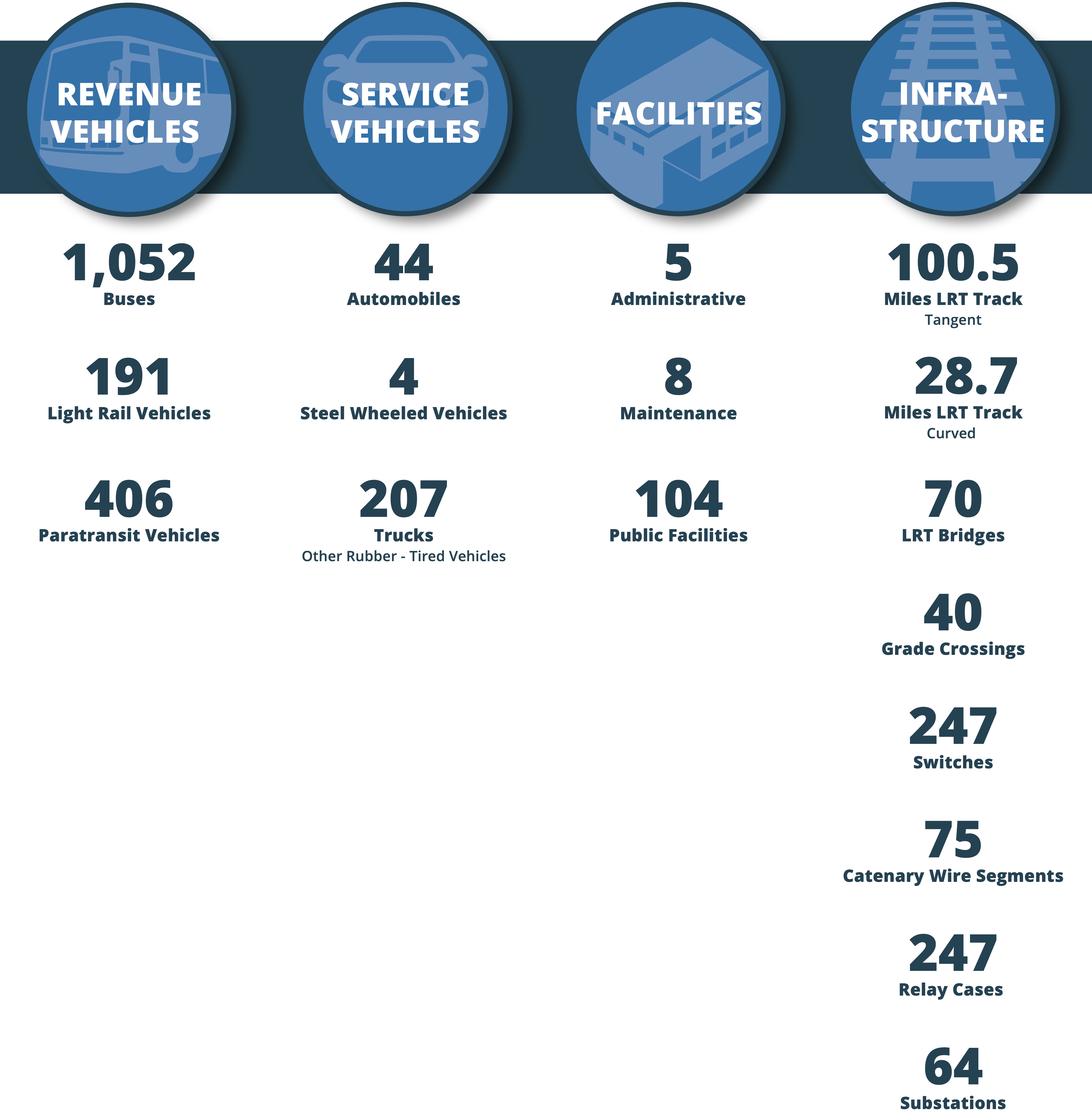

This example presents a transit agency, located in the Western U.S., termed “The Western Agency.” The agency operates three different transit modes: buses; paratransit vehicles (also called “cutaways”); and a Light Rail Transit (LRT) system. The agency’s asset hierarchy is summarized in Figure 9-6. Major asset classes include revenue vehicles, equipment (service vehicles), facilities and infrastructure. Each of these asset classes consists multiple subclasses. The infrastructure asset class includes the largest number of subclasses. In addition to LRT track, which may be either tangent (straight) or curved, this class includes bridges, special trackwork (grade crossings and switches), and power assets (catenary wire segments, relay cases, and substations).

Previously the Western Agency reported asset value in its TAMP based on the historic cost of asset acquisition or construction. This approach was used to maintain consistency with the agency’s reporting of asset value in its financial statements. As part of the previous effort, the agency collected data on the historic cost and year of purchase or construction for each of the asset classes and subclasses in the TAMP. For revenue vehicles, equipment and facilities costs are tracked at the asset level. For infrastructure assets, costs are tracked by asset subclass, grouping all assets of a given subclass built at a similar time.

For its next TAMP, the agency seeks to report value based on current replacement cost rather than historic cost, as current replacement cost is more closely tied to the cost of rehabilitating and replacing assets. However, for now the agency intends to include both the historic cost of its assets and the current depreciated replacement cost to facilitate comparison with the values in its prior TAMP.

The following subsections describe the approach the agency used for the asset value calculation, followed by a summary of the results. The asset classes are combined into two groups in the discussion: vehicles, which includes revenue vehicle and equipment; and fixed assets, including facilities and infrastructure.

Revenue Vehicles and Equipment (Service Vehicles)

As described above, the agency seeks to establish initial value based on current replacement cost. The agency estimates this initial value by adjusting the historic cost paid for each vehicle for inflation. The agency estimates the annual inflation rate for revenue and service vehicles has historically been approximately 1.6 percent.

The agency next reviews its treatment strategy for vehicles. The agency has established the useful life for its vehicles by vehicle type assuming that planned maintenance and rehabilitation activities are performed on a vehicle over its useful life. The useful life shown in Table 9-2 is estimated based on historical asset performance. At the end of a vehicle’s useful life the vehicle is replaced with a new vehicle. Since vehicle treatments are included within the useful life estimates, the agency establishes that the only treatment explicitly modeled in the asset value calculation should be the initial purchase of the vehicle. While the agency auctions used assets at the end of their useful life, the value received is negligible, so for the sake of this analysis, they assume a residual value of $0. To depreciate vehicle asset value the agency elects to use an age-based approach. The depreciation calculation is made separately for each vehicle.

Table 9-2. Useful Life for Vehicles

| Asset Class | Subclass | Useful Life (years) |

|---|---|---|

| Revenue Vehicles | Buses | 14 |

| Light Rail Vehicles | 40 | |

| Paratransit Vehicles | 10 | |

| Equipment (Service Vehicles) | Automobiles | 8 |

| Steel Wheeled Vehicles | 25 | |

| Trucks and Other Rubber-Tired Vehicles | 14 |

Facilities and Infrastructure

As in the case of vehicles, the agency seeks to establish initial value based on current replacement cost. The agency estimates this initial value by adjusting the historic construction costs of each asset for inflation. The agency estimates the annual inflation rate for construction has been approximately 3.0 percent over the facilities’ lifespan.

Next, the agency reviews its treatment strategies for fixed assets. For these assets, the agency periodically measures asset conditions using the five-point condition scale established by FTA. Using this scale, condition ranges from 1 (worst condition) to 5 (best condition). If an asset has a condition of 2 or less it is deemed to be not in good repair and beyond its useful life. Useful lives are established by asset class, as shown in Table 9-3. When an asset has reached the end of its useful life it is replaced. The agency performs different treatments on an individual asset over its life, but these are reflected in its condition score. Given the availability of condition data, the agency establishes that the only treatment explicitly modeled in the asset value calculation is the asset construction. The agency further assumes that the residual value of an asset at the end of its life is $0.

Table 9-3. Useful Life for Fixed Assets

| Asset Class | Subclass | Useful Life (years) |

|---|---|---|

| Facilities | Administrative | 60 |

| Maintenance | ||

| Public Facilities | ||

| Infrastructure | LRT Track - Tangent | 35 |

| LRT Track - Curved | 30 | |

| LRT Bridges | 70 | |

| Grade Crossings | 15 | |

| Switches | 25 | |

| Catenary Wire Segments | 25 | |

| Relay Cases | 50 | |

| Substations | 25 |

To depreciate asset value the agency elects to use condition-based approach assuming that the change in condition is proportional to age. The effective age of an asset as a function of condition is modeled as follows:

E(c) = \frac{UL (5-c)}{(5-2)}

where E(c) is the useful life for a given condition c and UL is the useful life. The denominator is represented by the condition rating at the end of the asset’s useful life subtracted from the highest possible condition rating. With this approach, the effective life of an asset is 0 if its condition is rated as a 5 and is equal to its total useful life if the rating is 2 and it is fully depreciated.

Results Summary

Table 9-4 summarizes the results of the asset value calculation. For each asset class and subclass, it displays the historic cost, replacement cost, current value, ACR and annual depreciation. The table shows that the historic cost of the agency’s assets is $3.1 billion. Adjusting the historic costs for inflation, the current replacement cost of the asset inventory is estimated to be approximately $4.5 billion. The current value, which incorporates depreciation, is approximately $2.7 billion. The ACR for the agency’s asset inventory is 0.60, equal to the current value divided by the replacement cost. Absent investment in the assets, the inventory is expected to depreciate approximately $123 million per year.

Table 9-4. Summary Results for the Western Agency

| Asset Class | Asset Subclass | Historic Cost ($M) | Replacement Cost ($M) | Current Value ($M) | Annual Depreciation ($M) | ACR |

|---|---|---|---|---|---|---|

| Revenue Vehicles | Bus | 456 | 498 | 298 | 34 | 0.60 |

| Light Rail Vehicle | 506 | 603 | 433 | 15 | 0.72 | |

| Paratransit | 25 | 26 | 17 | 3 | 0.65 | |

| Subtotal | 987 | 1,127 | 748 | 51 | 0.66 | |

| Equipment | Automobiles | 3 | 3 | 1 | 0 | 0.27 |

| Steel Wheeled Vehicles | 2 | 2 | 2 | 0 | 0.86 | |

| Trucks and Other Rubber-Tired Vehicles | 35 | 39 | 23 | 3 | 0.60 | |

| Subtotal | 40 | 44 | 26 | 3 | 0.59 | |

| Facilities | Administrative | 19 | 39 | 23 | 1 | 0.58 |

| Maintenance | 170 | 400 | 195 | 7 | 0.49 | |

| Public Facilities | 925 | 1,485 | 789 | 25 | 0.53 | |

| Subtotal | 1,114 | 1,924 | 1,007 | 32 | 0.52 | |

| Infrastructure | LRT Track - Tangent | 503 | 710 | 473 | 20 | 0.67 |

| LRT Track - Curved | 144 | 203 | 135 | 7 | 0.67 | |

| LRT Bridges | 190 | 268 | 161 | 3 | 0.60 | |

| Grade Crossings | 4 | 6 | 3 | 0 | 0.57 | |

| Switches | 4 | 5 | 3 | 0 | 0.50 | |

| Catenary Wire Segments | 35 | 50 | 26 | 2 | 0.53 | |

| Relay Cases | 65 | 87 | 70 | 2 | 0.80 | |

| Substations | 34 | 46 | 28 | 2 | 0.60 | |

| Subtotal | 980 | 1,374 | 899 | 37 | 0.65 | |

| Total | 3,121 | 4,469 | 2,680 | 123 | 0.60 | |