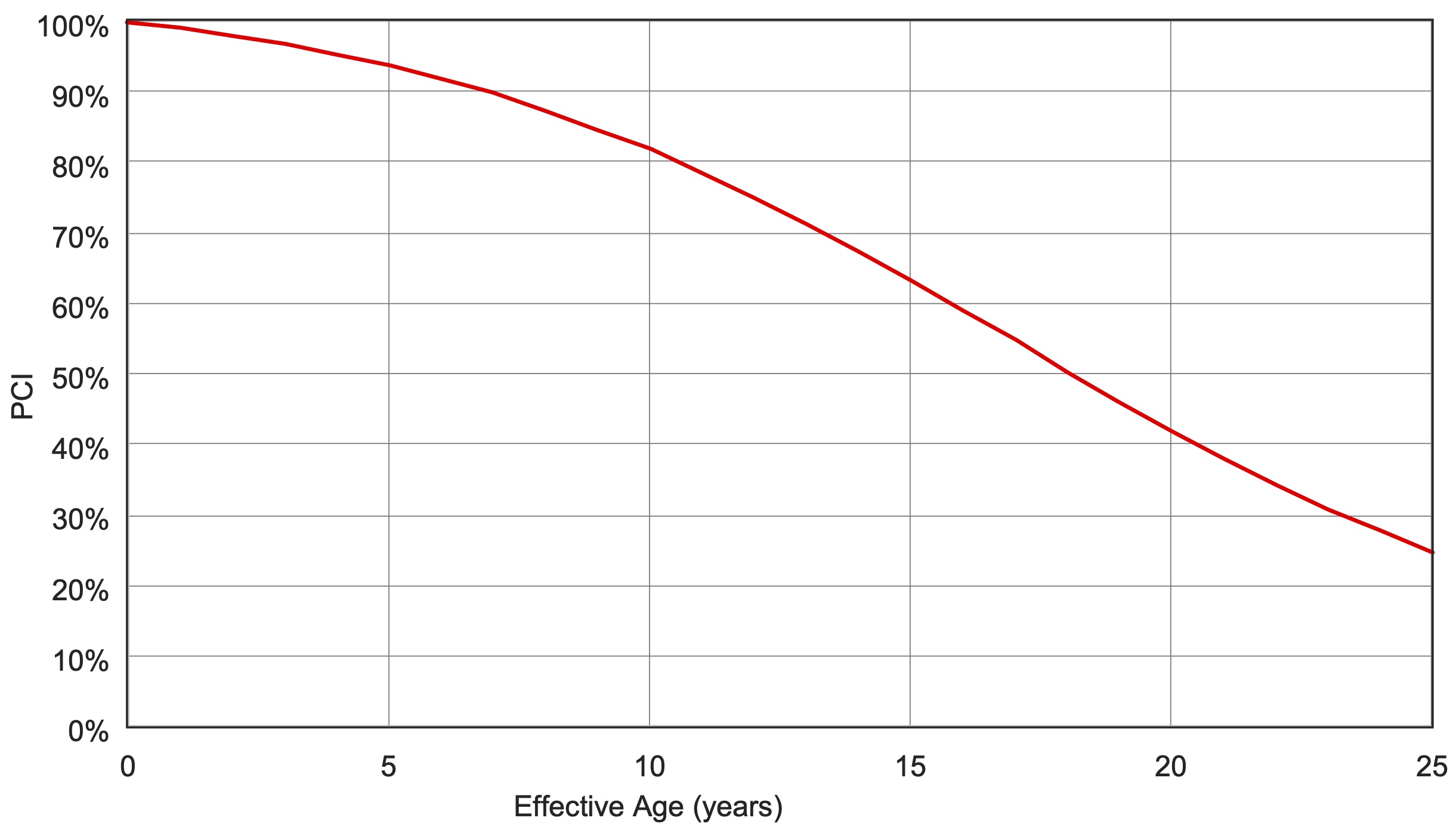

Pavement life varies by material type (e.g., asphalt, concrete, hybrid, etc.), operating environment, how the pavement is maintained, how the end-of-life is defined, and what specific assets are included as part of the pavement asset. Typically, the wearing surface of a road is assumed to last approximately 20 years, while the “full-depth life” which includes multiple rehabilitation treatments of the wearing surface, is assumed to be approximately 50 years (18).

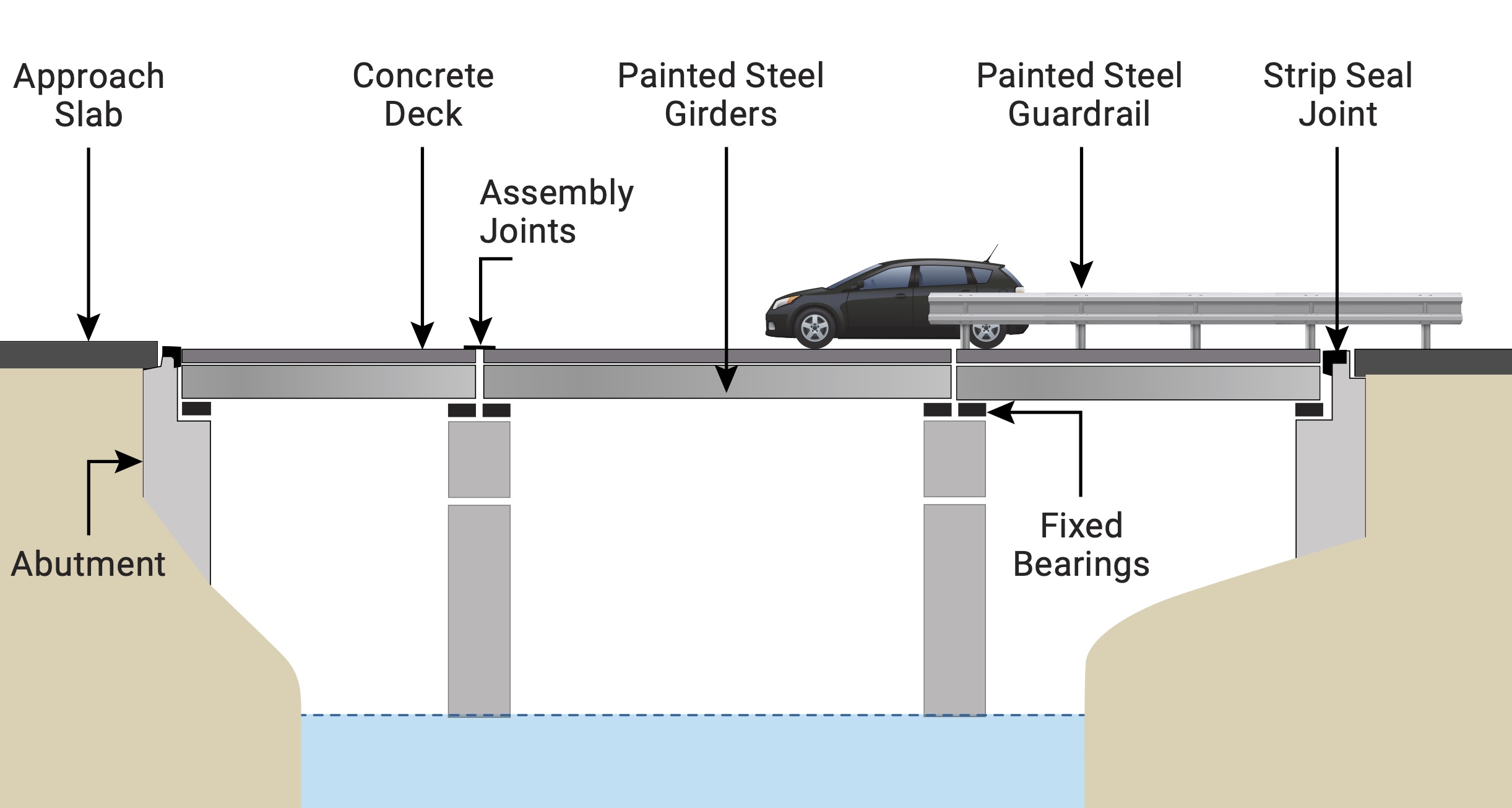

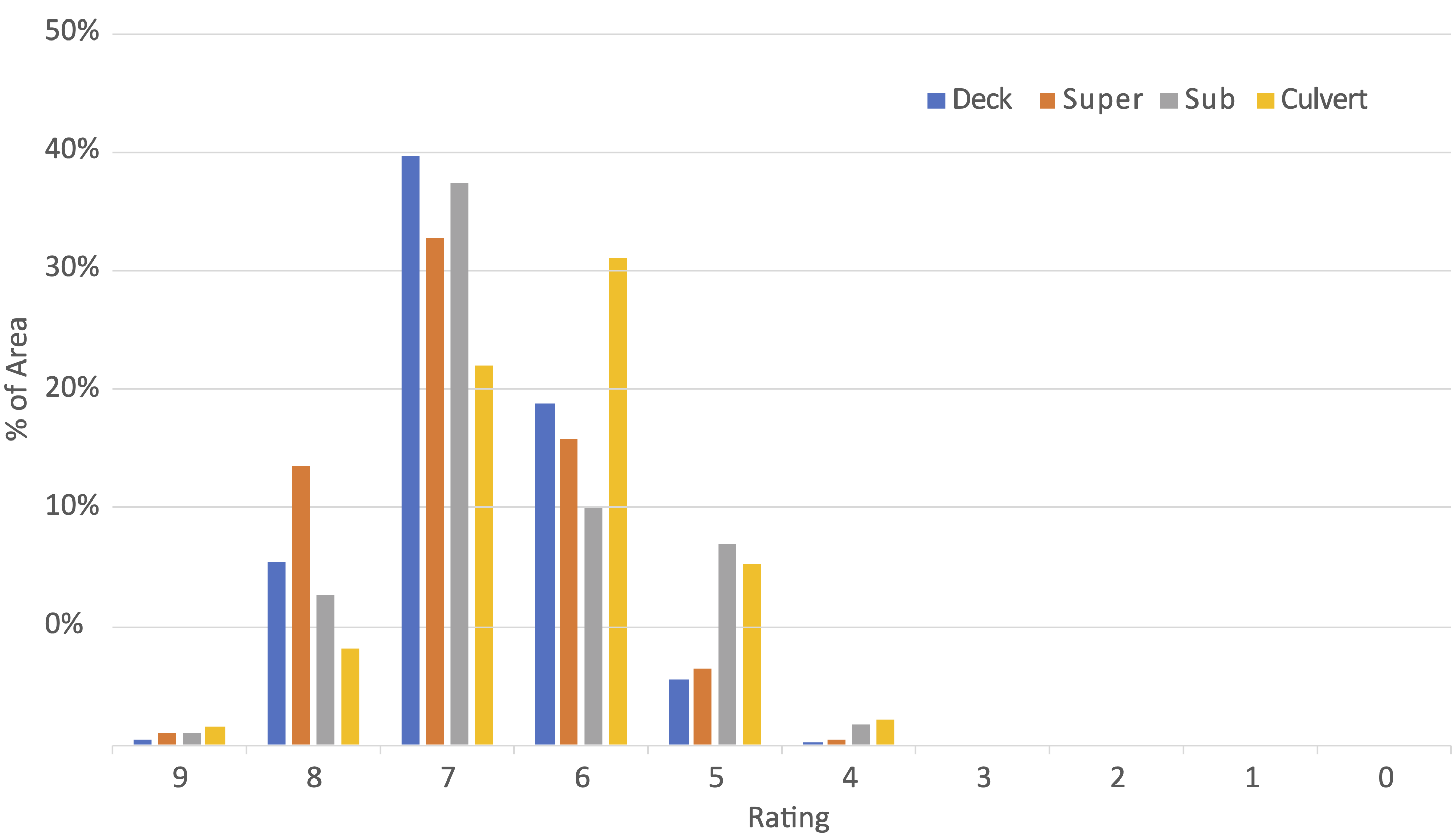

This asset class includes constructed works that allow a road to span a physical obstacle, such as a river or other road. For a highway agency structures are typically the asset class with the second greatest value following pavements.

Here this asset class is defined to include bridges and tunnels, and culverts. In practice the terms “structures” and “bridges” are often used interchangeably. In the U.S. bridges, tunnels and larger culverts are all included in the National Bridge Inventory (NBI) and State DOTs are required to estimate the value of their NHS structures in their TAMPs.

State DOTs are required to maintain an inventory of all bridges on public roads in their state. Also, State DOTs are to report condition data for the bridges in the state, collected through periodic visual inspections.

Structures are long-lived assets. As a practical matter, a structure can remain functional for 100 years or more if it is appropriately maintained. However, structures are often replaced when replacement is the most cost-effective alternative for addressing deterioration, or if the structure has functional issues that render it obsolete (e.g., designed for smaller loads or traffic levels than current standards). Based on review of the 2019 State DOT TAMPs, DOTs typically assume a design life of 75 years for their structures for the purpose of calculating asset value.

This class includes a number of different assets that either enhance mobility and/or improve safety. This includes, but is not limited to:

- Signs and their supporting structures

- Traffic signals

- Lighting

- Guardrail, median barriers, cable barriers and other impact attenuators

- Pavement markings and markers

- Intelligent Transportation Systems (ITS) devices such as cameras, other sensors and detectors, and variable message signs

- Tolling systems

- Grade crossings

Practices regarding management of traffic and safety assets vary widely between specific asset types and agencies. NCHRP Synthesis 371 provides a summary of current practices and typical asset lives for several common types of assets (19). Service lives for traffic and safety assets range from one to two years for certain types of pavement markings to 20 years or more for guardrails and median barriers.

Generally, agencies lack data on asset condition for many traffic and safety assets, as collecting condition data can be impractical and condition is often a poor predictor of when the asset needs to be replaced. Furthermore, many agencies have limited or incomplete inventory data on these assets, which is the starting block for collecting condition data. In many cases, traffic and safety assets are replaced due to functional obsolescence rather than as a result of their physical deterioration. As noted above, these assets are frequently replaced as part of a larger effort to rehabilitate a section of pavement or a corridor, and thus, they are often valued as part of the pavement asset class.

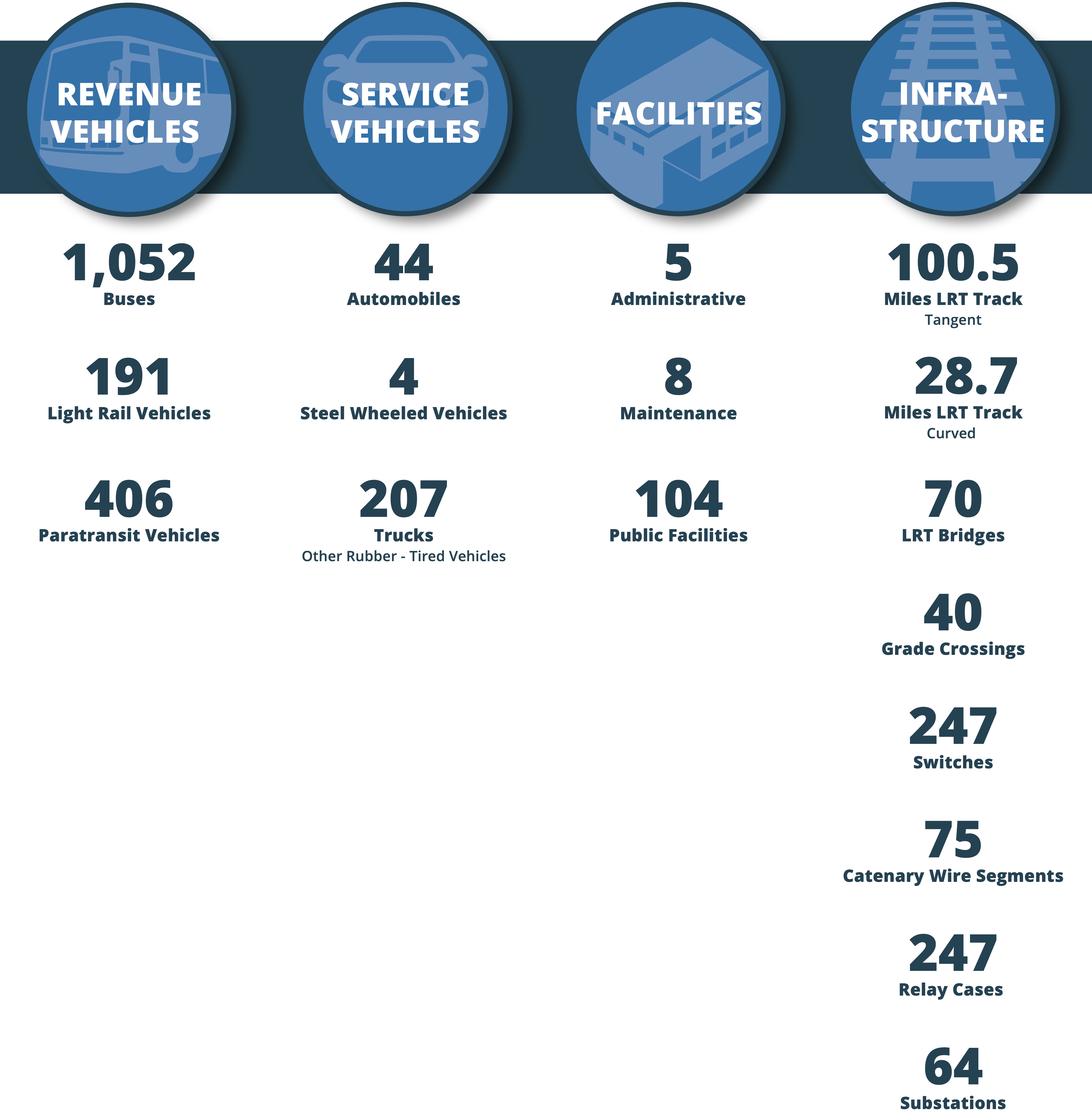

Vehicle assets include revenue and maintenance vehicles, such as buses, paratransit vehicles, ferries, train cars, tow trucks, plows, and various other types of service vehicles. For State DOTs vehicles are often a small portion of an agency’s inventory. On the other hand, for transit agencies revenue vehicles typically represent the largest single asset class an agency owns based on asset value.

The Federal Transit Administration (FTA) has published assumed useful lives, termed “useful life benchmarks,” for a range of vehicle types (20). Default values are 8 years for four-tired vehicles such as automobiles and vans, 14 years for buses, 31 years for light and heavy rail vehicles, and 39 years for commuter rail coaches and locomotives.

Agencies track inventory data on their vehicles, but approaches vary regarding tracking condition data. Often age or vehicle mileage is used as a proxy for asset condition. Transit agencies report data by vehicle subfleet for revenue and service vehicles to the National Transit Database (NTD).

A notable feature of vehicles is that relative to fixed assets they are more easily transferred from one owner to another. Thus, it is often feasible to establish a market value for vehicles using information on the sale or auction of used vehicles.

For transit systems that operate light rail, heavy rail or commuter rail, fixed guideway is a significant asset class. This includes track, communications and signals, and electrification systems. For the purpose of reporting to the NTD, transit agencies group other fixed assets besides facilities into the category of “Infrastructure.” In the NTD this category also includes structures and guideway for bus rapid transit systems that are addressed above in structures and pavement.

It is difficult to generalize management approaches and asset lives as these vary significantly between different asset subclasses and agencies. Generally fixed guideway assets tend to be long-lived. Track requires periodic rehabilitation but can be maintained indefinitely. Communications, signals, and electrification assets have varying lives which are often dictated by consideration of functional obsolescence rather than physical condition. Transit agencies report data on their inventory and its age to the NTD. FTA describes different guideway assets and management approaches in its Transit Asset Management Guide (21).

Transportation agencies own and operate a number of facilities. Typical facilities for highway agencies are discussed in (22) and include:

- Administrative facilities

- Maintenance depots;

- Rest areas;

- Toll plazas;

- Weight stations; and

- Communications facilities.

Transit facilities are classified in the NTD as either: administrative/maintenance facilities such as office buildings, bus garages or rail yards; or passenger facilities such as stations and parking garages. Airport facilities include many of these same types, as well as aircraft hangars, terminals, fueling facilities and baggage handling facilities. Many facilities include major pieces of equipment (e.g., vehicle lifts) that may be inventoried separately or considered as part of the facility.

Like structures, facilities are typically complex, with many different components, and have a seemingly indefinite lifespan. Overall facilities lives are estimated as 50 to 100 years in models such as FTA’s Transit Economic Requirements Model (TERM) Lite (23). Similar to vehicles, in some cases facilities may be transferable to other owners, simplifying the calculation of a market value for a facility.

Transportation agencies manage various other assets not addressed in the classes discussed above, including:

- Drainage: this encompasses pipes, gutters, drains, retention/detention ponds, and others. Management of drainage assets is complicated by the fact that many are underground and difficult to inventory. Also, in many cases it may be difficult to establish maintenance responsibility for drainage assets.

- Geotechnical: NCHRP identifies four basic subclasses of constructed geotechnical assets (24). These are slopes, embankments, subgrade, and retaining walls. Agencies may also identify geohazard locations (e.g., potential rockfall locations) in an asset inventory. As in the case of drainage assets, it can be a challenge to establish an inventory of geotechnical assets. Typically, these assets are long-lived, with asset lives similar to structures.

- Bicycle and Pedestrian Assets: bike lanes, sidewalks, curb ramps, and other related features. These assets promote multimodal accessibility, and in some cases (e.g., curb ramps) may be needed to comply with the legal requirements such as the Americans with Disabilities Act (ADA). Typically these assets have lives similar to traffic and safety assets described above.