In this case study, a state department of transportation in the Southwest, labeled the “Southwestern DOT”, calculated asset value for its pavements using two depreciation approaches to determine remaining (current) value. By comparing the results from the condition-based and age-based depreciation approaches, the Southwestern DOT was able to analyze the differences and identify the desired calculation approach for the DOT’s needs.

Background

The Southwestern DOT’s primary driver for calculating and reporting asset value is to comply with the Federal Highway Administration’s (FHWA) requirement that State DOTs include a calculation of the value of National Highway System (NHS) pavement and bridge assets in their transportation asset management plans (TAMPs), and that they calculate the cost of maintaining asset value (23 CFR § 515.7(d)(4)).

In the Southwestern DOT’s previous TAMPs, asset value was calculated using a replacement cost approach that did not consider age or condition of the assets, and thus did not reflect depreciation of the assets. Also, the calculation did not yield a meaningful estimate of the cost to maintain asset value, since the cost to maintain replacement value was $0. The Southwestern DOT decided to improve its calculation methodology by developing and testing two depreciation approaches for calculating remaining asset value and the cost to maintain asset value.

Methodology

Data

Data

The Southwestern DOT used a state performance measure (PCR) based on pavement distress data to measure condition and manage its pavements, collected for each management section on the network. The agency also had age data for each management section of pavement. Pavement asset value was calculated for the pavement as a whole, rather than breaking down a pavement into components.

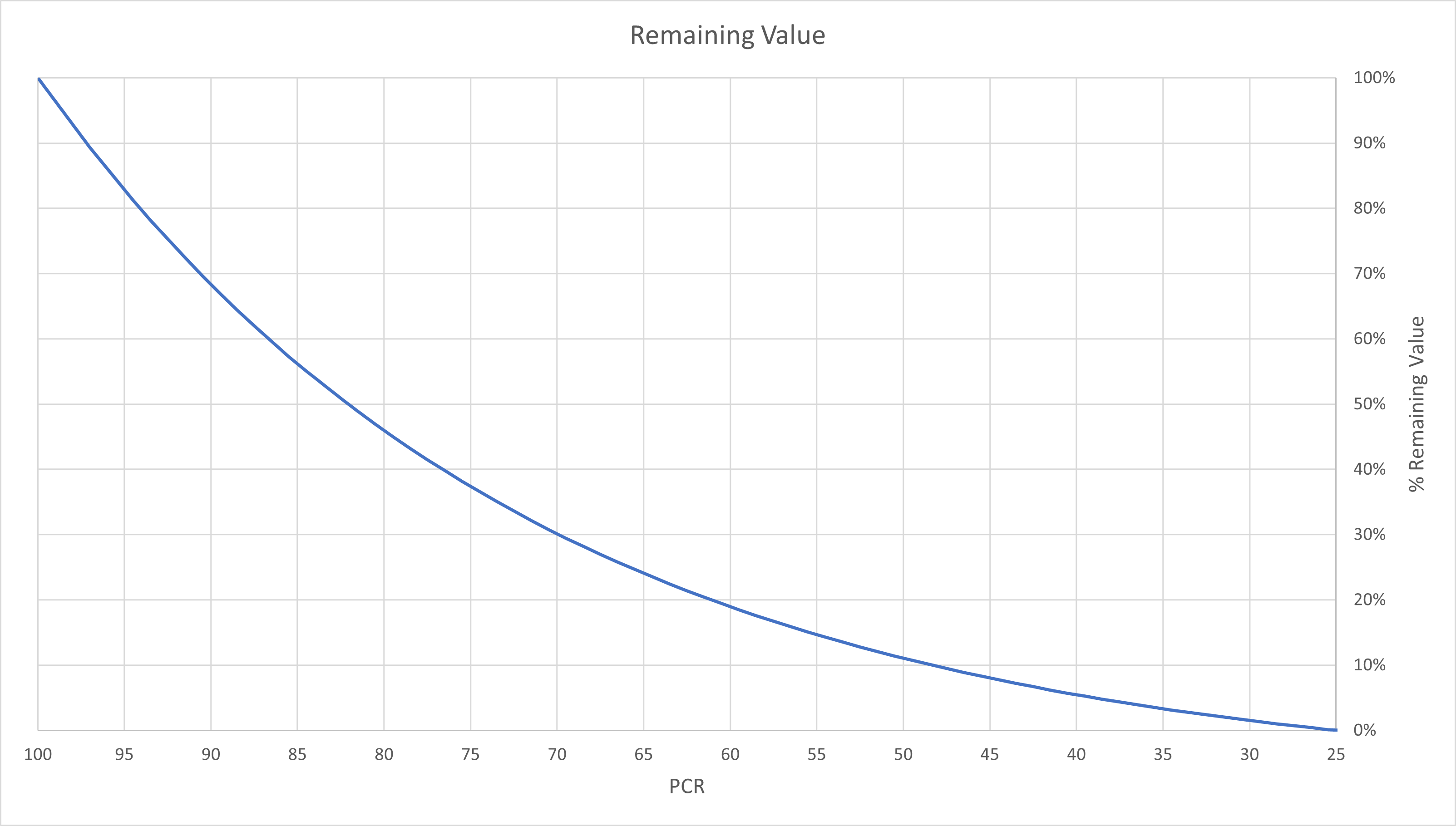

Condition-Based Approach

Asset value was assumed to depreciate linearly with respect to age, but given that PCR condition ratings decline in a non-linear manner, the overall relationship between condition and percent value remaining was non-linear as well. The Southwestern DOT used data from its pavement management system to establish a relationship between PCR and percent of life remaining, shown in the curve displayed in Figure 9-8 below. The end of life based on condition was defined as a PCR value of 25.

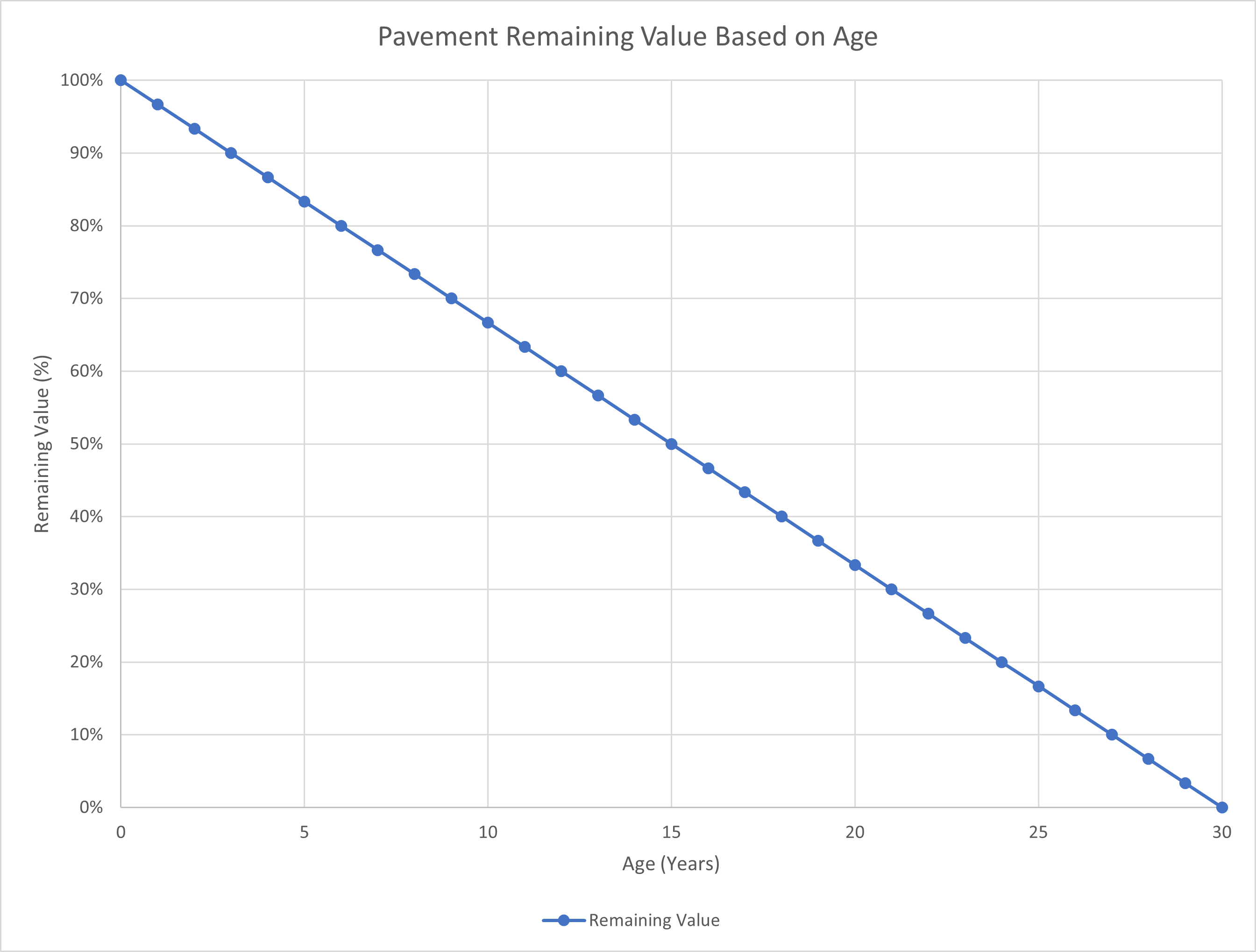

Age-Based Approach

The age-based approach assumed linear depreciation by year, where the end of life for a pavement was defined as 30 years. Figure 9-9 shows the curve representing the relationship between age and percent of value remaining for a given pavement section.

The Southwestern DOT used the curves to calculate remaining pavement value based on condition and age. In addition, the agency calculated a cost to maintain value and asset consumption ratio (ACR) for each approach. The calculations were performed in a spreadsheet tool where the agency could adjust parameters (e.g. cost, end of life criteria) to see the impacts on the results.

Results

Table 9-10 details the calculation of asset value for the Southwestern DOT’s pavements. The table shows replacement value and remaining asset value based on two approaches for calculating depreciation: using the PCR rating; and using pavement age irrespective of condition. The results are summarized by whether or not the pavement is located on the National Highway System (On NHS, Off NHS).

Table 9-10. Asset Value Results

| NHS | Replacement Value ($M) | Remaining Asset Value by Method ($M) | ACR by Method | Cost to Maintain by Method ($M) | |||

|---|---|---|---|---|---|---|---|

| Condition | Age-Based | Condition | Age-Based | Condition | Age-Based | ||

| On | 21,605 | 6,300 | 6,264 | 29.2% | 29.0% | 254 | 720 |

| Off | 36,369 | 6,814 | 6,532 | 18.7% | 18.0% | 427 | 1,212 |

| Total | 57,974 | 13,114 | 12,797 | 22.6% | 22.1% | 681 | 1,932 |

Lessons Learned

Lessons learned from the Southwestern DOT’s experience in comparing condition and age-based depreciation approaches for pavement asset valuation include:

- Using condition and age-based depreciation approaches for pavement can yield different remaining asset value results. An agency should carefully consider which approach is most appropriate to meet its needs.

- The basic differences between the approaches are easily understood. The age-based approach typically yields a lower remaining asset value. This approach does not account for work performed on pavements to extend their life; if a pavement is near the end of its life, it has a relatively low value, regardless of its condition.

- In addition, the Southwestern DOT’s cost to maintain value was lower for the condition approach than for the age approach. The lower cost for the condition approach compared to the age approach is to be expected, given that the condition approach modeled an effective end of life at 81 years, while the age approach assumed an end of life at 30 years.

- Setting key parameters has a big impact on the results. Parameters should be set to reflect current management practices and adjusted as needed.

- For example, changing the pavement end of life for the Southwestern DOT from 30 years to 40 years would double the remaining value from $12.8 billion to $24 billion.

ACKNOWLEDGEMENT OF SPONSORSHIP

This work was sponsored by the American Association of State Highway and Transportation Officials, in cooperation with the Federal Highway Administration, and was conducted in the National Cooperative Highway Research Program (NCHRP), which is administered by the Transportation Research Board of the National Academies of Sciences, Engineering, and Medicine.

DISCLAIMER

This is an uncorrected draft as submitted by the research team.

This material is based upon work supported by the FHWA under Agreement No. 693JJ32350025. Any opinions, findings, and conclusions or recommendations expressed or implied in this document are those of the researchers who performed the research and are not necessarily those of the Transportation Research Board; the National Academies of Sciences, Engineering, and Medicine; the FHWA; or the program sponsors.

No warranty is made by the developers or their employer as to the accuracy, completeness, or reliability of this software and its associated equations and documentation. No responsibility is assumed by the developers for incorrect results or damages resulting from the use of this software.

COPYRIGHT

This material and the copyrights therein are owned by the National Academies of Sciences, Engineering, and Medicine.